Question: Please help me on below 2 question with explanation. Thank you 8. You have decided to refinance your eight-unit apartment building, and the appraiser has

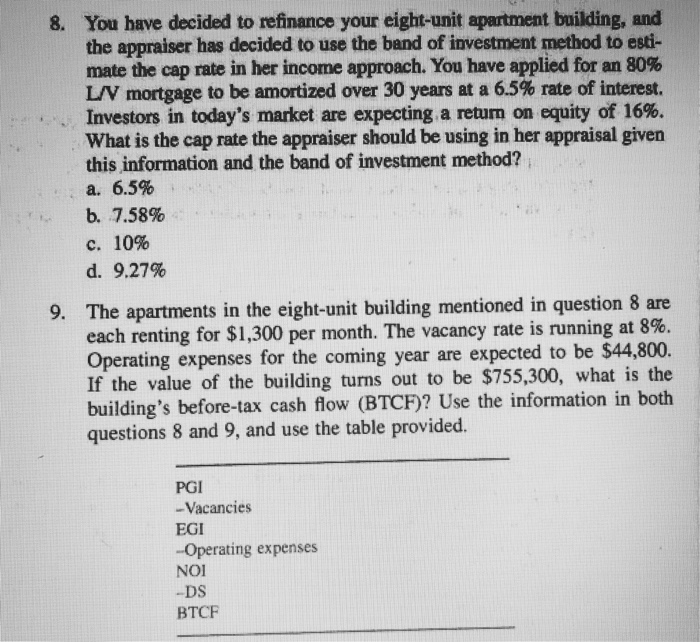

8. You have decided to refinance your eight-unit apartment building, and the appraiser has decided to use the band of investment method to esti- mate the cap rate in her income approach. You have applied for an 80% LV mortgage to be amortized over 30 years at a 65% rate of interest. Investors in today's market are expecting a return on equity of 16%. What is the cap rate the appraiser should be using in her appraisal given this information and the band of investment method? a. 6.5% b. 7.58% c. 10% d. 9.27% " 9. The apartments in the eight-unit building mentioned in question 8 are each renting for $1,300 per month. The vacancy rate is running at 8%. Operating expenses for the coming year are expected to be $44,800. If the value of the building turns out to be $755,300, what is the building's before-tax cash flow (BTCF? Use the information in both questions 8 and 9, and use the table provided. PGI -Vacancies EGI -Operating expenses NoI -DS BTCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts