Question: Please help me in this asap ,i need ledger , worksheet, statements, adjustments, closing enteries, post closing enteries Calibri 10 ' ' Il Custom aste

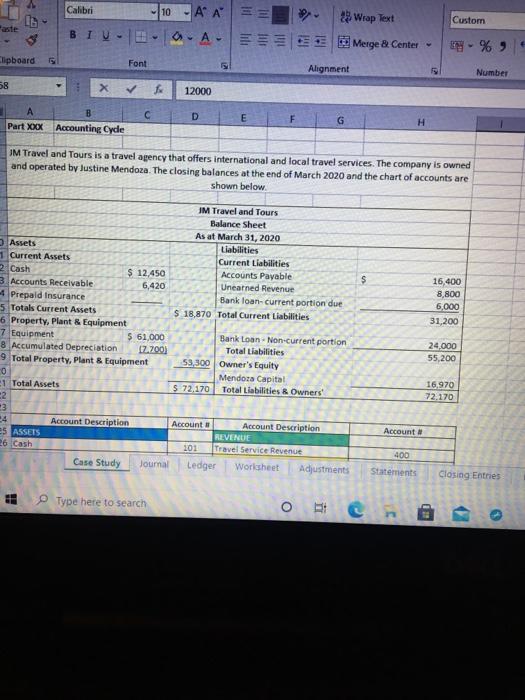

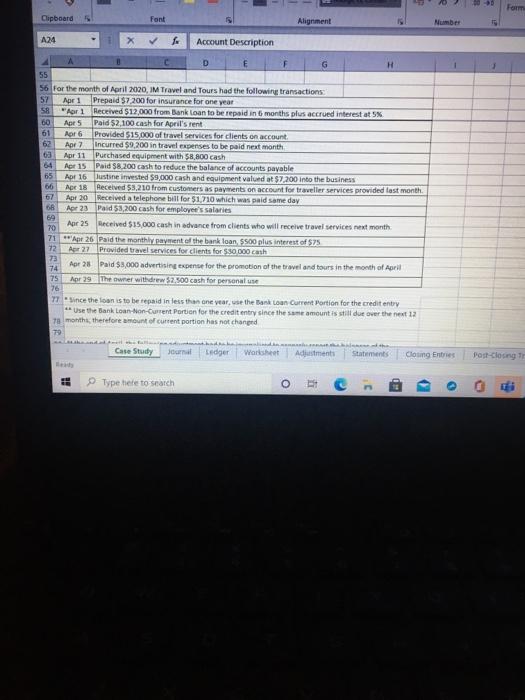

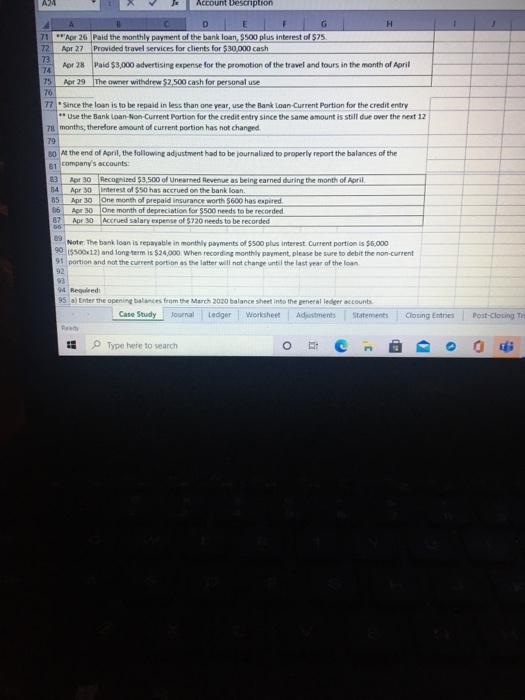

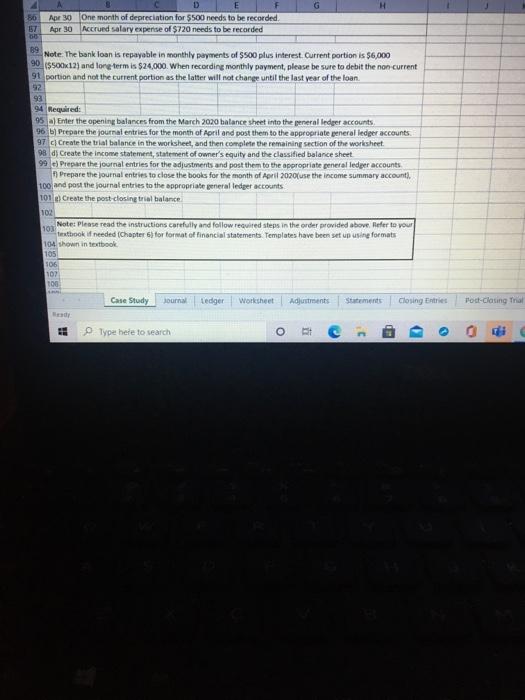

Calibri 10 ' ' Il Custom aste THIO BIU Wrap Text Merge Center - A- - % Clipboard Font Alignment Number 58 X 12000 Part XOOX C D E F H Accounting Cyde JM Travel and Tours is a travel agency that offers international and local travel services. The company is owned and operated by Justine Mendoza. The closing balances at the end of March 2020 and the chart of accounts are shown below $ 16,400 8,800 6,000 31,200 IM Travel and Tours Balance Sheet As at March 31, 2020 Assets Liabilities 1 Current Assets Current Liabilities 2 Cash $ 12.450 Accounts Payable 3 Accounts Receivable 6,420 Unearned Revenue - Prepaid Insurance Bank loan-current portion due 5 Totals Current Assets $ 18,870 Total Current Liabilities 6 Property, Plant & Equipment 7 Equipment 5 61,000 Bank Loan Non-current portion 8 Accumulated Depreciation 17.700) Total Liabilities 9 Total Property, Plant & Equipment 53.300 Owner's Equity 0 Mendoza Capital 1 Total Assets $ 72,170 Total Liabilities & Owners 22 3 4 Account Description Account Account Description 25 ASSETS REVENUE 26 Cash 201 Travel Service Revenue Case Study Journal Ledger Worksheet Adjustments 24,000 55,200 16.970 72. 170 Account 400 Statements Closing Entries Type here to search o 13 - Form Clipboard font Alignment Number A24 X Account Description A C D F G 55 56 For the month of April 2020, IM Travel and Tours had the following transactions S7 Apr1 Prepaid $7.200 for insurance for one year 58 "Aer1 Received $12,000 from Bank Loan to be repaid in 6 months plus accrued interest at 5% 00 Apr 5 Paid $2,100 cash for April's rent 61 Apr 6 Provided 515.000 of travel Services for clients on account 62 Apr 7 Incurred $9,200 in travel expenses to be paid next month 63 Apr 11 Purchased equipment with 58,800 cash 64 Apr 15 Paid $8.200 cash to reduce the balance of accounts payable 65 Apr 16 Iustine invested $9,000 cash and equipment valued at $7,200 into the business 66 Apr 18 Received 53.210 from customers as payments on account for traveller services provided last month. Apr 20 Received a telephone bill for $1.710 which was paid same day Apr 23 Paid $3,200 cash for employee's salaries 69 Apr 25 Received $15.000 cash in advance from clients who will receive travel services et months 70 71 Apr 26 Paid the monthly payment of the bank loan $500 plus interest of S75 72 Apr 27 Provided travel services for clients for $30.000 cash 73 Apr 28 Paid $3,000 advertising expense for the promotion of the twel and tours in the month of April 74 75 Apr 29 The owner withdrew $2,500 cash for personal use 76 77 Since the loan is to be repaid in less than one year, use the Bank Loan Current Portion for the credit entry - Use the Bank Loan on-Current Portion for the credit entry since the same amount is still due over the next 12 T8 month, therefore amount of current portion has not changed 79 Case Study jar Ledger Worth Adjustments Statements Clong Entries Post-Cloung HE . Type here to search O ti D > A24 Account Description D G H 71 Apr 26 Paid the monthly payment of the bank loan $500 plus interest of $75 72 Por 27 Provided travel services for clients for $30,000 cash 74 Apr 28 Paid $3,000 advertising expense for the promotion of the travel and tours in the month of April T5 for 29 The owner withdrew $2,500 cash for personal use 70 77. Since the loan is to be repeld in less than one year, use the Blank Loan Current Portion for the credit entry ** Use the Bank Loan Non Current Portion for the credit entry since the same amount is still due over the next 12 78 months, therefore amount of current portion has not changed 79 30 Me the end of Goril, the following adjustment had to be journalind to properly report the balances of the 81 company's accounts: Apt 30 Recopied $3.500 of Unearned revenue as being earned during the month of April Apr 30 rest of $50 has accrued on the bank loan 85 Apr 30 One month of prepaid insurance worth 5600 has expired 36 Apr 30 One month of depreciation for $500 needs to be recorded Apr 30 Accrued salary expense of 5720 needs to be recorded 83 14 07 00 89 Note: The bank loan is repayable in monthly payments of $500 plus interest Current portion is 56,000 905500x12) and long term is $24,000 when recording monthly payment please be sure to debit the non-current 91 portion and not the current portion as the latter will not change until the last year of the loan 92 93 94 Required 95 ) Enter the opening balances from the March 2020 balance sheet into the general ledger accounts Case Study Lediger Worksheet Adients Statements Closing Entre Post-Closing Type here to search a 3 H 56 Apr 30 One month of depreciation for $500 needs to be recorded. 57 Apr 30 Accrued salary expense of $720 needs to be recorded 00 89 Note. The bank loan is repayable in monthly payments of $500 plus interest Current portion is $6,000 90 issox12) and long term is $24,000. When recording monthly payment, please be sure to debit the non current 91 portion and not the current portion as the latter will not change until the last year of the loan 92 98 94 Required: 95. b) Enter the opening balances from the March 2020 balance sheet into the peneral ledger accounts 96 by Prepare the journal entries for the month of April and post them to the appropriate general ledger accounts 97 Create the trial balance in the worksheet, and then complete the remaining section of the worksheet 98 ds Create the income statement, statement of owner's equity and the classified balance sheet 99) Prepare the journal entries for the adjustments and post them to the appropriate general ledger accounts Prepare the journal entries to close the books for the month of April 2020 use the income summary account too and post the journal entries to the appropriate general ledger accounts 101. Create the post closing trial balance 102 103 Note: Please read the instructions carefully and follow required steps in the order provided above. Refer to your tattoo if needed (Chapter 6 for format of financial statements Templates have been set up using formats 104 shown in textbook 105 106 107 100 Case Study Journal Ledger Worksheet Adjustments Closing Entries Post-Closing Trial Seady Type here to search C Calibri 10 ' ' Il Custom aste THIO BIU Wrap Text Merge Center - A- - % Clipboard Font Alignment Number 58 X 12000 Part XOOX C D E F H Accounting Cyde JM Travel and Tours is a travel agency that offers international and local travel services. The company is owned and operated by Justine Mendoza. The closing balances at the end of March 2020 and the chart of accounts are shown below $ 16,400 8,800 6,000 31,200 IM Travel and Tours Balance Sheet As at March 31, 2020 Assets Liabilities 1 Current Assets Current Liabilities 2 Cash $ 12.450 Accounts Payable 3 Accounts Receivable 6,420 Unearned Revenue - Prepaid Insurance Bank loan-current portion due 5 Totals Current Assets $ 18,870 Total Current Liabilities 6 Property, Plant & Equipment 7 Equipment 5 61,000 Bank Loan Non-current portion 8 Accumulated Depreciation 17.700) Total Liabilities 9 Total Property, Plant & Equipment 53.300 Owner's Equity 0 Mendoza Capital 1 Total Assets $ 72,170 Total Liabilities & Owners 22 3 4 Account Description Account Account Description 25 ASSETS REVENUE 26 Cash 201 Travel Service Revenue Case Study Journal Ledger Worksheet Adjustments 24,000 55,200 16.970 72. 170 Account 400 Statements Closing Entries Type here to search o 13 - Form Clipboard font Alignment Number A24 X Account Description A C D F G 55 56 For the month of April 2020, IM Travel and Tours had the following transactions S7 Apr1 Prepaid $7.200 for insurance for one year 58 "Aer1 Received $12,000 from Bank Loan to be repaid in 6 months plus accrued interest at 5% 00 Apr 5 Paid $2,100 cash for April's rent 61 Apr 6 Provided 515.000 of travel Services for clients on account 62 Apr 7 Incurred $9,200 in travel expenses to be paid next month 63 Apr 11 Purchased equipment with 58,800 cash 64 Apr 15 Paid $8.200 cash to reduce the balance of accounts payable 65 Apr 16 Iustine invested $9,000 cash and equipment valued at $7,200 into the business 66 Apr 18 Received 53.210 from customers as payments on account for traveller services provided last month. Apr 20 Received a telephone bill for $1.710 which was paid same day Apr 23 Paid $3,200 cash for employee's salaries 69 Apr 25 Received $15.000 cash in advance from clients who will receive travel services et months 70 71 Apr 26 Paid the monthly payment of the bank loan $500 plus interest of S75 72 Apr 27 Provided travel services for clients for $30.000 cash 73 Apr 28 Paid $3,000 advertising expense for the promotion of the twel and tours in the month of April 74 75 Apr 29 The owner withdrew $2,500 cash for personal use 76 77 Since the loan is to be repaid in less than one year, use the Bank Loan Current Portion for the credit entry - Use the Bank Loan on-Current Portion for the credit entry since the same amount is still due over the next 12 T8 month, therefore amount of current portion has not changed 79 Case Study jar Ledger Worth Adjustments Statements Clong Entries Post-Cloung HE . Type here to search O ti D > A24 Account Description D G H 71 Apr 26 Paid the monthly payment of the bank loan $500 plus interest of $75 72 Por 27 Provided travel services for clients for $30,000 cash 74 Apr 28 Paid $3,000 advertising expense for the promotion of the travel and tours in the month of April T5 for 29 The owner withdrew $2,500 cash for personal use 70 77. Since the loan is to be repeld in less than one year, use the Blank Loan Current Portion for the credit entry ** Use the Bank Loan Non Current Portion for the credit entry since the same amount is still due over the next 12 78 months, therefore amount of current portion has not changed 79 30 Me the end of Goril, the following adjustment had to be journalind to properly report the balances of the 81 company's accounts: Apt 30 Recopied $3.500 of Unearned revenue as being earned during the month of April Apr 30 rest of $50 has accrued on the bank loan 85 Apr 30 One month of prepaid insurance worth 5600 has expired 36 Apr 30 One month of depreciation for $500 needs to be recorded Apr 30 Accrued salary expense of 5720 needs to be recorded 83 14 07 00 89 Note: The bank loan is repayable in monthly payments of $500 plus interest Current portion is 56,000 905500x12) and long term is $24,000 when recording monthly payment please be sure to debit the non-current 91 portion and not the current portion as the latter will not change until the last year of the loan 92 93 94 Required 95 ) Enter the opening balances from the March 2020 balance sheet into the general ledger accounts Case Study Lediger Worksheet Adients Statements Closing Entre Post-Closing Type here to search a 3 H 56 Apr 30 One month of depreciation for $500 needs to be recorded. 57 Apr 30 Accrued salary expense of $720 needs to be recorded 00 89 Note. The bank loan is repayable in monthly payments of $500 plus interest Current portion is $6,000 90 issox12) and long term is $24,000. When recording monthly payment, please be sure to debit the non current 91 portion and not the current portion as the latter will not change until the last year of the loan 92 98 94 Required: 95. b) Enter the opening balances from the March 2020 balance sheet into the peneral ledger accounts 96 by Prepare the journal entries for the month of April and post them to the appropriate general ledger accounts 97 Create the trial balance in the worksheet, and then complete the remaining section of the worksheet 98 ds Create the income statement, statement of owner's equity and the classified balance sheet 99) Prepare the journal entries for the adjustments and post them to the appropriate general ledger accounts Prepare the journal entries to close the books for the month of April 2020 use the income summary account too and post the journal entries to the appropriate general ledger accounts 101. Create the post closing trial balance 102 103 Note: Please read the instructions carefully and follow required steps in the order provided above. Refer to your tattoo if needed (Chapter 6 for format of financial statements Templates have been set up using formats 104 shown in textbook 105 106 107 100 Case Study Journal Ledger Worksheet Adjustments Closing Entries Post-Closing Trial Seady Type here to search C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts