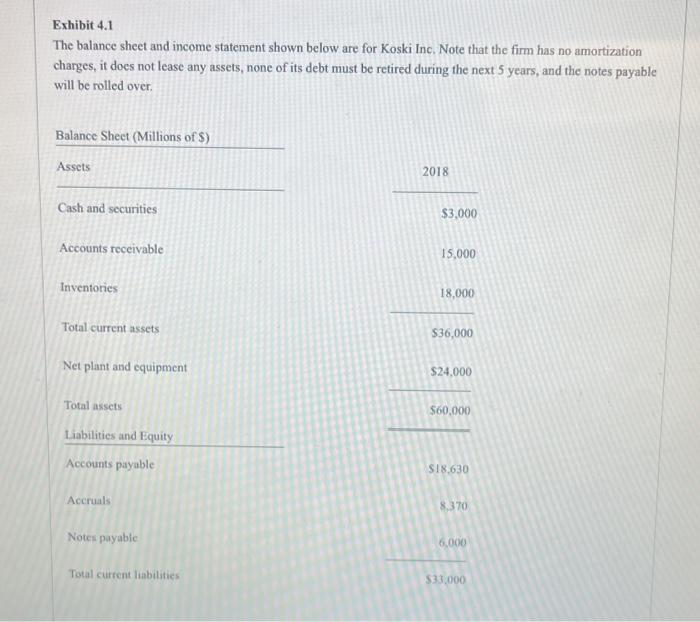

Question: please help me! i cant figure this out. it has to be one of the options given Exhibit 4.1 The balance sheet and income statement

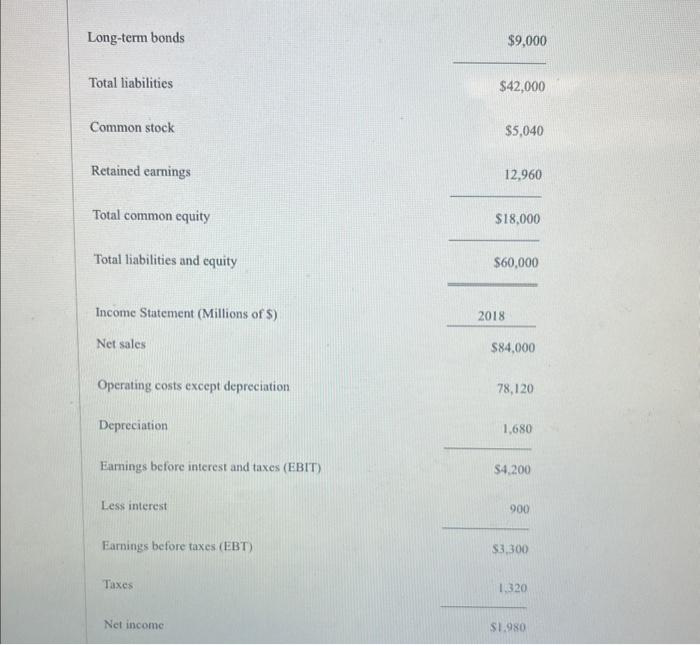

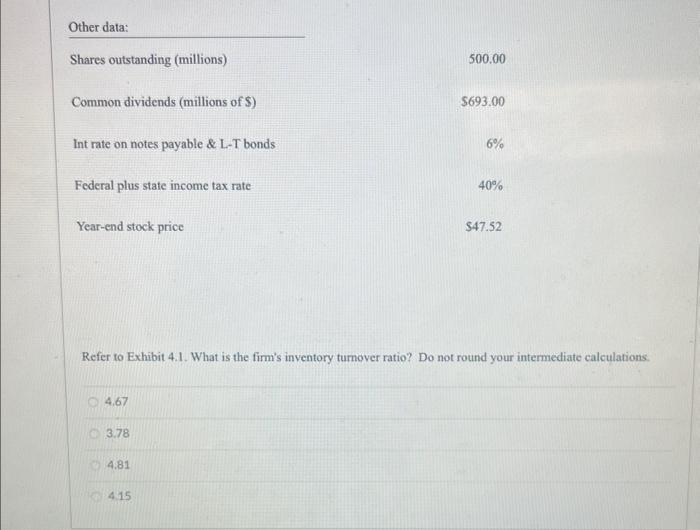

Exhibit 4.1 The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Long-term bonds Total liabilities $42,000 Common stock $5,040 Retained earnings Total common equity Total liabilities and equity Income Statement (Millions of S) Net sales $84,0002018 Operating costs except depreciation 78,120 Depreciation Eamings before interest and taxes (EBIT) $4.200 Less interest Earnings before taxes (EBT) 53,300 Taxes Net income S1.980 Refer to Exhibit 4.1. What is the firm's inventory turnover ratio? Do not round your intermediate calculations. 4.67 3.78 4.81 415

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts