Question: Please help me on this problem. I have added all the deductions in and cannot find the income tax as you can see above. Can

Please help me on this problem. I have added all the deductions in and cannot find the income tax as you can see above. Can someone help?

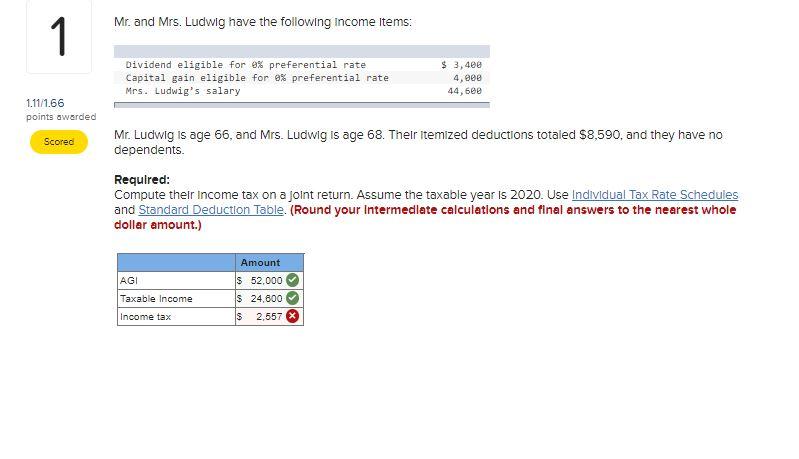

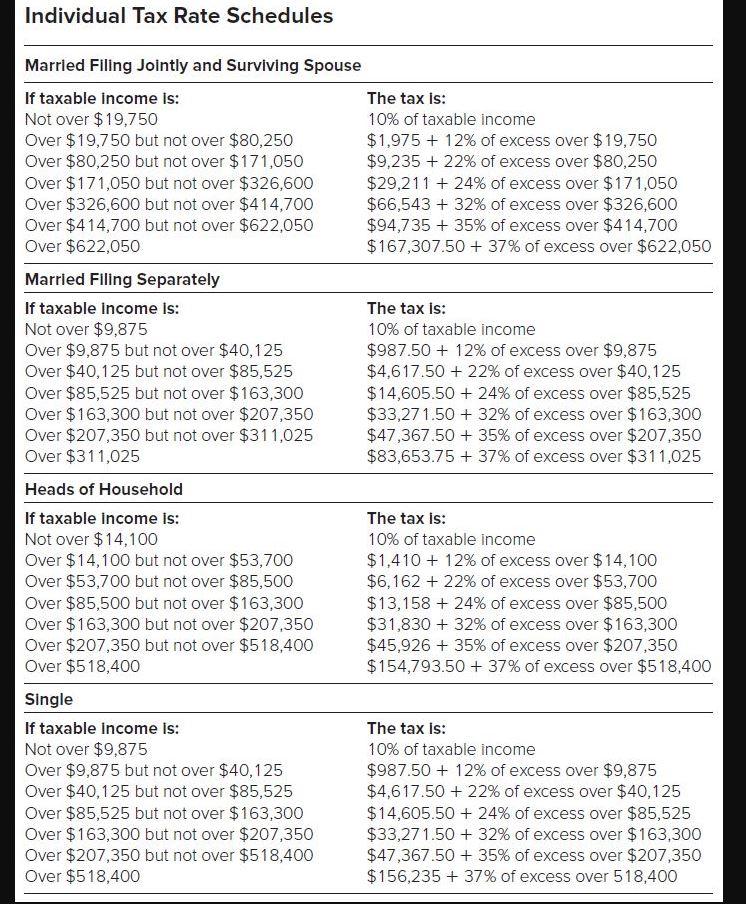

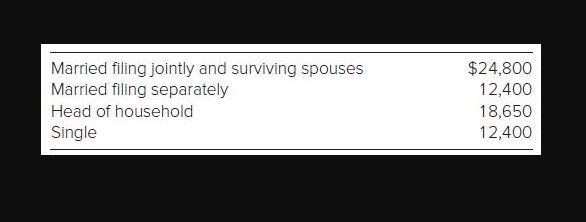

Mr. and Mrs. Ludwig have the following income items: 1 Dividend eligible for e% preferential rate Capital gain eligible for e% preferential rate Mrs. Ludwig's salary $ 3,400 4,000 44,600 1.11/1.66 points awarded Scored Mr. Ludwig is age 66, and Mrs. Ludwig is age 68. Their itemized deductions totaled $8,590, and they have no dependents. Required: Compute their income tax on a joint return. Assume the taxable year is 2020. Use Individual Tax Rate Schedules and Standard Deduction Table. (Round your Intermediate calculations and final answers to the nearest whole dollar amount.) AGI Taxable income Amount $ 52.000 $ 24,800 $ 2,557 Income tax Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse If taxable income is: The tax is: Not over $19,750 10% of taxable income Over $19,750 but not over $80,250 $1,975 + 12% of excess over $19,750 Over $80,250 but not over $171,050 $9,235 + 22% of excess over $80,250 Over $171,050 but not over $326,600 $29,211 + 24% of excess over $171,050 Over $326,600 but not over $414,700 $66,543 + 32% of excess over $326,600 Over $414,700 but not over $622,050 $94,735 + 35% of excess over $414,700 Over $622,050 $167,307.50 + 37% of excess over $622,050 Married Filing Separately If taxable income is: The tax is: Not over $9,875 10% of taxable income Over $9,875 but not over $40,125 $987.50 + 12% of excess over $9,875 Over $40,125 but not over $85,525 $4,617.50 + 22% of excess over $40,125 Over $85,525 but not over $163,300 $14,605.50 + 24% of excess over $85,525 Over $163,300 but not over $207,350 $33,271.50 + 32% of excess over $163,300 Over $207,350 but not over $311,025 $47,367.50 + 35% of excess over $207,350 Over $311,025 $83,653.75 + 37% of excess over $311,025 Heads of Household If taxable income is: The tax is: Not over $14,100 10% of taxable income Over $14,100 but not over $53,700 $1,410 + 12% of excess over $14,100 Over $53,700 but not over $85,500 $6,162 + 22% of excess over $53,700 Over $85,500 but not over $163,300 $13,158 +24% of excess over $85,500 Over $163,300 but not over $207,350 $31,830 + 32% of excess over $163,300 Over $207,350 but not over $518,400 $45,926 + 35% of excess over $207,350 Over $518,400 $154,793.50 + 37% of excess over $518,400 Single If taxable income is: The tax is: Not over $9,875 10% of taxable income Over $9,875 but not over $40,125 $987.50 + 12% of excess over $9,875 Over $40,125 but not over $85,525 $4,617.50 + 22% of excess over $40,125 Over $85,525 but not over $163,300 $14,605.50 + 24% of excess over $85,525 Over $163,300 but not over $207,350 $33,271.50 + 32% of excess over $163,300 Over $207,350 but not over $518,400 $47,367.50 + 35% of excess over $207,350 Over $518,400 $156,235 + 37% of excess over 518,400 Married filing jointly and surviving spouses Married filing separately Head of household Single $24,800 12,400 18,650 12,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts