Question: Please help me I am stuck on this problem, I would truly appreciate your help! Please note, answers are not the same as previous years!

Please help me I am stuck on this problem, I would truly appreciate your help! Please note, answers are not the same as previous years!

I need all parts answered, thank you so much for your help!

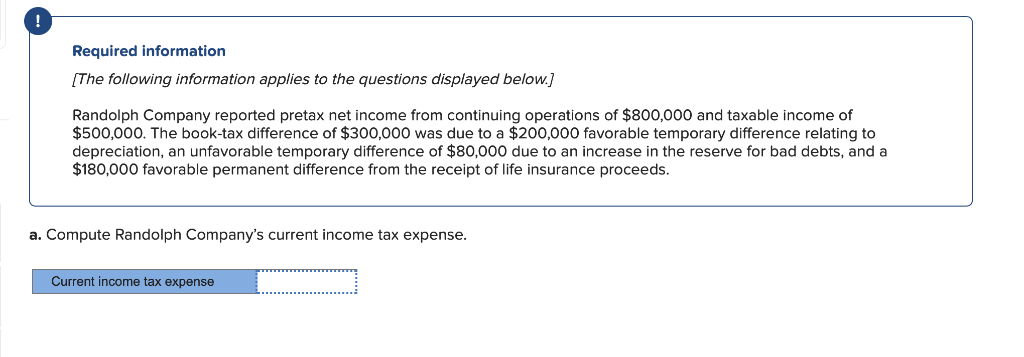

Required information The following information applies to the questions displayed below. Randolph Company reported pretax net income from continuing operations of $800,000 and taxable income of $500,000. The book-tax difference of $300,000 was due to a $200,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $80,000 due to an increase in the reserve for bad debts, and a $180,000 favorable permanent difference from the receipt of life insurance proceeds. a. Compute Randolph Company's current income tax expense. Current income tax expense b. Compute Randolph Company's deferred income tax expense or benefit. Deferred income tax expense c. Compute Randolph Company's effective tax rate. (Round your answer to 2 decimal places.) Effective tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts