Question: please help me! I have no idea why is wrong Current Attempt in Progress The following information was taken from the records of Splish Inc.

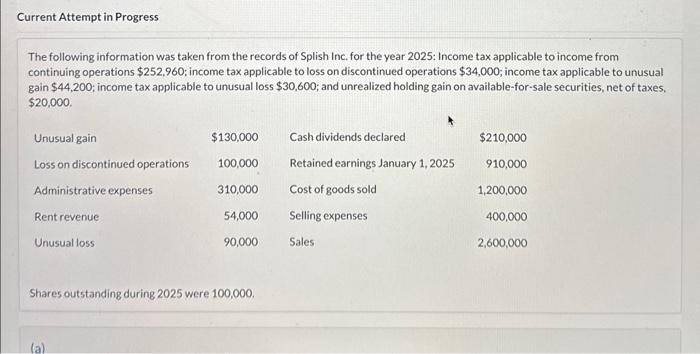

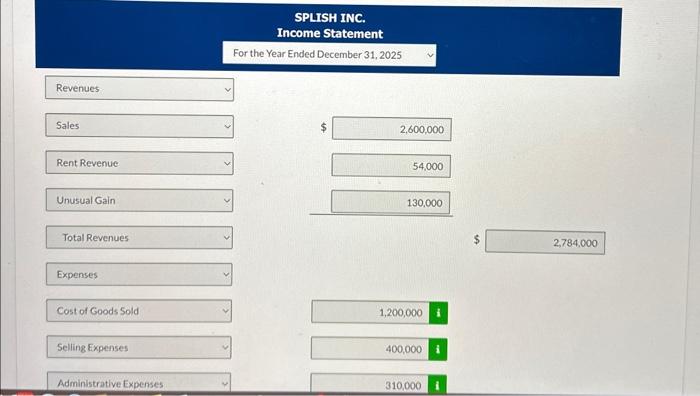

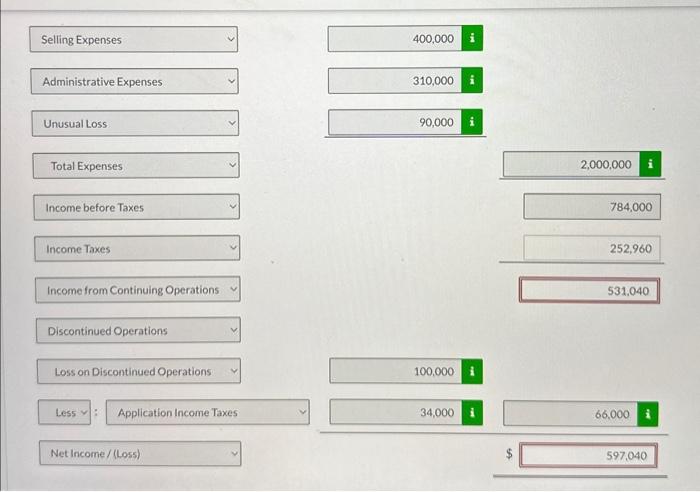

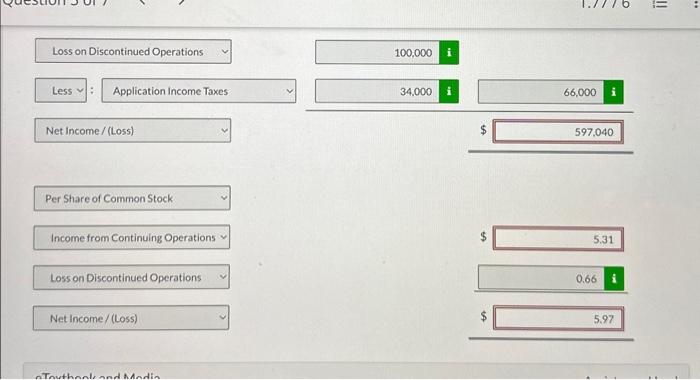

Current Attempt in Progress The following information was taken from the records of Splish Inc. for the year 2025: Income tax applicable to income from continuing operations $252,960; income tax applicable to loss on discontinued operations $34,000; income tax applicable to unusual gain $44,200; income tax applicable to unusual loss $30,600; and unrealized holding gain on available-for-sale securities, net of taxes, $20,000. Shares outstanding during 2025 were 100,000. SPLISH INC. Income Statement For the Year Ended December 31, 2025 Revenues Rent Revenue Unusual Gain Total Revenues Expenses Cost of Goods Sold 130,000 $2,784,000 Selling Expenses \begin{tabular}{|l|l|} \hline 1,200,000 & 1 \\ \hline \end{tabular} Administrative Expenses Selling Expenses \begin{tabular}{|l|l|} \hline 400,000 & i \\ \hline \end{tabular} Administrative Expenses \begin{tabular}{|l|l|} \hline 310,000 & i \\ \hline \end{tabular} Unusual Loss \begin{tabular}{|l|l|} \hline 90,000 & i \\ \hline \end{tabular} Total Expenses \begin{tabular}{rr|} \hline 2,000,000 & i \\ \hline 784,000 \\ \hline \end{tabular} Income Taxes Income from Continuing Operations Discontinued Operations Loss on Discontinued Operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts