Question: Please help me on my multiple choice. thanks MULTIPLE CHOICE: Analyze the following questions and choose among the options which you think is the correct

Please help me on my multiple choice. thanks

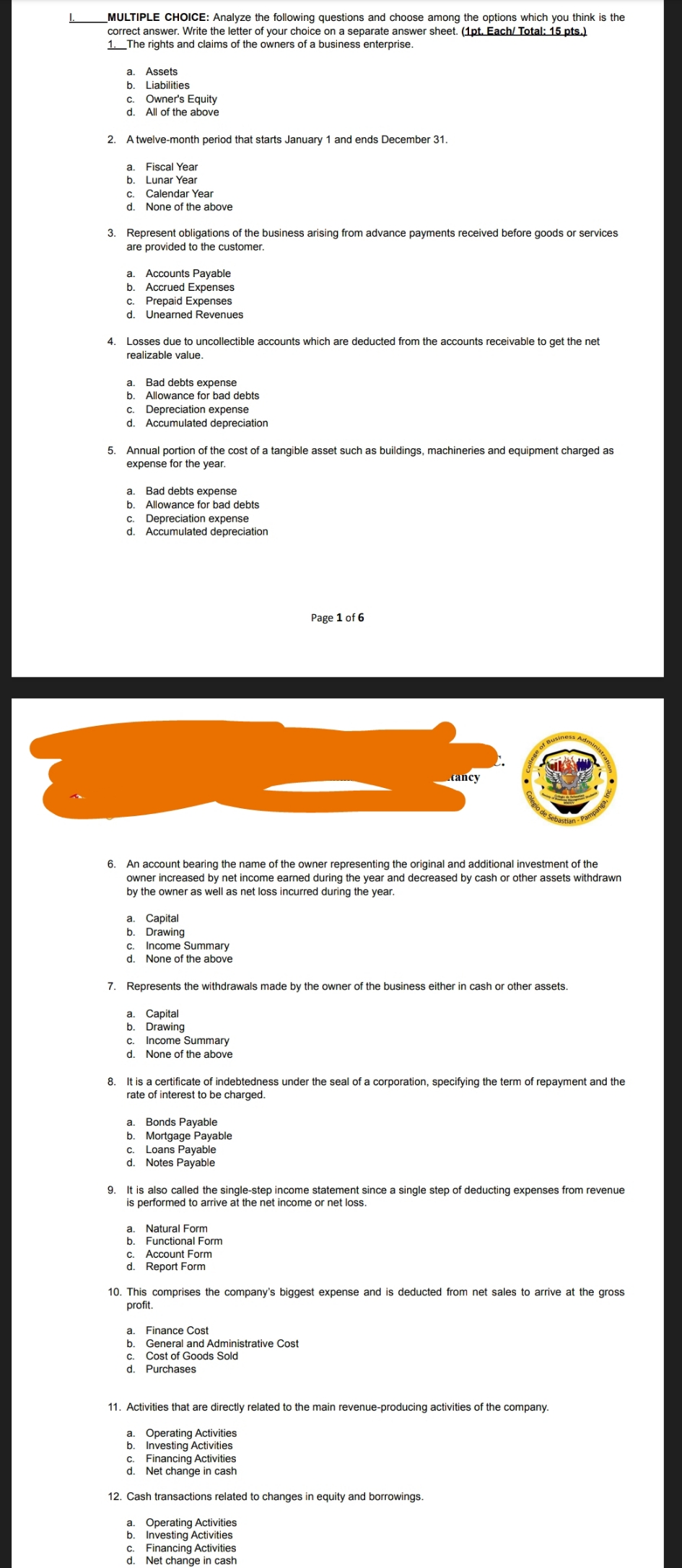

MULTIPLE CHOICE: Analyze the following questions and choose among the options which you think is the correct answer. Write the letter of your choice on a separate answer sheet. (1pt. Each/ Total: 15 pts.) 1. The rights and claims of the owners of a business enterprise. a. Assets . Liabilities c. Owner's Equity d. All of the above 2. A twelve-month period that starts January 1 and ends December 31. a. Fiscal Year b. Lunar Year Calendar Year d None of the above 3. Represent obligations of the business arising from advance payments received before goods or services are provided to the customer. a. Accounts Payable . Accrued Expenses c. Prepaid Expenses d. Unearned Revenues 4. Losses due to uncollectible accounts which are deducted from the accounts receivable to get the net realizable value. . Bad debts expense b. Allowance for bad debts c. Depreciation expense d. Accumulated depreciation 5. Annual portion of the cost of a tangible asset such as buildings, machineries and equipment charged as expense for the year a. Bad debts expense b. Allowance for bad debts C. Depreciation expense d. Accumulated depreciation Page 1 of 6 fancy stian - Pan 6. An account bearing the name of the owner representing the original and additional investment of the owner increased by net income earned during the year and decreased by cash or other assets withdrawn by the owner as well as net loss incurred during the year. a. Capital b. Drawing Income Summary d None of the above 7. Represents the withdrawals made by the owner of the business either in cash or other assets. a. Capital b. Drawing C. Income Summary d. None of the above 8. ertificate of indebtedness under the seal of a corporation, specifying the term of repayment and the rate of interest to be charged. a. Bonds Payable b. Mortgage Payable c. Loans Payable d. Notes Payable 9. It is also called the single-step income statement since a single step of deducting expenses from revenue is performed to arrive at the net income or net loss. a. Natural Form b. Functional Form C. Account Form d. Report Form 10. This comprises the company's biggest expense and is deducted from net sales to arrive at the gross profit. a. Finance Cost b. General and Administrative Cost C. Cost of Goods Sold d. Purchases 11. Activities that are directly related to the main revenue-producing activities of the company. a. Operating Activities b. Investing Activities C. Financing Activities d Net change in cash 12. Cash transactions related to changes in equity and borrowings. a. Operating Activities b. Investing Activities C. Financing Activities Net change in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts