Question: Please help me in solving this Thank you Consider three 4-year maturity bonds; each bond has a face value of $100. All bonds mature on

Please help me in solving this

Thank you

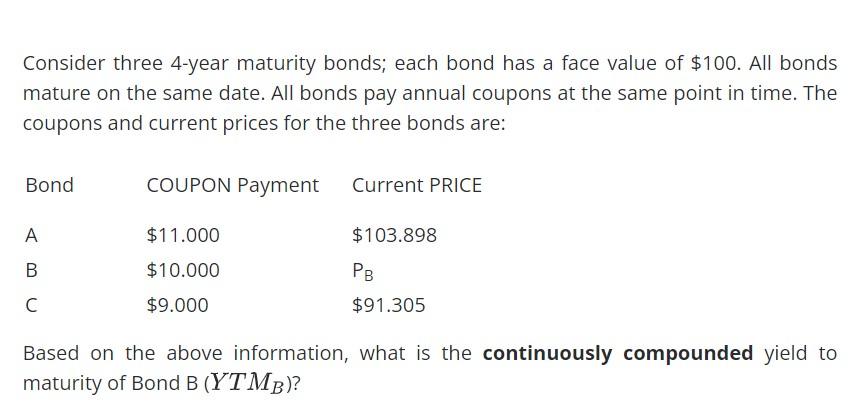

Consider three 4-year maturity bonds; each bond has a face value of $100. All bonds mature on the same date. All bonds pay annual coupons at the same point in time. The coupons and current prices for the three bonds are: Bond COUPON Payment Current PRICE A $11.000 $103.898 B $10.000 PB $91.305 $9.000 Based on the above information, what is the continuously compounded yield to maturity of Bond B (YTMB)? Consider three 4-year maturity bonds; each bond has a face value of $100. All bonds mature on the same date. All bonds pay annual coupons at the same point in time. The coupons and current prices for the three bonds are: Bond COUPON Payment Current PRICE A $11.000 $103.898 B $10.000 PB $91.305 $9.000 Based on the above information, what is the continuously compounded yield to maturity of Bond B (YTMB)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts