Question: please help me on this please Apple acquired 80 percent of Apol on December 31, 2012. Based on the purchase price, goodwill of 300,000 was

please help me on this please

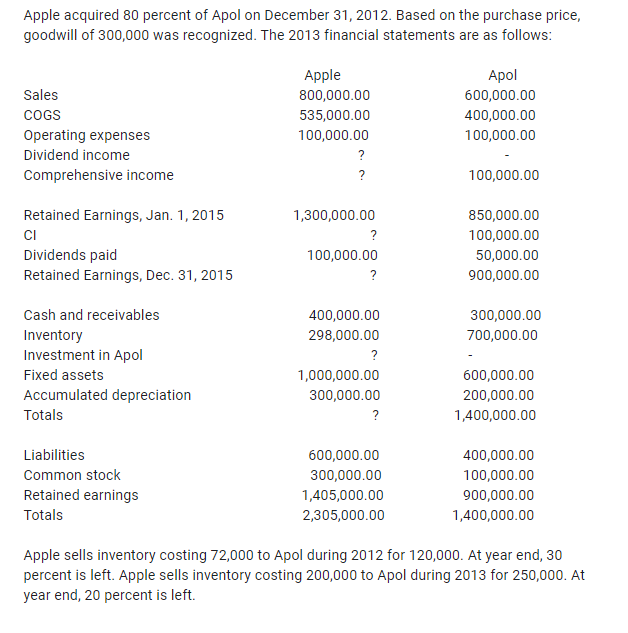

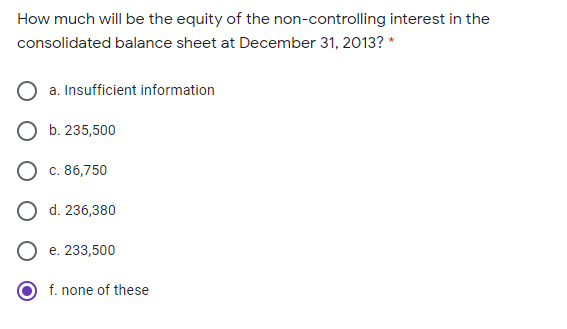

Apple acquired 80 percent of Apol on December 31, 2012. Based on the purchase price, goodwill of 300,000 was recognized. The 2013 financial statements are as follows: Apple Apol Sales 800,000.00 600,000.00 COGS 535,000.00 400,000.00 Operating expenses 100,000.00 100,000.00 Dividend income Comprehensive income 100,000.00 Retained Earnings, Jan. 1, 2015 1,300,000.00 850,000.00 CI 2 100,000.00 Dividends paid 100,000.00 50,000.00 Retained Earnings, Dec. 31, 2015 900,000.00 Cash and receivables 400,000.00 300,000.00 Inventory 298,000.00 700,000.00 Investment in Apol Fixed assets 1,000,000.00 600,000.00 Accumulated depreciation 300,000.00 200,000.00 Totals ? 1,400,000.00 Liabilities 600,000.00 400,000.00 Common stock 300,000.00 100,000.00 Retained earnings 1,405,000.00 900,000.00 Totals 2,305,000.00 1,400,000.00 Apple sells inventory costing 72,000 to Apol during 2012 for 120,000. At year end, 30 percent is left. Apple sells inventory costing 200,000 to Apol during 2013 for 250,000. At year end, 20 percent is left.How much will be the equity of the non-controlling interest in the consolidated balance sheet at December 31, 2013? * O a. Insufficient information O b. 235,500 O C. 86,750 O d. 236,380 e. 233,500 O f. none of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts