Question: Please help me, i will give good rating 2. (a) Bromwich Inc, a US company, is considering undertaking a new project in the UK. This

Please help me, i will give good rating

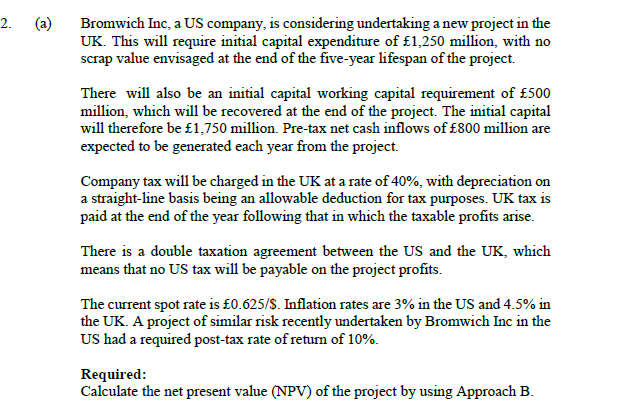

2. (a) Bromwich Inc, a US company, is considering undertaking a new project in the UK. This will require initial capital expenditure of 1,250 million, with no scrap value envisaged at the end of the five-year lifespan of the project. There will also be an initial capital working capital requirement of 500 million, which will be recovered at the end of the project. The initial capital will therefore be 1,750 million. Pre-tax net cash inflows of 800 million are expected to be generated each year from the project. Company tax will be charged in the UK at a rate of 40%, with depreciation on a straight-line basis being an allowable deduction for tax purposes. UK tax is paid at the end of the year following that in which the taxable profits arise. There is a double taxation agreement between the US and the UK, which means that no US tax will be payable on the project profits. The current spot rate is 0.625/$. Inflation rates are 3% in the US and 4.5% in the UK. A project of similar risk recently undertaken by Bromwich Inc in the US had a required post-tax rate of return of 10%. Required: Calculate the net present value (NPV) of the project by using Approach B. 2. (a) Bromwich Inc, a US company, is considering undertaking a new project in the UK. This will require initial capital expenditure of 1,250 million, with no scrap value envisaged at the end of the five-year lifespan of the project. There will also be an initial capital working capital requirement of 500 million, which will be recovered at the end of the project. The initial capital will therefore be 1,750 million. Pre-tax net cash inflows of 800 million are expected to be generated each year from the project. Company tax will be charged in the UK at a rate of 40%, with depreciation on a straight-line basis being an allowable deduction for tax purposes. UK tax is paid at the end of the year following that in which the taxable profits arise. There is a double taxation agreement between the US and the UK, which means that no US tax will be payable on the project profits. The current spot rate is 0.625/$. Inflation rates are 3% in the US and 4.5% in the UK. A project of similar risk recently undertaken by Bromwich Inc in the US had a required post-tax rate of return of 10%. Required: Calculate the net present value (NPV) of the project by using Approach B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts