Question: please help me i will gove you thumbs up! Exercise 17-9 (Algo) Allocating overhead using plantwide rate and departmental rates LO P1, P2 Laval produces

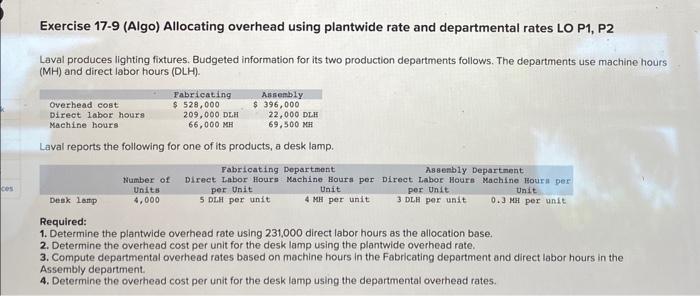

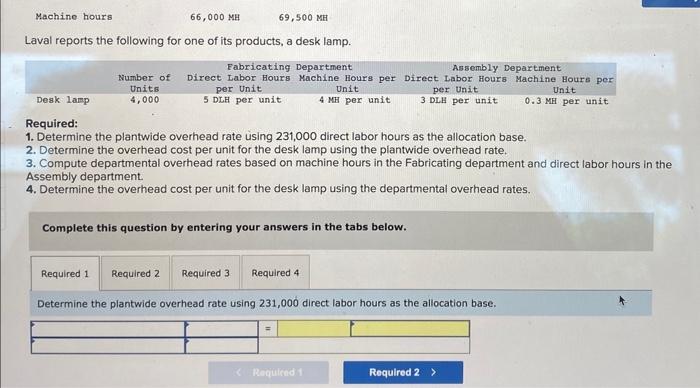

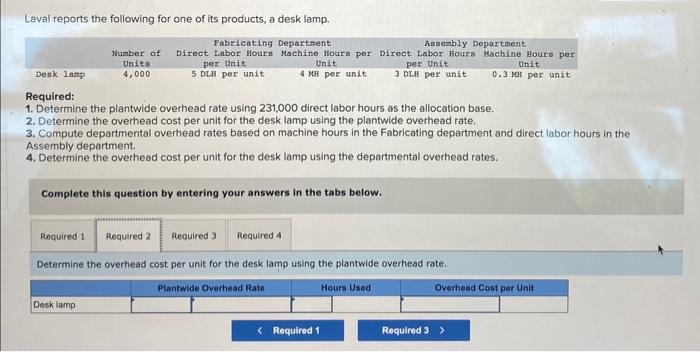

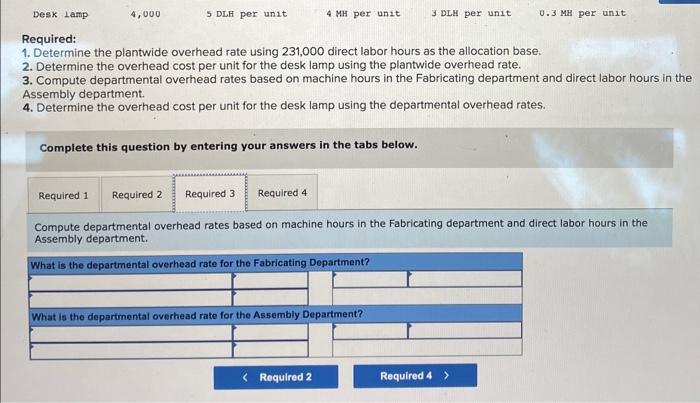

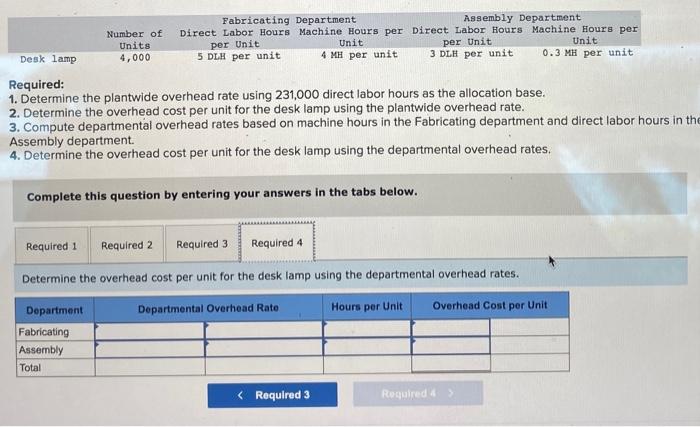

Exercise 17-9 (Algo) Allocating overhead using plantwide rate and departmental rates LO P1, P2 Laval produces lighting fixtures. Budgeted information for its two production departments follows. The departments use machine hours (MH) and direct labor hours (DLH). Laval reports the following for one of its products, a desk lamp. Required: 1. Determine the plantwide overhead rate using 231,000 direct labor hours as the allocation base. 2. Determine the overhead cost per unit for the desk lamp using the plantwide overhead rate. 3. Compute departmental overhead rates based on machine hours in the Fabricating department and direct labor hours in the Assembly department. 4. Determine the overhead cost per unit for the desk lamp using the departmental overhead rates. Machine hours 66,000MH69,500MH Laval reports the following for one of its products, a desk lamp. Required: 1. Determine the plantwide overhead rate using 231,000 direct labor hours as the allocation base. 2. Determine the overhead cost per unit for the desk lamp using the plantwide overhead rate. 3. Compute departmental overhead rates based on machine hours in the Fabricating department and direct labor hours in the Assembly department. 4. Determine the overhead cost per unit for the desk lamp using the departmental overhead rates. Complete this question by entering your answers in the tabs below. Determine the plantwide overhead rate using 231,000 direct labor hours as the allocation base. Laval reports the following for one of its products, a desk lamp. Required: 1. Determine the plantwide overhead rate using 231,000 direct labor hours as the allocation base. 2. Determine the overhead cost per unit for the desk lamp using the plantwide overhead rate. 3. Compute departmental overhead rates based on machine hours in the Fabricating department and direct labor hours in the Assembly department. 4. Determine the overhead cost per unit for the desk lamp using the departmental overhead rates. Complete this question by entering your answers in the tabs below. Required: 1. Determine the plantwide overhead rate using 231,000 direct labor hours as the allocation base. 2. Determine the overhead cost per unit for the desk lamp using the plantwide overhead rate. 3. Compute departmental overhead rates based on machine hours in the Fabricating department and direct labor hours in the Assembly department. 4. Determine the overhead cost per unit for the desk lamp using the departmental overhead rates. Complete this question by entering your answers in the tabs below. Compute departmental overhead rates based on machine hours in the Fabricating department and direct labor hours in the Assembly department. Required: 1. Determine the plantwide overhead rate using 231,000 direct labor hours as the allocation base. 2. Determine the overhead cost per unit for the desk lamp using the plantwide overhead rate. 3. Compute departmental overhead rates based on machine hours in the Fabricating department and direct labor hours in th Assembly department. 4. Determine the overhead cost per unit for the desk lamp using the departmental overhead rates. Complete this question by entering your answers in the tabs below. Determine the overhead cost per unit for the desk lamp using the departmental overhead rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts