Question: Please help me on this excel interpretation. Thank you so much! Problem 1. Decision Trees (14 points) AZRE is a mid-size pharmaceutical firm specializing in

Please help me on this excel interpretation. Thank you so much!

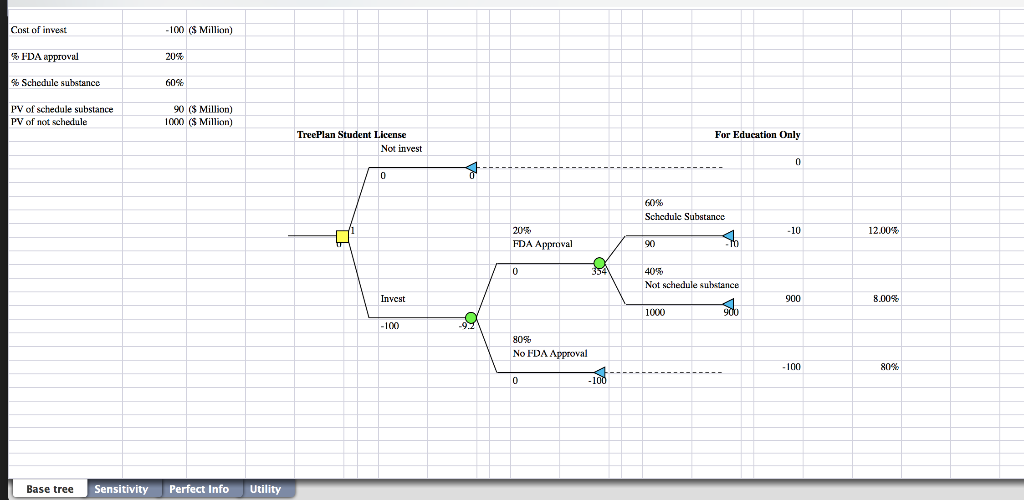

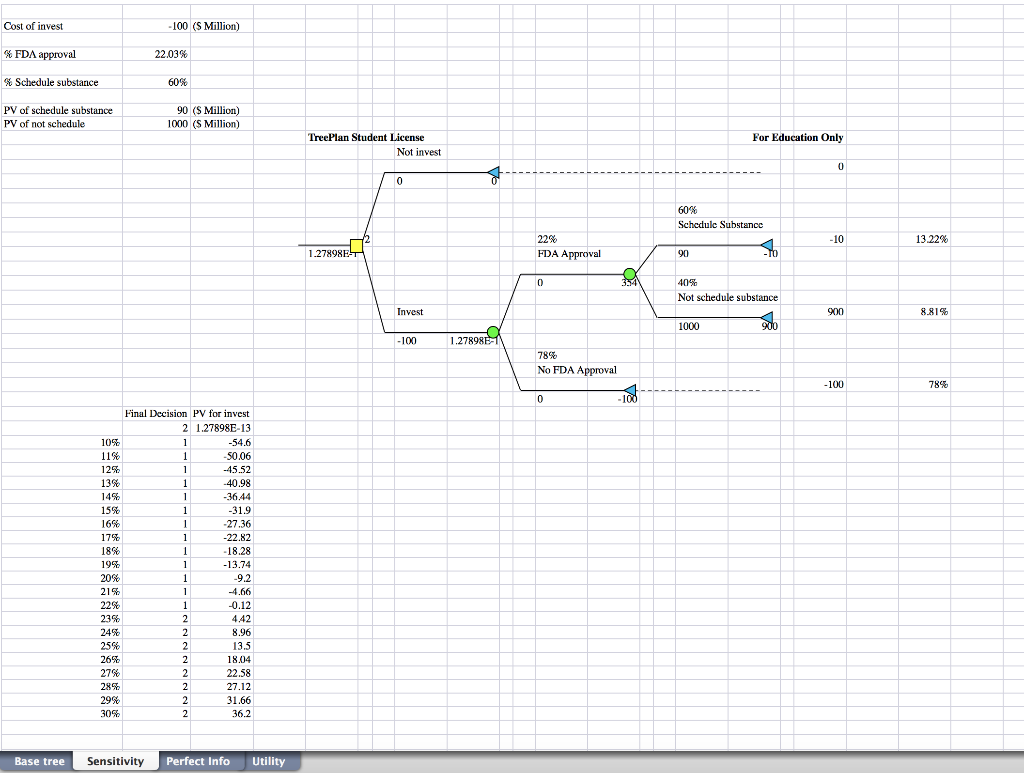

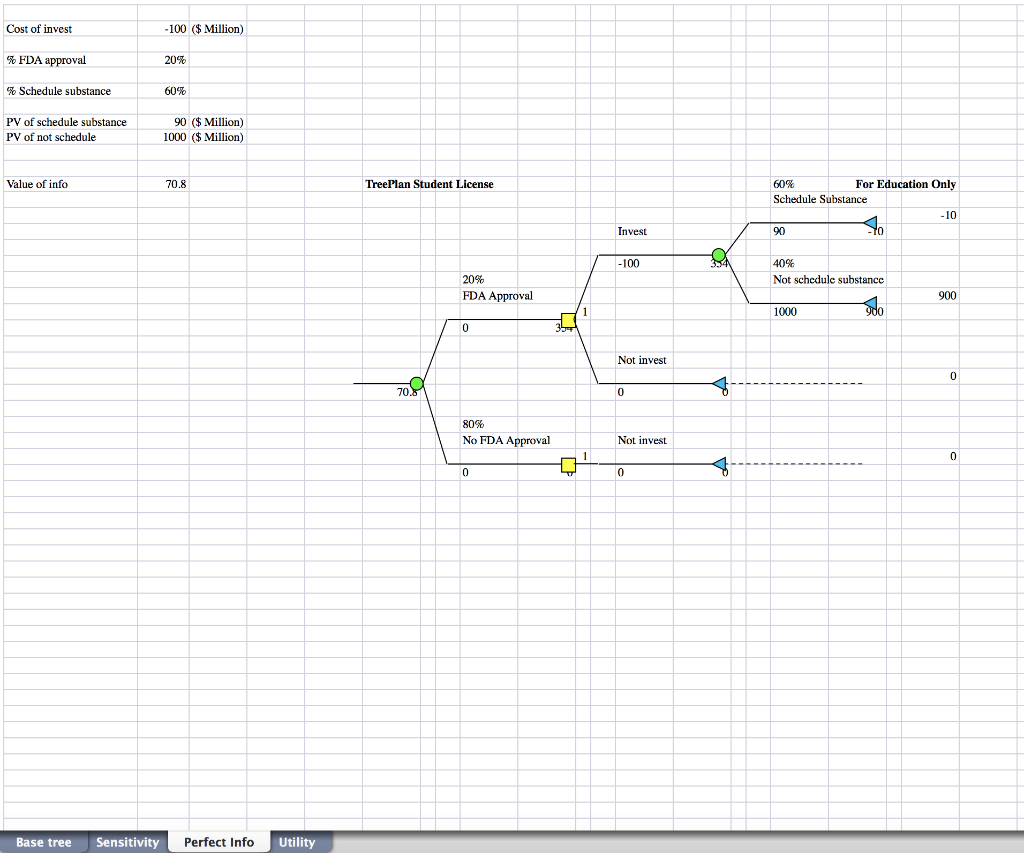

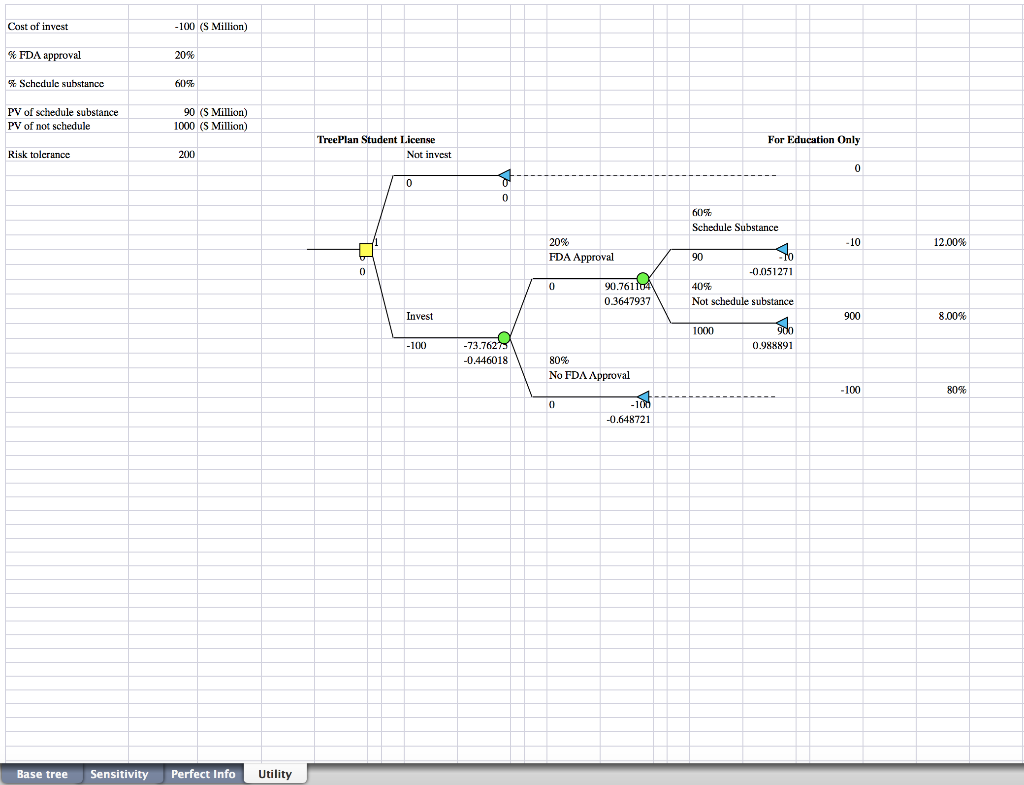

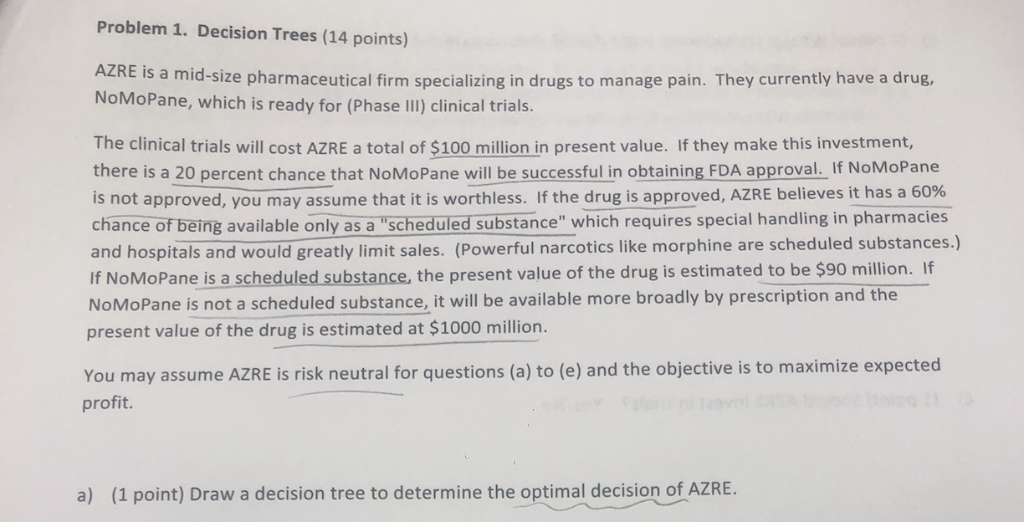

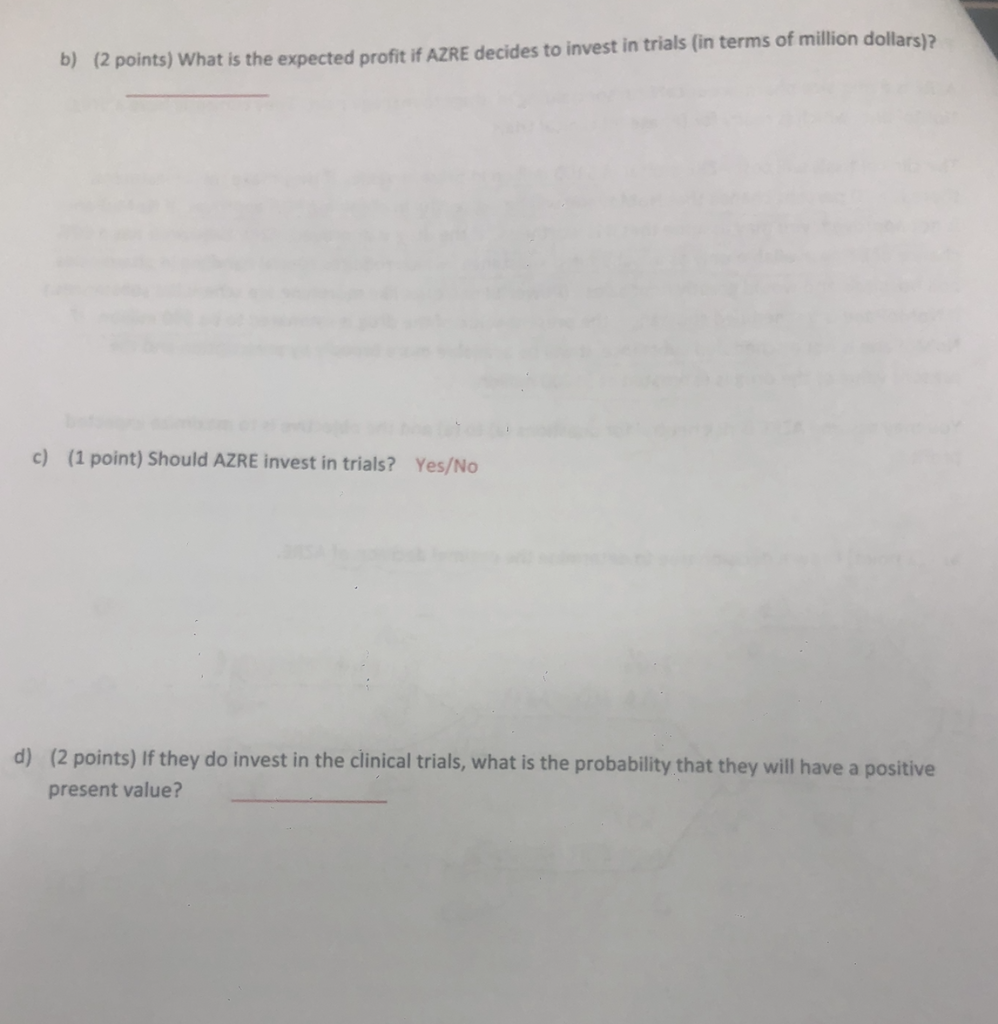

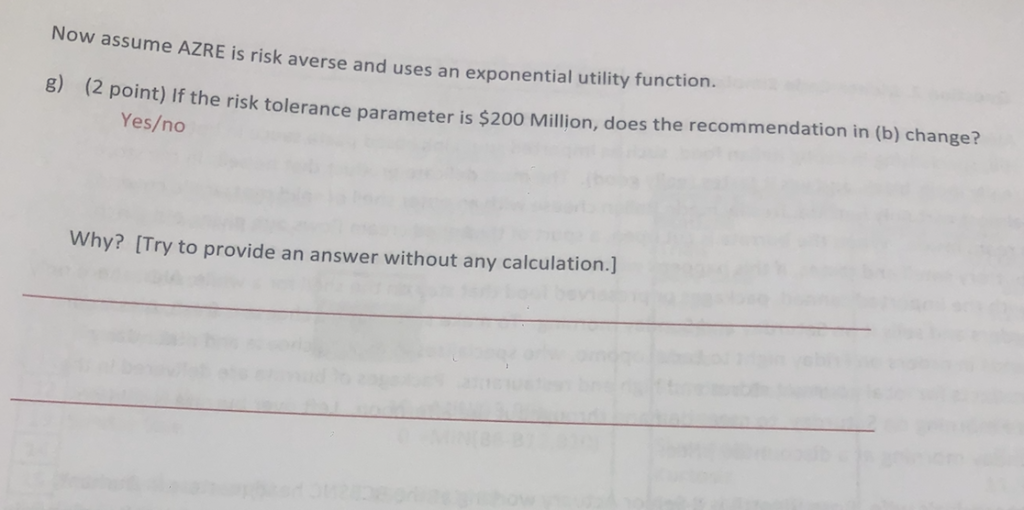

Problem 1. Decision Trees (14 points) AZRE is a mid-size pharmaceutical firm specializing in drugs to manage pain. They currently have a drug, NoMoPane, which is ready for (Phase IIl) clinical trials. The clinical trials will cost AZRE a total of $100 million in present value. If they make this investment there is a 20 percent chance that NoMoPane will be successful in obtaining FDA approval. If NoMoPane is not approved, you may assume that it is worthless. If the drug is approved, AZRE believes it has a 60% chance of being available only as a "scheduled substance" which requires special handling in pharmacies and hospitals and would greatly limit sales. (Powerful narcotics like morphine are scheduled substances.) If NoMoPane is a scheduled substance, the present value of the drug is estimated to be $90 million. If NoMoPane is not a scheduled substance, it will be available more broadly by prescription and the present value of the drug is estimated at $1000 million. You may assume AZRE is risk neutral for questions (a) to (e) and the objective is to maximize expected profit. a) (1 point) Draw a decision tree to determine the optimal decision of AZRE Problem 1. Decision Trees (14 points) AZRE is a mid-size pharmaceutical firm specializing in drugs to manage pain. They currently have a drug, NoMoPane, which is ready for (Phase IIl) clinical trials. The clinical trials will cost AZRE a total of $100 million in present value. If they make this investment there is a 20 percent chance that NoMoPane will be successful in obtaining FDA approval. If NoMoPane is not approved, you may assume that it is worthless. If the drug is approved, AZRE believes it has a 60% chance of being available only as a "scheduled substance" which requires special handling in pharmacies and hospitals and would greatly limit sales. (Powerful narcotics like morphine are scheduled substances.) If NoMoPane is a scheduled substance, the present value of the drug is estimated to be $90 million. If NoMoPane is not a scheduled substance, it will be available more broadly by prescription and the present value of the drug is estimated at $1000 million. You may assume AZRE is risk neutral for questions (a) to (e) and the objective is to maximize expected profit. a) (1 point) Draw a decision tree to determine the optimal decision of AZRE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts