Question: please help me I don't understand the lookup function Calculate taxes based on the net profit for all three routes. You do not need to

please help me I don't understand the lookup function

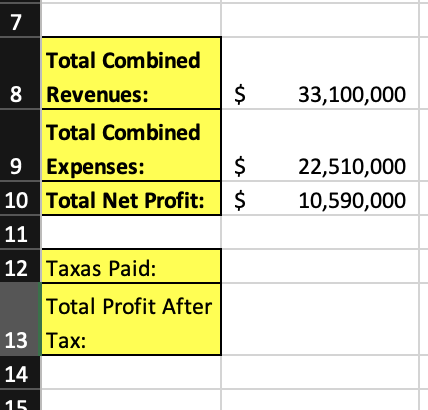

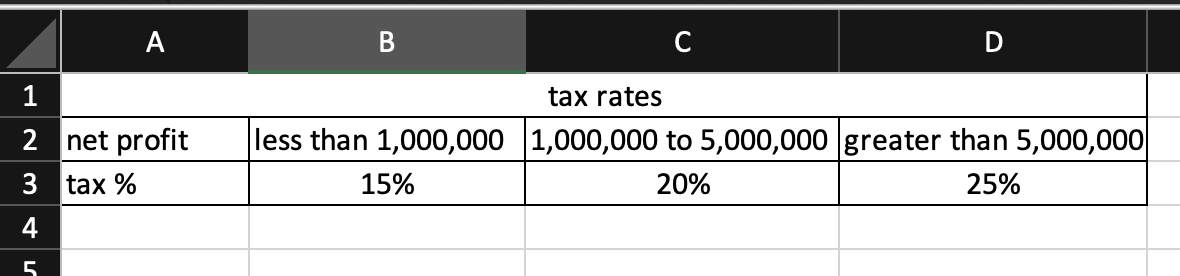

- Calculate taxes based on the net profit for all three routes. You do not need to calculate this value per route. Tax rates are determined based upon your net profit. The tax owed is calculated as the applicable tax rate times the net profit. Make a table on a new worksheet to contain the following tax rates:

- If your company makes a net profit of less than $1,000,000 you are taxed at 15% ,

- If your company makes a net profit of at least $1,000,000 but less than $5,000,000 you are taxed at 20%,

- If your company makes a net profit of $5,000,000 or more you are taxed at 25%.

- After you make the new worksheet, use a lookup function to calculate the amount you have paid in taxes and your total profits after-taxes.

7 Total Combined 8 Revenues: $ 33,100,000 $ Total Combined 9 Expenses: 10 Total Net Profit: 11 22,510,000 10,590,000 12 Taxas Paid: Total Profit After 13 Tax: 14 15 A B 1 2 net profit 3 tax % 4 tax rates less than 1,000,000 1,000,000 to 5,000,000 greater than 5,000,000 15% 20% 25% 5 7 Total Combined 8 Revenues: $ 33,100,000 $ Total Combined 9 Expenses: 10 Total Net Profit: 11 22,510,000 10,590,000 12 Taxas Paid: Total Profit After 13 Tax: 14 15 A B 1 2 net profit 3 tax % 4 tax rates less than 1,000,000 1,000,000 to 5,000,000 greater than 5,000,000 15% 20% 25% 5

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock