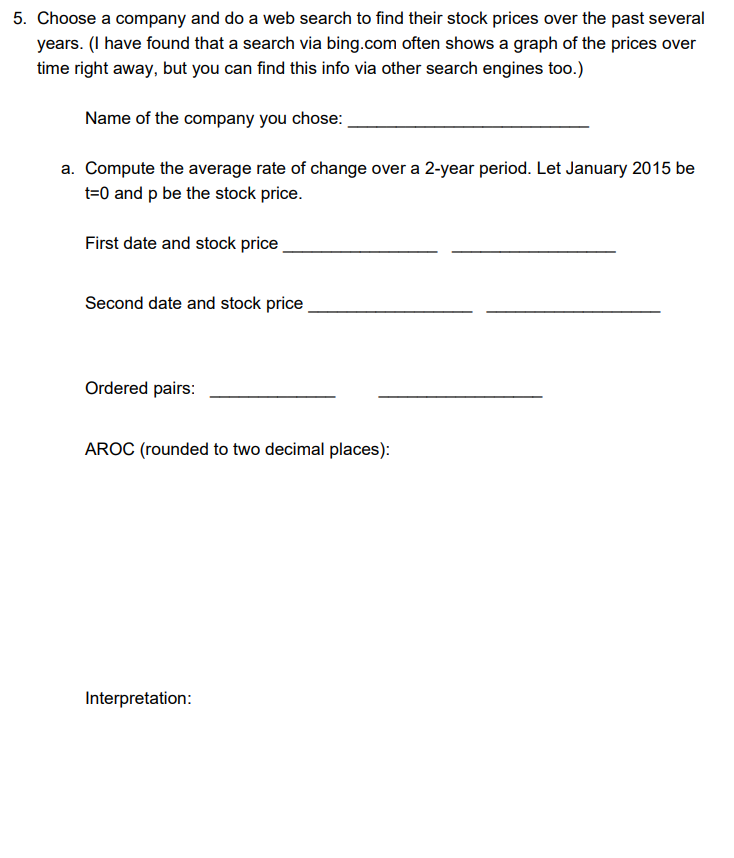

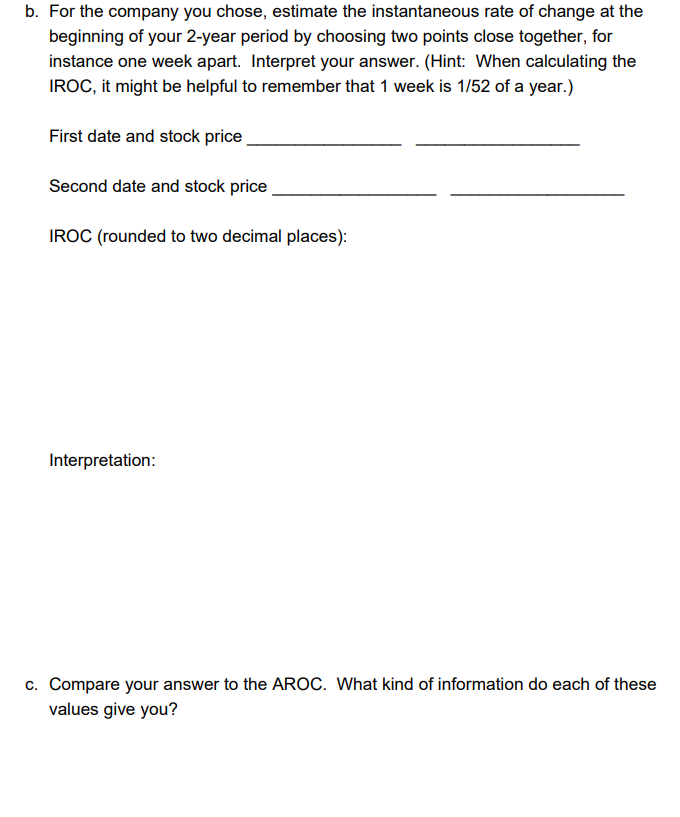

Question: Please help me i really dont know how to do this, u can just use any major company. THANK YOU 5. Choose a company and

Please help me i really don"t know how to do this, u can just use any major company. THANK YOU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts