Question: PLEASE HELP ME, NEED THE ANSWER TODAY. AND I ONLY HAVE 30 MINS. This window shows your responses and what was marked correct and incorrect

PLEASE HELP ME, NEED THE ANSWER TODAY. AND I ONLY HAVE 30 MINS.

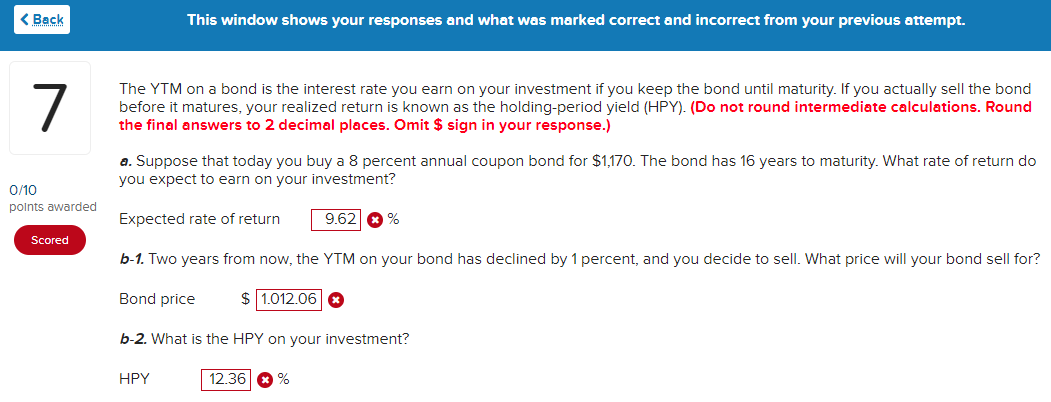

This window shows your responses and what was marked correct and incorrect from your previous attempt. The YTM on a bond is the interest rate you earn on your investment if you keep the bond until maturity. If you actually sell the bond before it matures, your realized return is known as the holding-period yield (HPY). (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit \$ sign in your response.) a. Suppose that today you buy a 8 percent annual coupon bond for $1,170. The bond has 16 years to maturity. What rate of return do you expect to earn on your investment? Expected rate of return % b-1. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell. What price will your bond sell for? Bond price $ b-2. What is the HPY on your investment? HPY %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts