Question: please help me on these, i'm on a time crunch. thank you !! Activity-Based Costing Mainline Marine Company has total estimated factory overhead for the

please help me on these, i'm on a time crunch. thank you !!

please help me on these, i'm on a time crunch. thank you !!

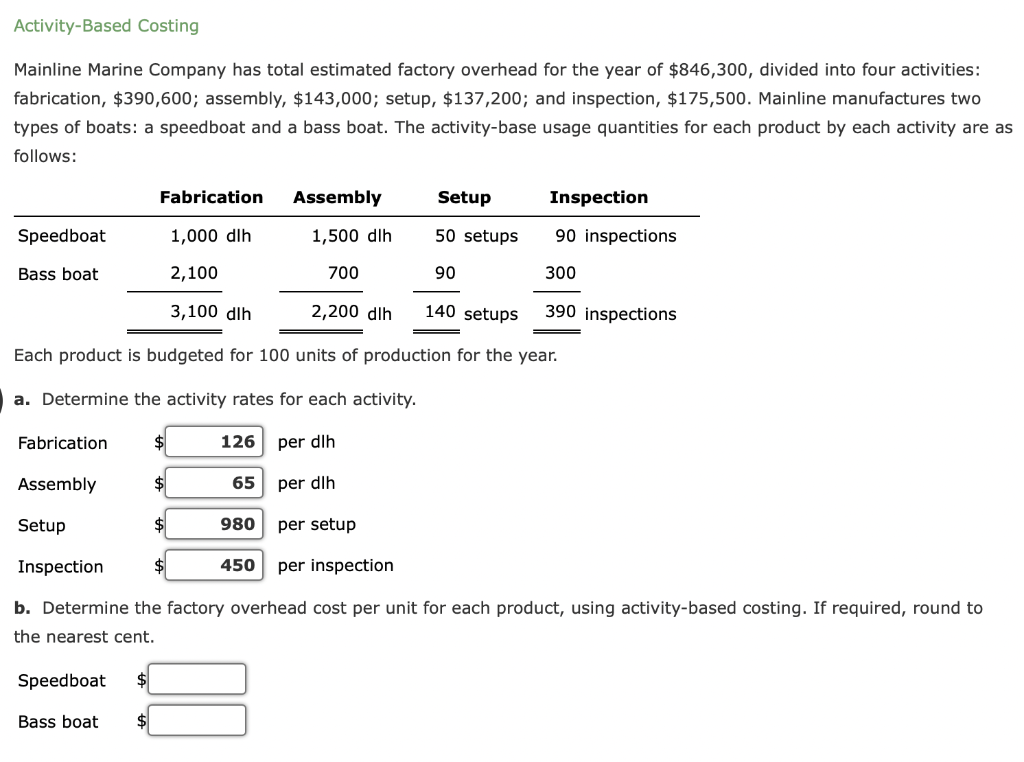

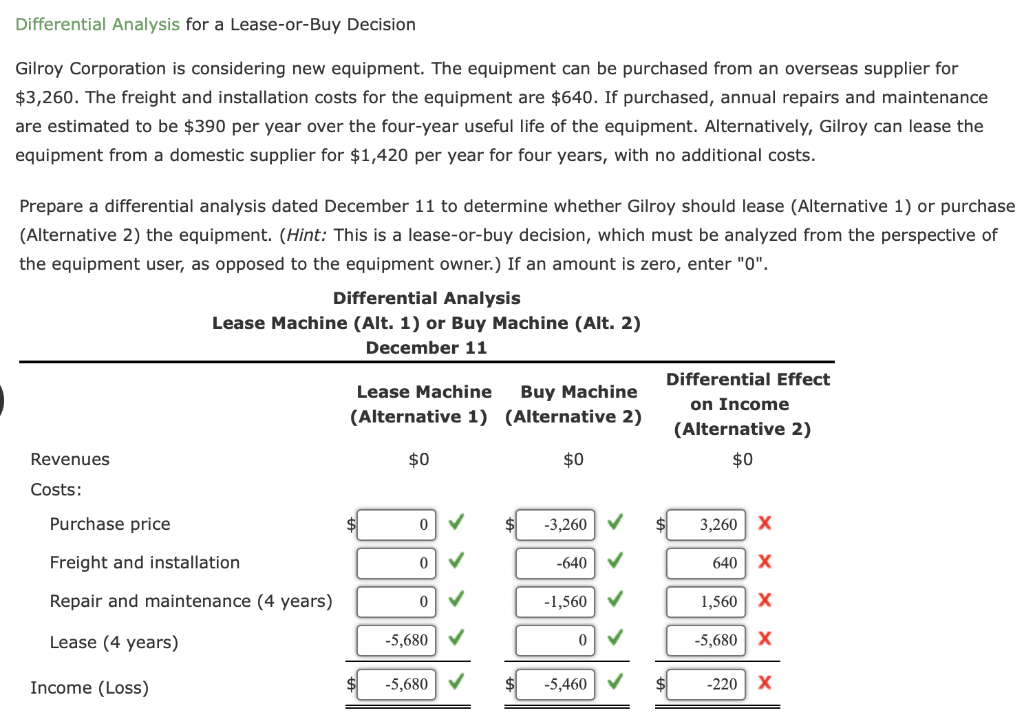

Activity-Based Costing Mainline Marine Company has total estimated factory overhead for the year of $846,300, divided into four activities: fabrication, $390,600; assembly, $143,000; setup, $137,200; and inspection, $175,500. Mainline manufactures two types of boats: a speedboat and a bass boat. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 1,000 dlh 1,500 dlh 50 setups 90 inspections Bass boat 2,100 700 90 300 3,100 dlh 2,200 dlh 140 setups 390 inspections Each product is budgeted for 100 units of production for the year. a. Determine the activity rates for each activity. Fabrication $ 126 per dlh Assembly 65 per dlh Setup 980 per setup Inspection 450 per inspection b. Determine the factory overhead cost per unit for each product, using activity-based costing. If required, round to the nearest cent. Speedboat $ Bass boat $ Differential Analysis for a Lease-or-Buy Decision Gilroy Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $3,260. The freight and installation costs for the equipment are $640. If purchased, annual repairs and maintenance are estimated to be $390 per year over the four-year useful life of the equipment. Alternatively, Gilroy can lease the equipment from a domestic supplier for $1,420 per year for four years, with no additional costs. Prepare a differential analysis dated December 11 to determine whether Gilroy should lease (Alternative 1) or purchase (Alternative 2) the equipment. (Hint: This is a lease-or-buy decision, which must be analyzed from the perspective of the equipment user, as opposed to the equipment owner.) If an amount is zero, enter "0". Differential Analysis Lease Machine (Alt. 1) or Buy Machine (Alt. 2) December 11 Lease Machine Buy Machine (Alternative 1) (Alternative 2) Differential Effect on Income (Alternative 2) $0 $0 $0 Revenues Costs: 0 -3,260 3,260 X 0 -640 640 X 0 -1,560 1,560 X 0 -5,680 X -5,460 -220 X Purchase price Freight and installation Repair and maintenance (4 years) Lease (4 years) Income (Loss) -5,680 -5,680

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts