Question: please help me. if you need the problem emailed to you, please let me know. as soon as i screenshot, it loses alot of its

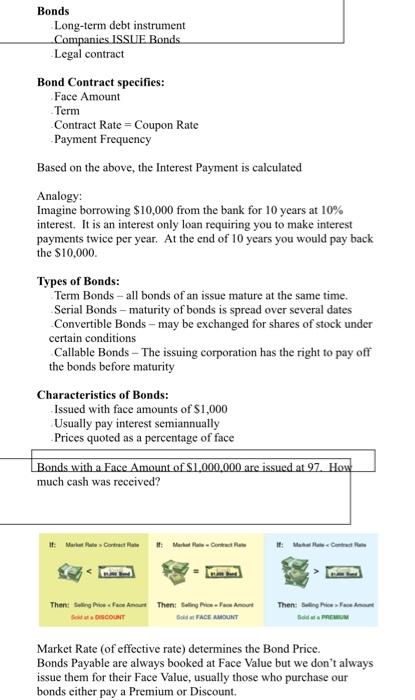

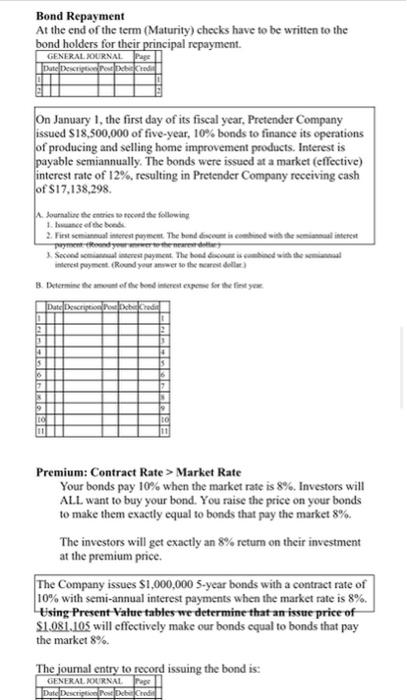

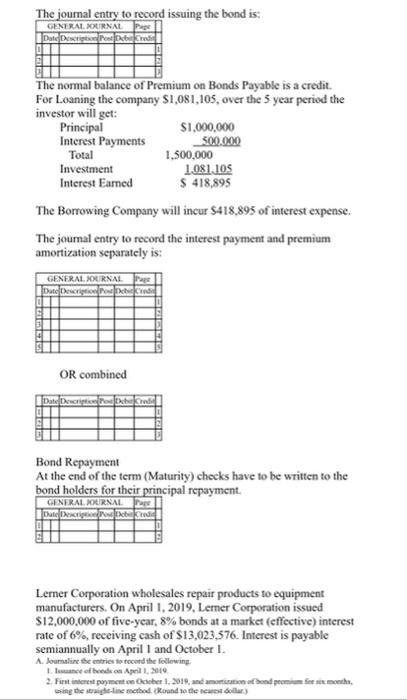

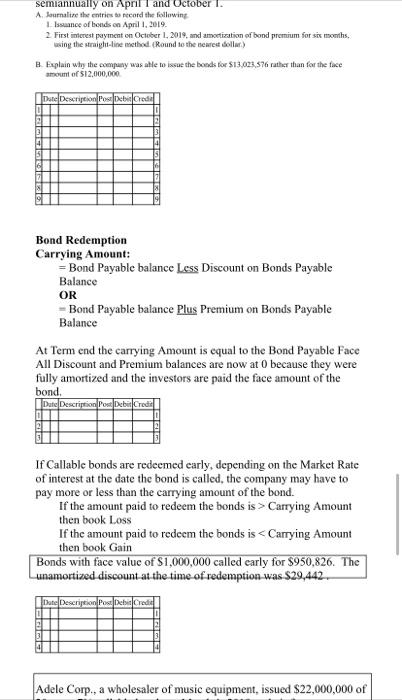

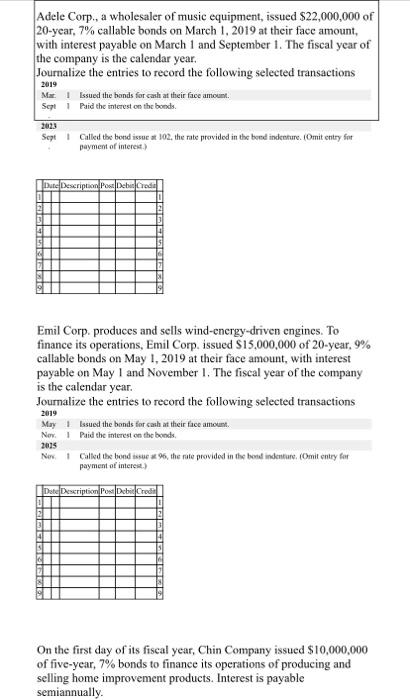

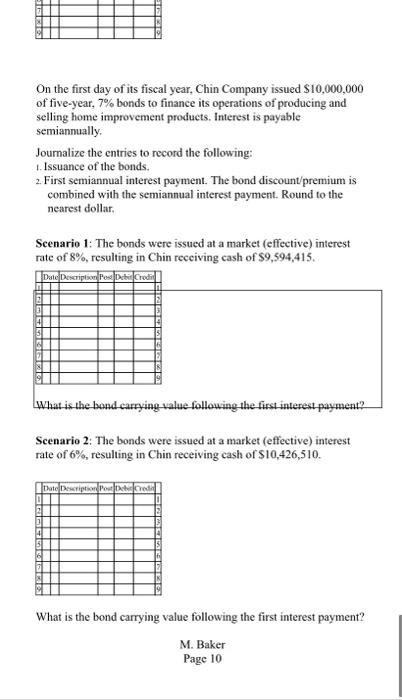

Bonds Long-term debt instrument Companies. ISSUE Bonds Legal contract Bond Contract specifies: Face Amount Term Contract Rate = Coupon Rate Payment Frequency Based on the above, the Interest Payment is calculated Analogy: Imagine borrowing $10,000 from the bank for 10 years at 10% interest. It is an interest only loan requiring you to make interest payments twice per year. At the end of 10 years you would pay back the $10,000 Types of Bonds: Term Bonds - all bonds of an issue mature at the same time. Serial Bonds - maturity of bonds is spread over several dates Convertible Bonds - may be exchanged for shares of stock under certain conditions Callable Bonds - The issuing corporation has the right to pay off the bonds before maturity Characteristics of Bonds: Issued with face amounts of $1,000 Usually pay interest semiannually Prices quoted as a percentage of face Bonds with a Face Amount of S1.000.000 are issued at 97. How much cash was received? it: Marta Puterte #: Mertua #t: Mature Then: Stig PiecesAurt Then: Bai Foot DISCOUNT So FACE AMOUNT Then: Stingent SEUM Market Rate (of effective rate) determines the Bond Price. Bonds Payable are always booked at Face Value but we don't always issue them for their Face Value, usually those who purchase our bonds either pay a Premium or Discount. Scenario: It takes a while to get approval and print the bonds. At the time they were printed the interest rate printed on the bond was 10%. By the time we go to issue the Bonds, interest rates have gone up to 12%. Nobody will buy our bonds that only pay 10% so we have to adjust the price to give them an EFFECTIVE interest rate of 12%. Even though the interest payments made every 6 months will be at 10%, we adjust the initial price of the bond to exactly what it must be to yield an effective interest rate of 12%. Journal entries for bonds payable. BONDS are always booked at FACE. Any difference between Face Value of the bonds and the issue price is recorded in a Bonds Discount (debit) or Bonds Premium (credit) account. Bond Issue: Face $1,000,000 Term: 5 years Contract rate: 10% semiannual (5% every 6 months) Contract Rate Market Rate Your bonds pay 10% when the market rate for similar bonds is also 10%; bonds will issue at Face Value (no discount or premium). The journal entry to record issuing the bond is GENERAL JOURNAL Page Date Descriptore! Interest Payment Semiannually (every 6 months) checks have to be written to the bond holders for their interest payment. GENERAL JOURNAL Date Descriptseobrir Bond Repayment At the end of the term (Maturity) checks have to be written to the bond holders for their principal repayment. GENERAL JOURNAL Page Dute Description Code Gabriel Co, produces and distributes semiconductors for use by computer manufacturers, Gabriel Co. issued 600,000 of 10-year, 8% bonds on May 1 of the current year at face value, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year Journalize the entries to record the following selected transactions for the current year May 1 Issued the beds for cash at their face Now Paid the interest on the bonds Dec 31 Rocorded accrued interest for two month GENERAL JOURNAL Page Date Descriptio Post reporterede Discount: Contract Rate Market Rate Your bonds pay 10% when the market rate is 8%. Investors will ALL.want to buy your bond. You raise the price on your bonds to make them exactly equal to bonds that pay the market 8%. The investors will get exactly an 8% return on their investment at the premium price. The Company issues $1,000,000 5-year bonds with a contract rate of 10% with semi-annual interest payments when the market rate is 8%. Using Present Value tables we determine that an issue price of $1.081.105 will effectively make our bonds equal to bonds that pay the market 8% The journal entry to record issuing the bond is: Date Descriptive robe robe GENERAL MOURNAL The journal entry to record issuing the bond is: GENERAL MOURNAL Dale Descrip Credi The normal balance of Premium on Bonds Payable is a credit. For Loaning the company $1,081,105, over the 3 year period the investor will get: Principal $1,000,000 Interest Payments 500.000 Total 1,500,000 Investment 1.081.105 Interest Eamed $ 418,895 The Borrowing Company will incur S418,895 of interest expense. The journal entry to record the interest payment and premium amortization separately is: GENERAL JOURNAL Dute Descript OR combined Date Descriere Bond Repayment At the end of the term (Maturity) checks have to be written to the bond holders for their principal repayment GENERAL JOURNAL Pape Dale bed Lemer Corporation wholesales repair products to equipment manufacturers. On April 1, 2019. Lerner Corporation issued $12,000,000 of five-year, 8% bonds at a market (effective) interest rate of 6%, receiving cash of $13,023.576. Interest is payable semiannually on April 1 and October 1. A. Journal entries to record the following le of bed on April, 2. First interest payment Oceber 1, 2019. and moon and promoth, ering the line method. Round to the cast dollar) semiannually on April 1 and October I. A. Journalte the entries to record the following 1 Issuance of bonds on April , 2019. 2 First interest payment on October 1, 2019 and amortization of bond premium for six months. using the straight-line method. (Round to the nearest dollar) B Explain why the company was able to issue the book for $13,023,576 rather than for the face amount of $12,000,000 Date Description Posted 14 5 Bond Redemption Carrying Amount: = Bond Payable balance Less Discount on Bonds Payable Balance OR - Bond Payable balance Plus Premium on Bonds Payable Balance At Term end the carrying Amount is equal to the Bond Payable Face All Discount and Premium balances are now at O because they were fully amortized and the investors are paid the face amount of the bond Date Description Pose Debit Crede If Callable bonds are redeemed early, depending on the Market Rate of interest at the date the bond is called the company may have to pay more or less than the carrying amount of the bond. If the amount paid to redeem the bonds is > Carrying Amount then book Loss If the amount paid to redeem the bonds is Carrying Amount then book Gain Bonds with face value of $1,000,000 called early for $950,826. The unamortized discount at the time of redemption was $29,442 Date Description PowDebit Credis Adele Corp., a wholesaler of music equipment, issued $22,000,000 of Adele Corp., a wholesaler of music equipment, issued $22,000,000 of 20-year, 7% callable bonds on March 1, 2019 at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions Ma Issued the bands for cash at their face amount. Sept Paid the interest on the bonds. 2019 2023 Sept called the bond issue st 302, the rate provided in the bond indenture. (Omit entry fot payment of interest.) Dute Description Powerede Emil Corp. produces and sells wind-energy-driven engines. To finance its operations, Emil Corp. issued $15,000,000 of 20-year, 9% callable bonds on May 1, 2019 at their face amount, with interest payable on May 1 and November 1, The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions May Issued the bonds for cash at their face amount New Paid the interest on the bonds Now I called the bond tasue se %6, the note provided in the bott indenturo. (Omit entry for 2019 2015 payment of interest.) Date Description Pos Debid Credit 14 On the first day of its fiscal year, Chin Company issued $10,000,000 of five-year, 7% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. On the first day of its fiscal year, Chin Company issued $10,000,000 of five-year, 7% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. Journalize the entries to record the following: 1. Issuance of the bonds. 2. First semiannual interest payment. The bond discount/premium is combined with the semiannual interest payment. Round to the nearest dollar Scenario 1: The bonds were issued at a market (effective) interest rate of 8%, resulting in Chin receiving cash of $9,594,415. Deste Description Pod Debit Credi 1 + 5 What is the band carrying value following the first interest payment? Scenario 2: The bonds were issued at a market (effective) interest rate of 6%, resulting in Chin receiving cash of $10,426,510. Date Description Powe 2 2 5 6 What is the bond carrying value following the first interest payment? M. Baker Page 10 Bonds Long-term debt instrument Companies. ISSUE Bonds Legal contract Bond Contract specifies: Face Amount Term Contract Rate = Coupon Rate Payment Frequency Based on the above, the Interest Payment is calculated Analogy: Imagine borrowing $10,000 from the bank for 10 years at 10% interest. It is an interest only loan requiring you to make interest payments twice per year. At the end of 10 years you would pay back the $10,000 Types of Bonds: Term Bonds - all bonds of an issue mature at the same time. Serial Bonds - maturity of bonds is spread over several dates Convertible Bonds - may be exchanged for shares of stock under certain conditions Callable Bonds - The issuing corporation has the right to pay off the bonds before maturity Characteristics of Bonds: Issued with face amounts of $1,000 Usually pay interest semiannually Prices quoted as a percentage of face Bonds with a Face Amount of S1.000.000 are issued at 97. How much cash was received? it: Marta Puterte #: Mertua #t: Mature Then: Stig PiecesAurt Then: Bai Foot DISCOUNT So FACE AMOUNT Then: Stingent SEUM Market Rate (of effective rate) determines the Bond Price. Bonds Payable are always booked at Face Value but we don't always issue them for their Face Value, usually those who purchase our bonds either pay a Premium or Discount. Scenario: It takes a while to get approval and print the bonds. At the time they were printed the interest rate printed on the bond was 10%. By the time we go to issue the Bonds, interest rates have gone up to 12%. Nobody will buy our bonds that only pay 10% so we have to adjust the price to give them an EFFECTIVE interest rate of 12%. Even though the interest payments made every 6 months will be at 10%, we adjust the initial price of the bond to exactly what it must be to yield an effective interest rate of 12%. Journal entries for bonds payable. BONDS are always booked at FACE. Any difference between Face Value of the bonds and the issue price is recorded in a Bonds Discount (debit) or Bonds Premium (credit) account. Bond Issue: Face $1,000,000 Term: 5 years Contract rate: 10% semiannual (5% every 6 months) Contract Rate Market Rate Your bonds pay 10% when the market rate for similar bonds is also 10%; bonds will issue at Face Value (no discount or premium). The journal entry to record issuing the bond is GENERAL JOURNAL Page Date Descriptore! Interest Payment Semiannually (every 6 months) checks have to be written to the bond holders for their interest payment. GENERAL JOURNAL Date Descriptseobrir Bond Repayment At the end of the term (Maturity) checks have to be written to the bond holders for their principal repayment. GENERAL JOURNAL Page Dute Description Code Gabriel Co, produces and distributes semiconductors for use by computer manufacturers, Gabriel Co. issued 600,000 of 10-year, 8% bonds on May 1 of the current year at face value, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year Journalize the entries to record the following selected transactions for the current year May 1 Issued the beds for cash at their face Now Paid the interest on the bonds Dec 31 Rocorded accrued interest for two month GENERAL JOURNAL Page Date Descriptio Post reporterede Discount: Contract Rate Market Rate Your bonds pay 10% when the market rate is 8%. Investors will ALL.want to buy your bond. You raise the price on your bonds to make them exactly equal to bonds that pay the market 8%. The investors will get exactly an 8% return on their investment at the premium price. The Company issues $1,000,000 5-year bonds with a contract rate of 10% with semi-annual interest payments when the market rate is 8%. Using Present Value tables we determine that an issue price of $1.081.105 will effectively make our bonds equal to bonds that pay the market 8% The journal entry to record issuing the bond is: Date Descriptive robe robe GENERAL MOURNAL The journal entry to record issuing the bond is: GENERAL MOURNAL Dale Descrip Credi The normal balance of Premium on Bonds Payable is a credit. For Loaning the company $1,081,105, over the 3 year period the investor will get: Principal $1,000,000 Interest Payments 500.000 Total 1,500,000 Investment 1.081.105 Interest Eamed $ 418,895 The Borrowing Company will incur S418,895 of interest expense. The journal entry to record the interest payment and premium amortization separately is: GENERAL JOURNAL Dute Descript OR combined Date Descriere Bond Repayment At the end of the term (Maturity) checks have to be written to the bond holders for their principal repayment GENERAL JOURNAL Pape Dale bed Lemer Corporation wholesales repair products to equipment manufacturers. On April 1, 2019. Lerner Corporation issued $12,000,000 of five-year, 8% bonds at a market (effective) interest rate of 6%, receiving cash of $13,023.576. Interest is payable semiannually on April 1 and October 1. A. Journal entries to record the following le of bed on April, 2. First interest payment Oceber 1, 2019. and moon and promoth, ering the line method. Round to the cast dollar) semiannually on April 1 and October I. A. Journalte the entries to record the following 1 Issuance of bonds on April , 2019. 2 First interest payment on October 1, 2019 and amortization of bond premium for six months. using the straight-line method. (Round to the nearest dollar) B Explain why the company was able to issue the book for $13,023,576 rather than for the face amount of $12,000,000 Date Description Posted 14 5 Bond Redemption Carrying Amount: = Bond Payable balance Less Discount on Bonds Payable Balance OR - Bond Payable balance Plus Premium on Bonds Payable Balance At Term end the carrying Amount is equal to the Bond Payable Face All Discount and Premium balances are now at O because they were fully amortized and the investors are paid the face amount of the bond Date Description Pose Debit Crede If Callable bonds are redeemed early, depending on the Market Rate of interest at the date the bond is called the company may have to pay more or less than the carrying amount of the bond. If the amount paid to redeem the bonds is > Carrying Amount then book Loss If the amount paid to redeem the bonds is Carrying Amount then book Gain Bonds with face value of $1,000,000 called early for $950,826. The unamortized discount at the time of redemption was $29,442 Date Description PowDebit Credis Adele Corp., a wholesaler of music equipment, issued $22,000,000 of Adele Corp., a wholesaler of music equipment, issued $22,000,000 of 20-year, 7% callable bonds on March 1, 2019 at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions Ma Issued the bands for cash at their face amount. Sept Paid the interest on the bonds. 2019 2023 Sept called the bond issue st 302, the rate provided in the bond indenture. (Omit entry fot payment of interest.) Dute Description Powerede Emil Corp. produces and sells wind-energy-driven engines. To finance its operations, Emil Corp. issued $15,000,000 of 20-year, 9% callable bonds on May 1, 2019 at their face amount, with interest payable on May 1 and November 1, The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions May Issued the bonds for cash at their face amount New Paid the interest on the bonds Now I called the bond tasue se %6, the note provided in the bott indenturo. (Omit entry for 2019 2015 payment of interest.) Date Description Pos Debid Credit 14 On the first day of its fiscal year, Chin Company issued $10,000,000 of five-year, 7% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. On the first day of its fiscal year, Chin Company issued $10,000,000 of five-year, 7% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. Journalize the entries to record the following: 1. Issuance of the bonds. 2. First semiannual interest payment. The bond discount/premium is combined with the semiannual interest payment. Round to the nearest dollar Scenario 1: The bonds were issued at a market (effective) interest rate of 8%, resulting in Chin receiving cash of $9,594,415. Deste Description Pod Debit Credi 1 + 5 What is the band carrying value following the first interest payment? Scenario 2: The bonds were issued at a market (effective) interest rate of 6%, resulting in Chin receiving cash of $10,426,510. Date Description Powe 2 2 5 6 What is the bond carrying value following the first interest payment? M. Baker Page 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts