Question: please help me! i attatched the excel sheet too. not sure if it will be helpful tho i need help figuring this out. i dont

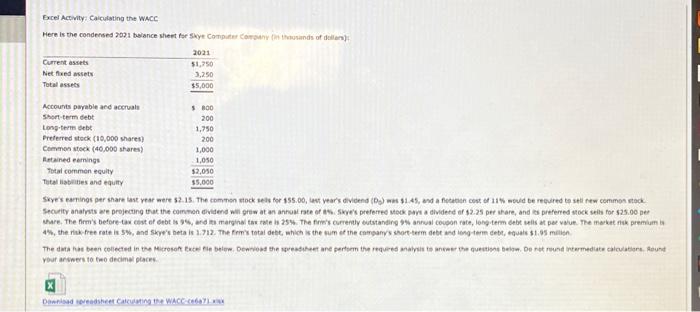

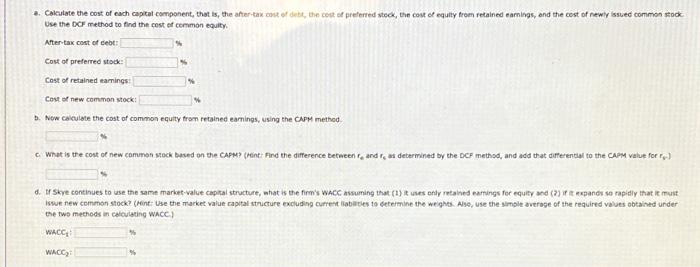

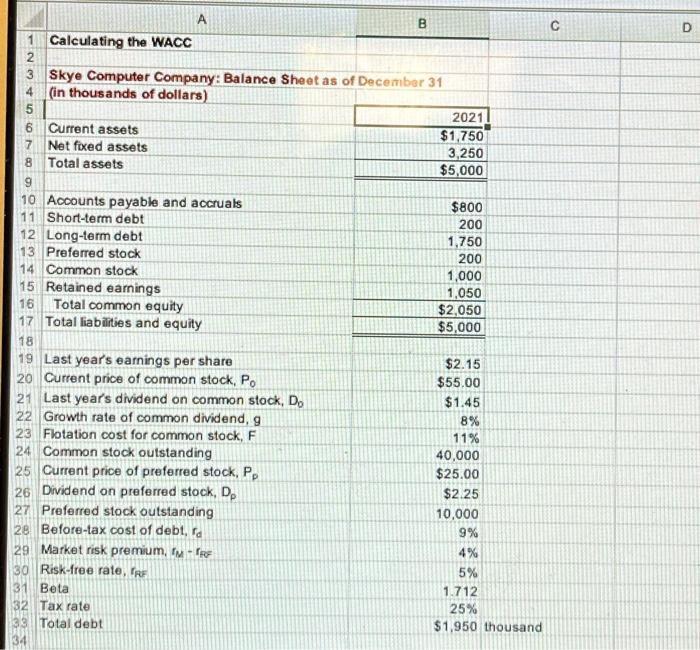

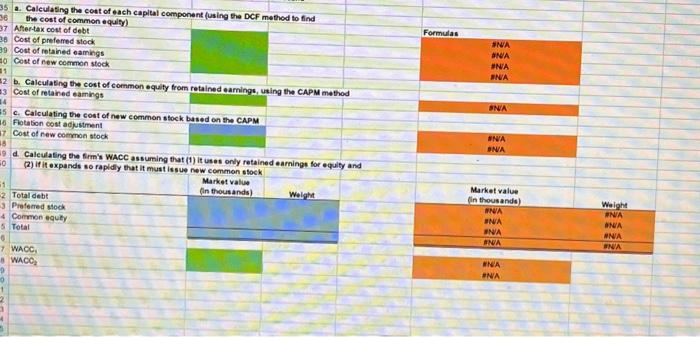

Excel Aceivity: Caiculating the waCc your arserito teo decimel places Dantisad weadsheet Catculating the WicC-cabeyl: and 4. Cakulate the cost of each captal component, that is, the antertaik wist of dett, the cent sof preterted stod, the cost of equity trom retained eamings, and the cost of newiy issued common stook Use the DCF method to find the cost ef common equilty. Mtentax cost of cebt: Cost of preferred stod: Cost of retained eamings: Cost of new common stock: b. Now calailate the cost of common equity trom retained eamings, using the CAPM method c. Whut is the cost of new common syock based on the CAPM? (peint: Find the difference betaeen r6 and r6 as determined by the DCF method, and add that differential to the CAPM value for r6 ) iswe new common stock? (Hent: Use the market value capital sthecure excluding current labaties to betermine the weights. Ase, use the simple averoge of the required values obtained under the two mechods in ceiculating wace. whec: wacc 2 C D \begin{tabular}{|l|l|} \hline 1 & Calculating the WACC \\ 2 & \\ 3 & Skye Computer Company: \\ 4 & (in thousands of dollars) \\ \hline \end{tabular} Skye Computer Company: Balance Sheet as of December 31 \begin{tabular}{|l|l|r|} \hline 5 & & 2021 \\ 6 & Current assets & $1,750 \\ \hline 7 & Net foxed assets & 3,250 \\ 8 & Total assets & $5,000 \\ \hline 9 & & \\ \hline \end{tabular} 10 Acoounts payable and accruats 11 Short-term debt 12 Long-term debt 13 Preferred stock 14 Common stock 15 Retained earnings 16 Total common equity 17 Total liabilities and equity 18 $8002001,7502001,0001,050$2,050$5,000 19 Last year's eamings per share 20 Current price of common stock, P0 21 Last year's dividend on common stock, D0 22 Growth rate of common dividend, g 23 Flotation cost for common stock, F 24 Common stock outstanding 25 Current price of preferred stock, PP 26 Dividend on preferred stock, Dp 27 Preferred stock outstanding 28 Before-tax cost of debt, rd 29 Market risk premium, fMre= a. Caleulasing the cott of each capltal component (using the DCF method to find the cost of common equity) After-tax cost of dobt. Formulas Cost of prefered stock Cost of rotained eamings Cost of now common stock b. CalculaEing the cost of common oquily from retained eamings, using the CAPM method \$NA DNA INA INAA Cost of retained eamings c. Calculating the cost of new common stock based on the CAPM Fiotabion cost adjustment Cost of new common atock d. Caleulating the frmis WACC assuming that (1) it uses only retained earninge for equity and (2) if it expands so rapldiy that it must issue new common stock Market value Totaldebt (in thousands) Prefemed shock Common equty Total WACC. WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts