Question: please help me now.I have to submit it mow U Search this course Ch 04: End-of-Chapter Problems - Bonds Valuation Attempts: 0 Keep the Highest:

please help me now.I have to submit it mow

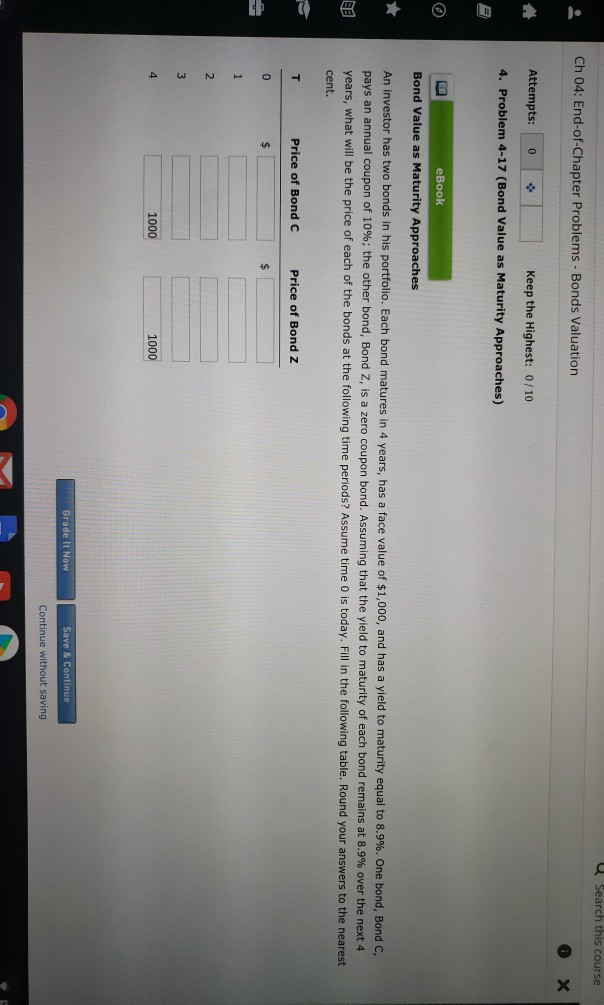

U Search this course Ch 04: End-of-Chapter Problems - Bonds Valuation Attempts: 0 Keep the Highest: 0/10 4. Problem 4-17 (Bond Value as Maturity Approaches) eBook Bond Value as Maturity Approaches An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity equal to 8.9%. One bond, Bond , pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 8.9% over the next 4 years, what will be the price of each of the bonds at the following time periods? Assume time 0 is today. Fill in the following table. Round your answers to the nearest cent. Price of Bond C Price of Bond z 1000 1000 Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts