Question: Please help me Journal these entries Acct 213 Notes and Accounts Receivable Transactions That Darned Company 12-Jan Sales, on account, totaled $137,200. 14-Mar Write-off accounts

Please help me Journal these entries

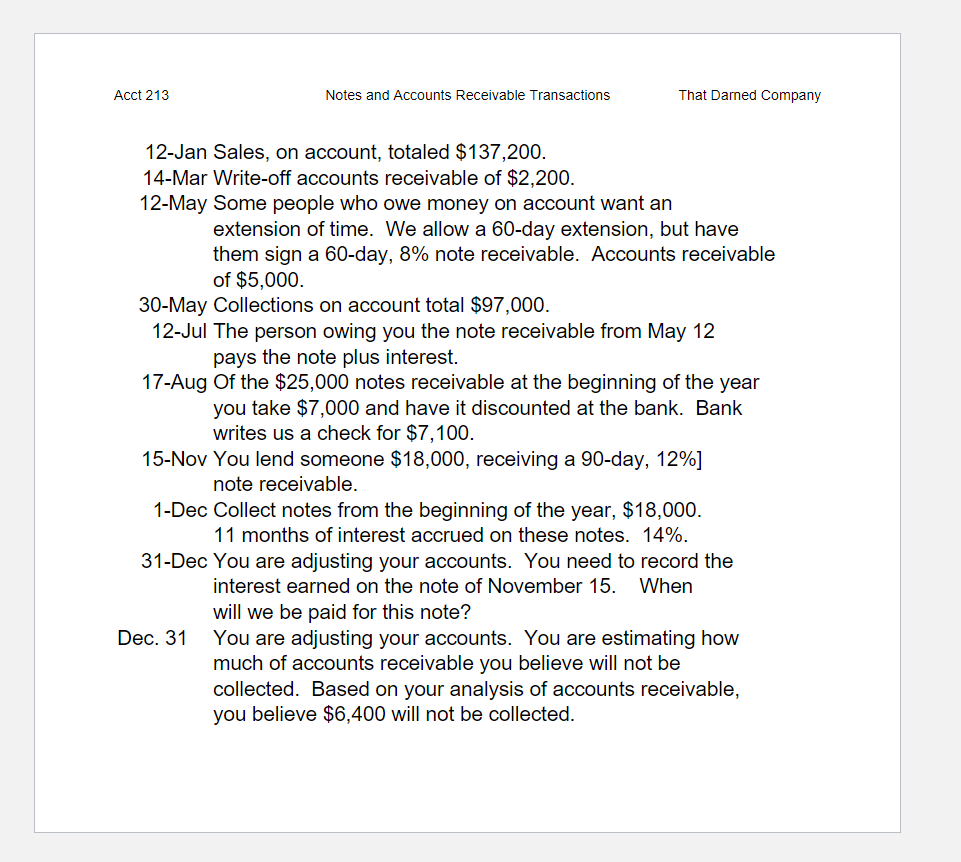

Acct 213 Notes and Accounts Receivable Transactions That Darned Company 12-Jan Sales, on account, totaled $137,200. 14-Mar Write-off accounts receivable of $2,200. 12-May Some people who owe money on account want an extension of time. We allow a 60-day extension, but have them sign a 60-day, 8% note receivable. Accounts receivable of $5,000. 30-May Collections on account total $97,000. 12-Jul The person owing you the note receivable from May 12 pays the note plus interest. 17-Aug Of the $25,000 notes receivable at the beginning of the year you take $7,000 and have it discounted at the bank. Bank writes us a check for $7,100. 15-Nov You lend someone $18,000, receiving a 90-day, 12%] note receivable. 1-Dec Collect notes from the beginning of the year, $18,000. 11 months of interest accrued on these notes. 14%. 31-Dec You are adjusting your accounts. You need to record the interest earned on the note of November 15. When will we be paid for this note? Dec. 31 You are adjusting your accounts. You are estimating how much of accounts receivable you believe will not be collected. Based on your analysis of accounts receivable, you believe $6,400 will not be collected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts