Question: please help me i need good marks please dont do on paper by pen do on word file please make new do not copy paste

please help me i need good marks please dont do on paper by pen do on word file please make new do not copy paste from others on chegg need big and good answer read full question carefully then give good answer need all points inside the answer please help me i need good marks i give you 2 likes

Solution:

a)

|

| FIFO | LIFO | Average cost |

| Beginning inventory |

|

|

|

| Purchases |

|

|

|

| Cost of goods available for sale |

|

|

|

| Ending inventory |

|

|

|

| Cost of goods sold |

|

|

|

b)

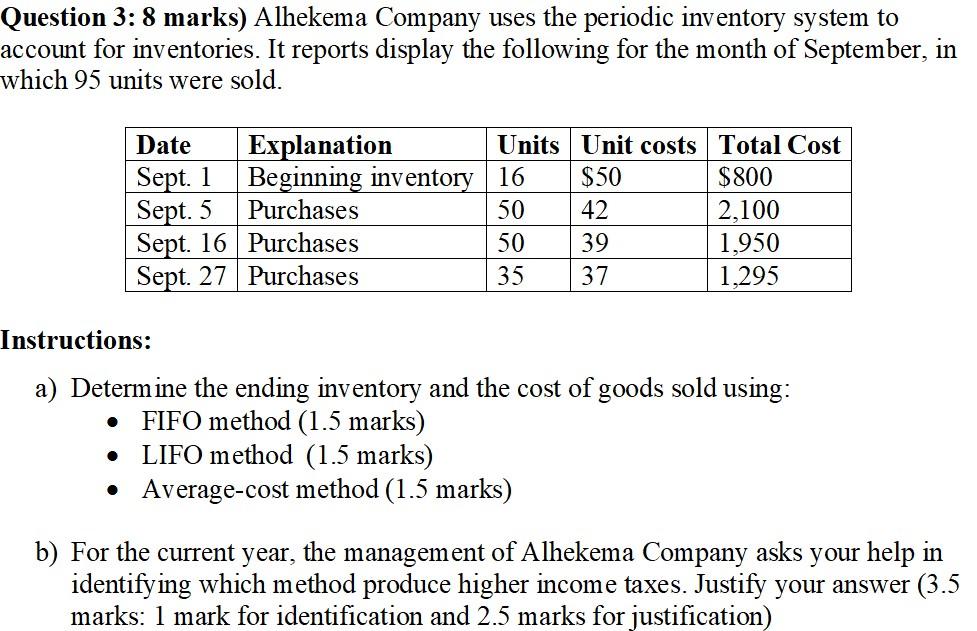

Question 3: 8 marks) Alhekema Company uses the periodic inventory system to account for inventories. It reports display the following for the month of September, which 95 units were sold. Sept. 5 Date Explanation Units Unit costs Total Cost Sept. 1 Beginning inventory 16 $50 $800 Purchases 50 42 2,100 Sept. 16 Purchases 50 39 1,950 Sept. 27 Purchases 35 37 1,295 Instructions: . a) Determine the ending inventory and the cost of goods sold using: FIFO method (1.5 marks) LIFO method (1.5 marks) Average-cost method (1.5 marks) b) For the current year, the management of Alhekema Company asks your help in identifying which method produce higher income taxes. Justify your answer (3.5 marks: 1 mark for identification and 2.5 marks for justification)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts