Question: Please help me . I need answer . Please . I will give good rating Question 1 Smile Selalu Corporation has to raise RM 5

Please help me . I need answer . Please . I will give good rating

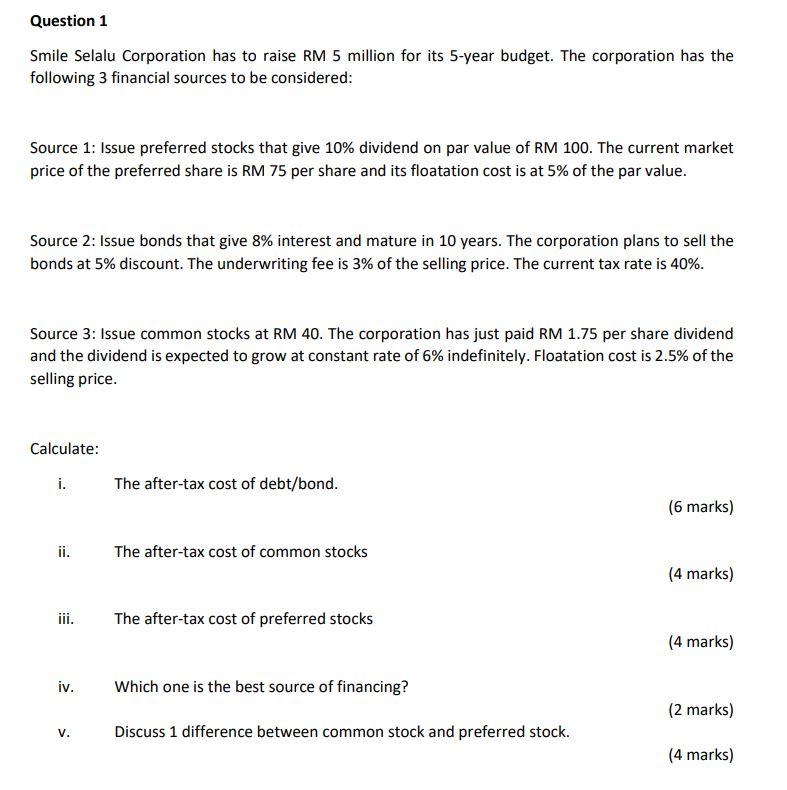

Question 1 Smile Selalu Corporation has to raise RM 5 million for its 5-year budget. The corporation has the following 3 financial sources to be considered: Source 1: Issue preferred stocks that give 10% dividend on par value of RM 100. The current market price of the preferred share is RM 75 per share and its floatation cost is at 5% of the par value. Source 2: Issue bonds that give 8% interest and mature in 10 years. The corporation plans to sell the bonds at 5% discount. The underwriting fee is 3% of the selling price. The current tax rate is 40%. Source 3: Issue common stocks at RM 40. The corporation has just paid RM 1.75 per share dividend and the dividend is expected to grow at constant rate of 6% indefinitely. Floatation cost is 2.5% of the selling price. Calculate: i. The after-tax cost of debt/bond. (6 marks) The after-tax cost of common stocks (4 marks) iii. The after-tax cost of preferred stocks (4 marks) iv. Which one is the best source of financing? (2 marks) V. Discuss 1 difference between common stock and preferred stock. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts