Question: please help me on all :( Ray Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's

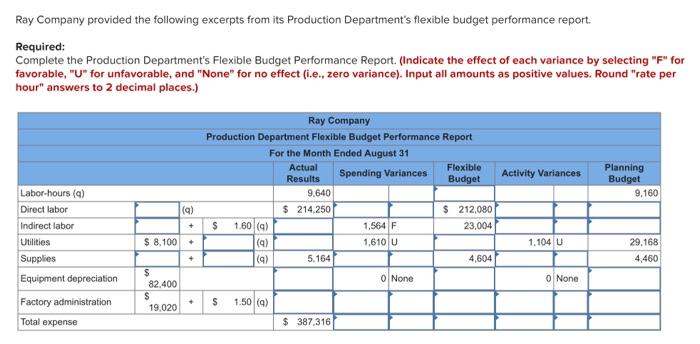

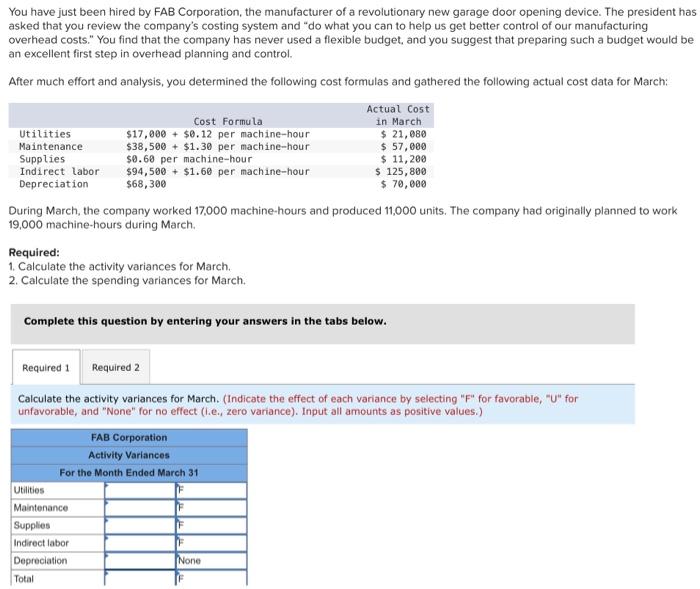

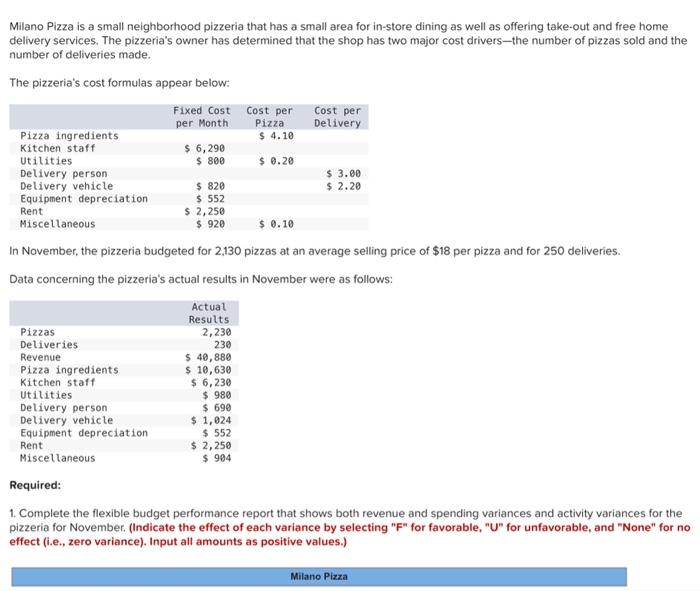

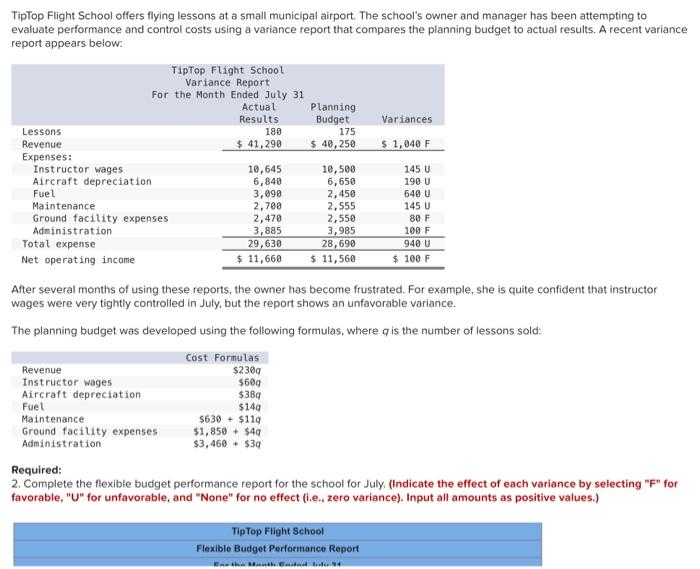

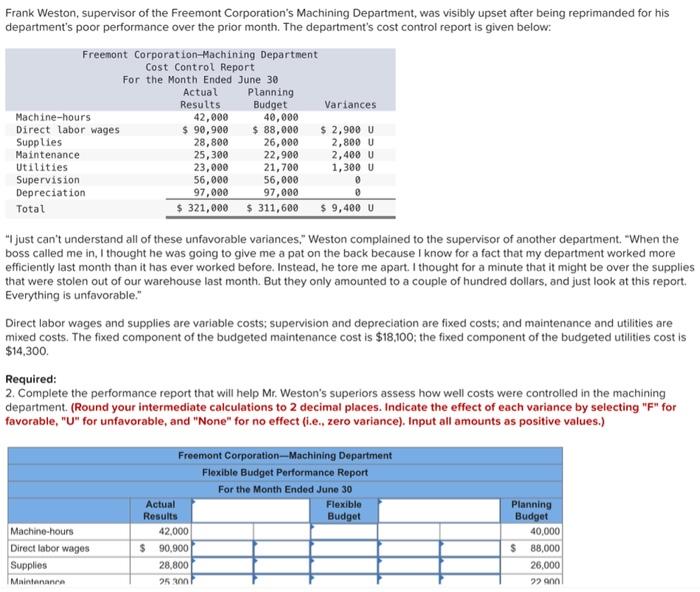

Ray Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round "rate per hour" answers to 2 decimal places.) Activity Variances Ray Company Production Department Flexible Budget Performance Report For the Month Ended August 31 Actual Flexible Spending Variances Results Budget 9.640 $ 214.250 $ 212,080 $ 1.60 (9) 1,564 F 23,004 (a) 1,610 U (9) 5,164 4,604 Planning Budget 9,160 Labor-hours (9) Direct labor Indirect labor Utilities Supplies Equipment depreciation (9) $ 8,100 1.104 U 29,168 + 4.460 o None O None $ 82.400 $ 19.020 Factory administration + S 1.50 (9) Total expense $ 387.316 You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president has asked that you review the company's costing system and do what you can to help us get better control of our manufacturing overhead costs." You find that the company has never used a flexible budget, and you suggest that preparing such a budget would be an excellent first step in overhead planning and control. After much effort and analysis, you determined the following cost formulas and gathered the following actual cost data for March: Actual Cost Cost Formula in March Utilities $17,000 + $0.12 per machine-hour $ 21,880 Maintenance $38,500 + $1.30 per machine-hour $ 57,000 Supplies $0.68 per machine-hour $ 11,200 Indirect labor $94,500 + $1.60 per machine-hour $ 125,800 Depreciation $68,300 $70,000 During March, the company worked 17,000 machine-hours and produced 11,000 units. The company had originally planned to work 19,000 machine-hours during March Required: 1. Calculate the activity variances for March 2. Calculate the spending variances for March. + Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the activity variances for March. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (l.e., zero variance). Input all amounts as positive values.) FAB Corporation Activity Variances For the Month Ended March 31 Utilities Maintenance Supplies F Indirect labor Depreciation None Total TE Rent Milano Pizza is a small neighborhood pizzeria that has a small area for in-store dining as well as offering take-out and free home delivery services. The pizzeria's owner has determined that the shop has two major cost drivers-the number of pizzas sold and the number of deliveries made. The pizzeria's cost formulas appear below: Fixed Cost Cost per Cost per per Month Pizza Delivery Pizza ingredients $ 4.10 Kitchen staff $ 6,290 Utilities $ 800 $ 0.20 Delivery person $ 3.00 Delivery vehicle $ 820 $ 2.20 Equipment depreciation $ 552 $ 2,250 Miscellaneous $ 920 $ 0.10 In November, the pizzeria budgeted for 2.130 pizzas at an average selling price of $18 per pizza and for 250 deliveries. Data concerning the pizzeria's actual results in November were as follows: Actual Results Pizzas 2,230 Deliveries 230 Revenue $ 40,880 Pizza ingredients $ 10,630 Kitchen staff $ 6,230 Utilities $ 980 Delivery person Delivery vehicle $ 1,024 Equipment depreciation Rent $ 2,250 Miscellaneous $ 904 Required: 1. Complete the flexible budget performance report that shows both revenue and spending variances and activity variances for the pizzeria for November. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) $ 690 $ 552 Milano Pizza TipTop Flight School offers flying lessons at a small municipal airport. The school's owner and manager has been attempting to evaluate performance and control costs using a variance report that compares the planning budget to actual results. A recent variance report appears below: TipTop Flight School Variance Report For the Month Ended July 31 Actual Planning Results Budget Variances Lessons 180 175 Revenue $ 41,290 $ 40,250 $ 1,040 F Expenses: Instructor wages 10,645 10,500 145 U Aircraft depreciation 6,840 6,650 190 U Fuel 3,090 2,450 640 U Maintenance 2,700 2,555 145 U Ground facility expenses 2,470 2,550 80 F Administration 3,885 3,985 100 F Total expense 29,630 28,690 940 U Net operating income $ 11,660 $ 11,560 $ 100 F After several months of using these reports, the owner has become frustrated. For example, she is quite confident that instructor wages were very tightly controlled in July, but the report shows an unfavorable variance. The planning budget was developed using the following formulas, where a is the number of lessons sold: Cost Formulas Revenue $2309 Instructor wages $60 Aircraft depreciation $389 $149 Maintenance $630 + $119 Ground facility expenses $1,850 + $40 Administration $3,460 + $30 Required: 2. Complete the flexible budget performance report for the school for July (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Fuel Tip Top Flight School Flexible Budget Porformance Report Frank Weston, supervisor of the Freemont Corporation's Machining Department, was visibly upset after being reprimanded for his department's poor performance over the prior month. The department's cost control report is given below: Freemont Corporation Machining Department Cost Control Report For the Month Ended June 30 Actual Planning Results Budget Variances Machine-hours 42,000 40,000 Direct labor wages $ 90,900 $ 88,000 $ 2,900 U Supplies 28,800 26,000 2,800 U Maintenance 25,300 22,900 2,400 U Utilities 23,000 21,700 1,300 U Supervision 56,000 56,000 Depreciation 97,000 97,000 8 Total $ 321,000 $ 311,600 $ 9,400 V just can't understand all of these unfavorable variances." Weston complained to the supervisor of another department. "When the boss called me in, I thought he was going to give me a pat on the back because I know for a fact that my department worked more efficiently last month than it has ever worked before. Instead, he tore me apart. I thought for a minute that it might be over the supplies that were stolen out of our warehouse last month. But they only amounted to a couple of hundred dollars, and just look at this report. Everything is unfavorable." Direct labor wages and supplies are variable costs; supervision and depreciation are fixed costs; and maintenance and utilities are mixed costs. The fixed component of the budgeted maintenance cost is $18,100; the fixed component of the budgeted utilities cost is $14,300. Required: 2. Complete the performance report that will help Mr. Weston's superiors assess how well costs were controlled in the machining department (Round your intermediate calculations to 2 decimal places. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect fi.e., zero variance). Input all amounts as positive values.) Freemont Corporation-Machining Department Flexible Budget Performance Report For the Month Ended June 30 Actual Flexible Results Budget 42.000 $ 90.900 28.800 Machine-hours Direct labor wages Supplies Maintenance Planning Budget 40,000 $ 88,000 26,000 92 ann 25 l

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts