Question: Please help me i will give good rating Jerry, a sole trader, commenced business on 1 January 2018 and prepares his financial statements to 31

Please help me i will give good rating

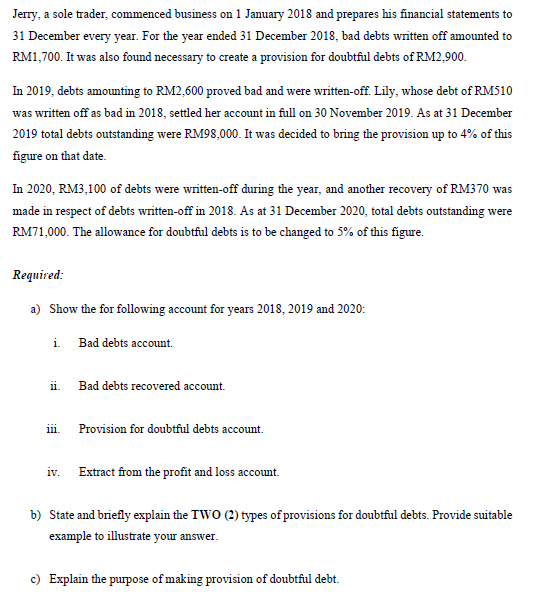

Jerry, a sole trader, commenced business on 1 January 2018 and prepares his financial statements to 31 December every year. For the year ended 31 December 2018, bad debts written off amounted to RM1,700. It was also found necessary to create a provision for doubtful debts of RM2,900. In 2019, debts amounting to RM2,600 proved bad and were written-off. Lily, whose debt of RM510 was written off as bad in 2018, settled her account in full on 30 November 2019. As at 31 December 2019 total debts outstanding were RM98.000. It was decided to bring the provision up to 4% of this figure on that date. In 2020, RM3,100 of debts were written-off during the year, and another recovery of RM370 was made in respect of debts written-off in 2018. As at 31 December 2020, total debts outstanding were RM71,000. The allowance for doubtful debts is to be changed to 5% of this figure. Required: a) Show the for following account for years 2018, 2019 and 2020: i. Bad debts account ii. Bad debts recovered account. 111 Provision for doubtful debts account. iv. Extract from the profit and loss account. b) State and briefly explain the TWO (2) types of provisions for doubtful debts. Provide suitable example to illustrate your answer. c) Explain the purpose of making provision of doubtful debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts