Question: please help me On Jan 1, 2010, Red Sea Development company purchased a crane for $1,200,000 with estimated useful life of 200,000 hours and residual

please help me

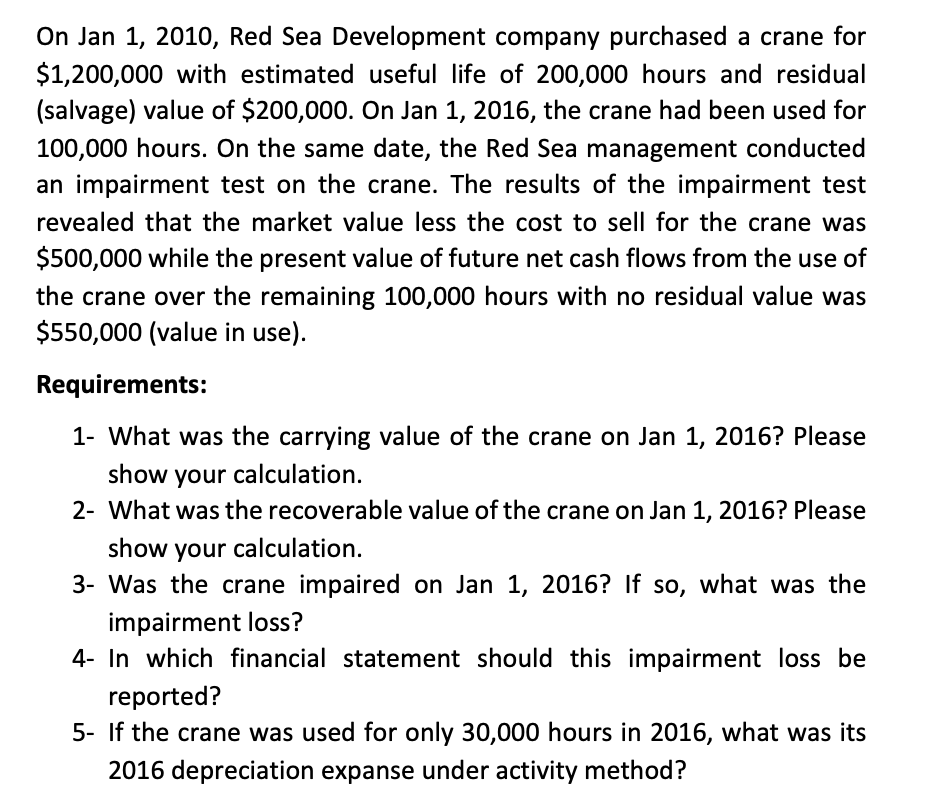

On Jan 1, 2010, Red Sea Development company purchased a crane for $1,200,000 with estimated useful life of 200,000 hours and residual (salvage) value of $200,000. On Jan 1, 2015, the crane had been used for 100,000 hours. On the same date, the Red Sea management conducted an impairment test on the crane. The results of the impairment test revealed that the market value less the cost to sell for the crane was $500,000 while the present value of future net cash flows from the use of the crane over the remaining 100,000 hours with no residual value was $550,000 (value in use). Requirements: 1- What was the carrying value of the crane on Jan 1, 2016? Please show your calculation. 2- What was the recoverable value of the crane on Jan 1, 2016? Please show your calculation. 3- Was the crane impaired on Jan 1, 2016? If so, what was the impairment loss? 4- In which financial statement should this impairment loss be reported? 5- If the crane was used for only 30,000 hours in 2016, what was its 2016 depreciation expanse under activity method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts