Question: PLEASE HELP ME ONLY PART C (NOT A AND B) Part A: Part B: Part C: ONLY DO PART C Prepare the journal entries for

PLEASE HELP ME ONLY PART C (NOT A AND B)

Part A:

Part A:

Part B:

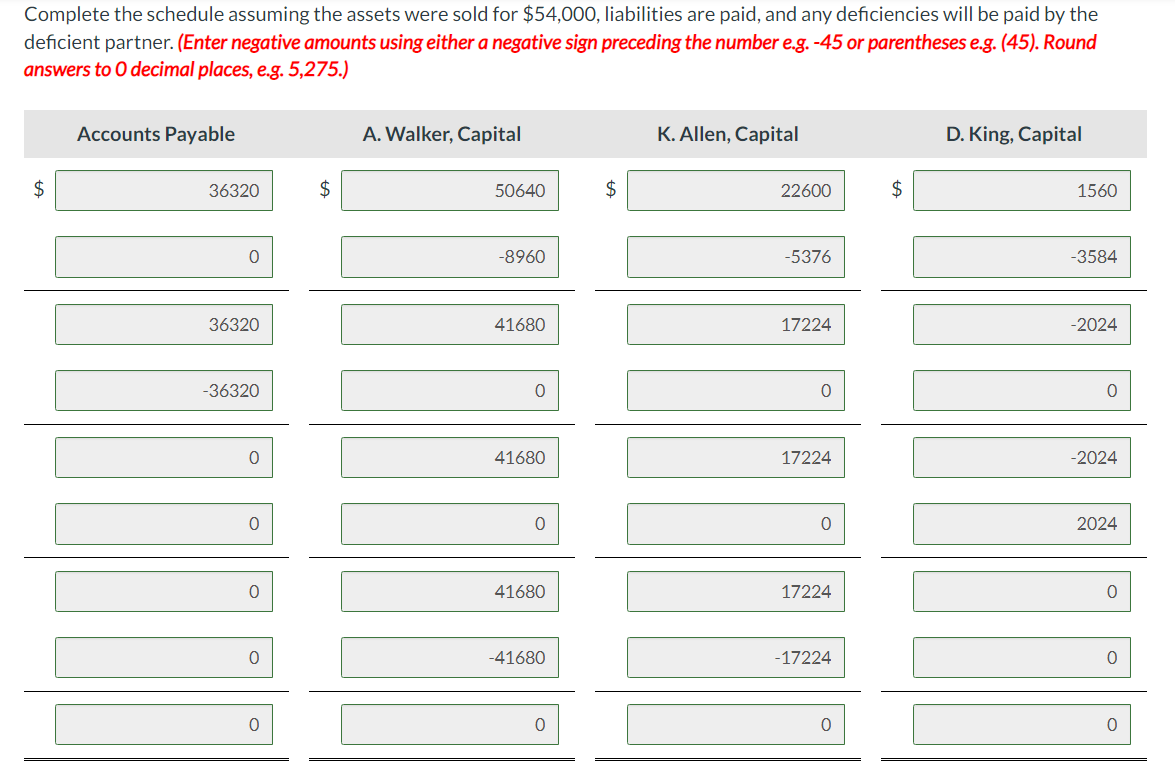

Part C: ONLY DO PART C

Prepare the journal entries for the liquidation of the partnership assuming the noncash assets were sold for $36,000, liabilities are paid, and the cash is distributed appropriately.

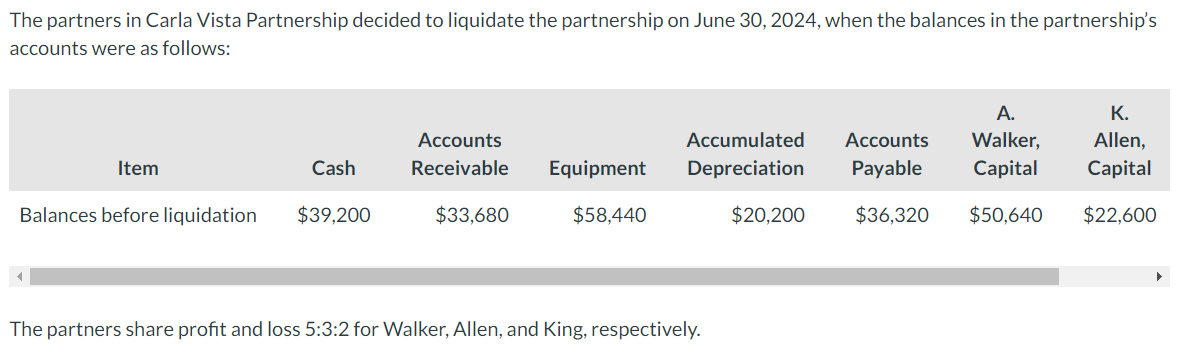

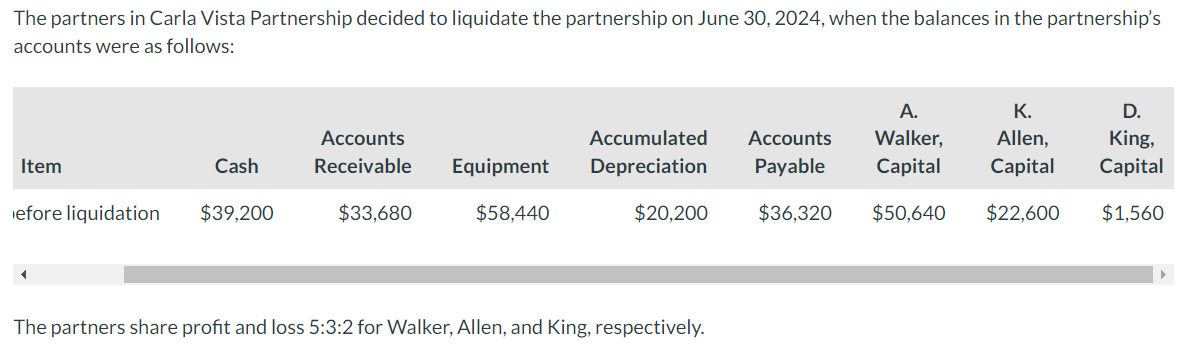

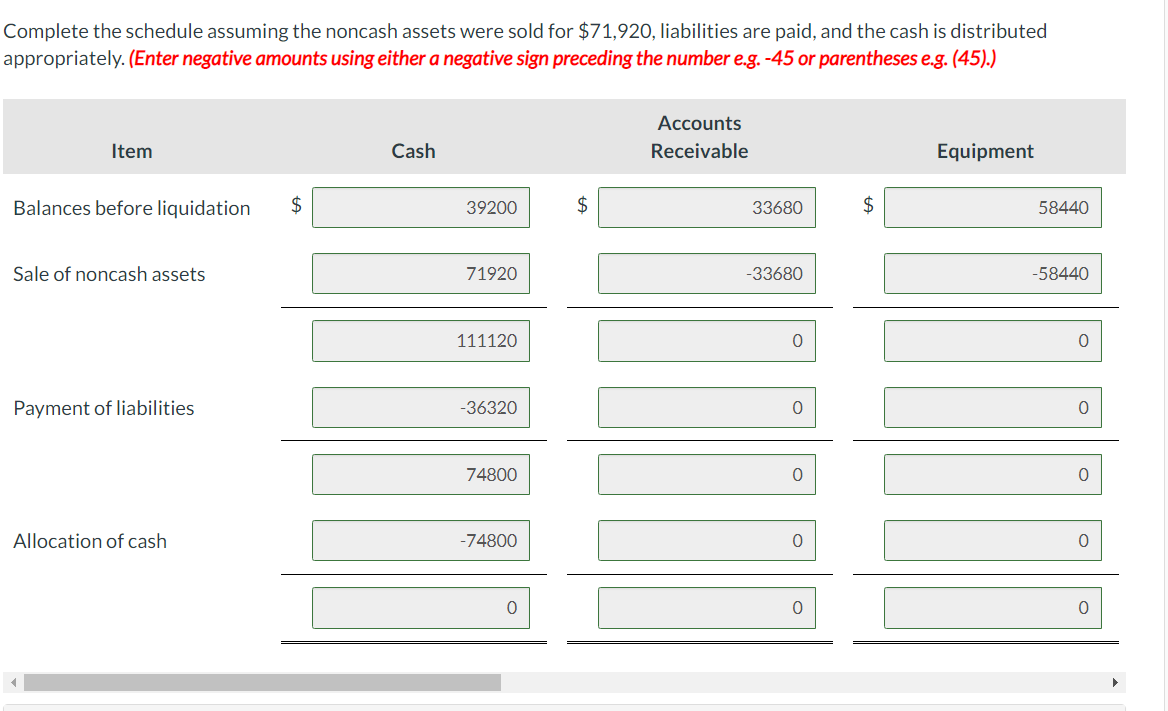

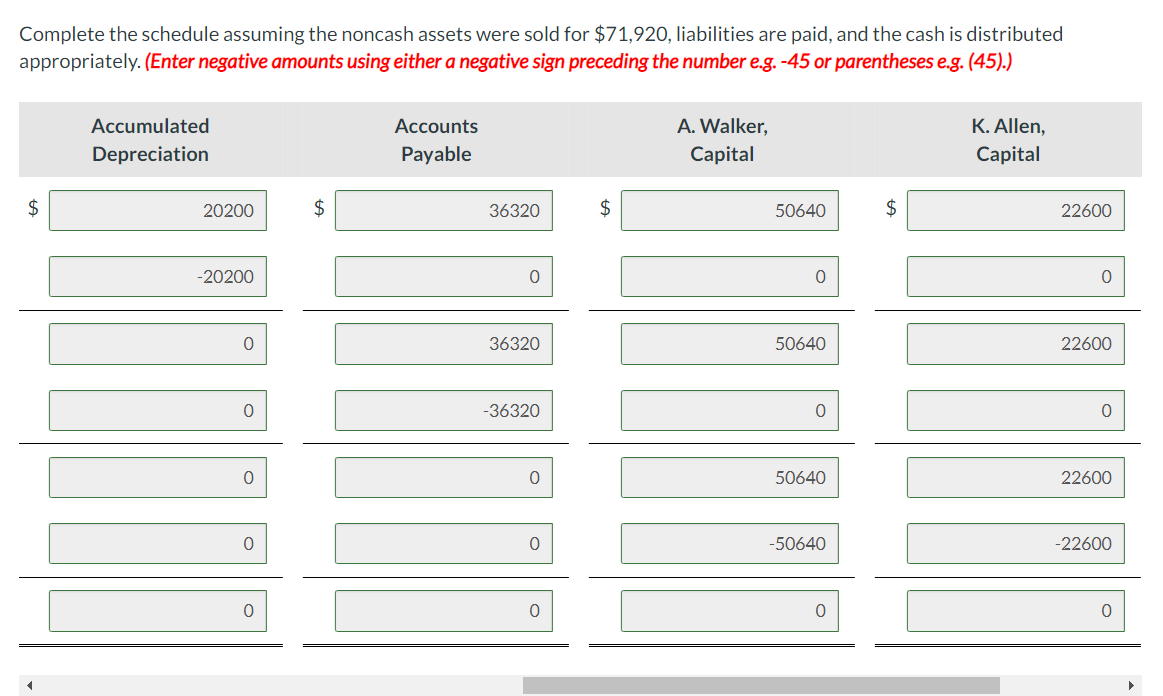

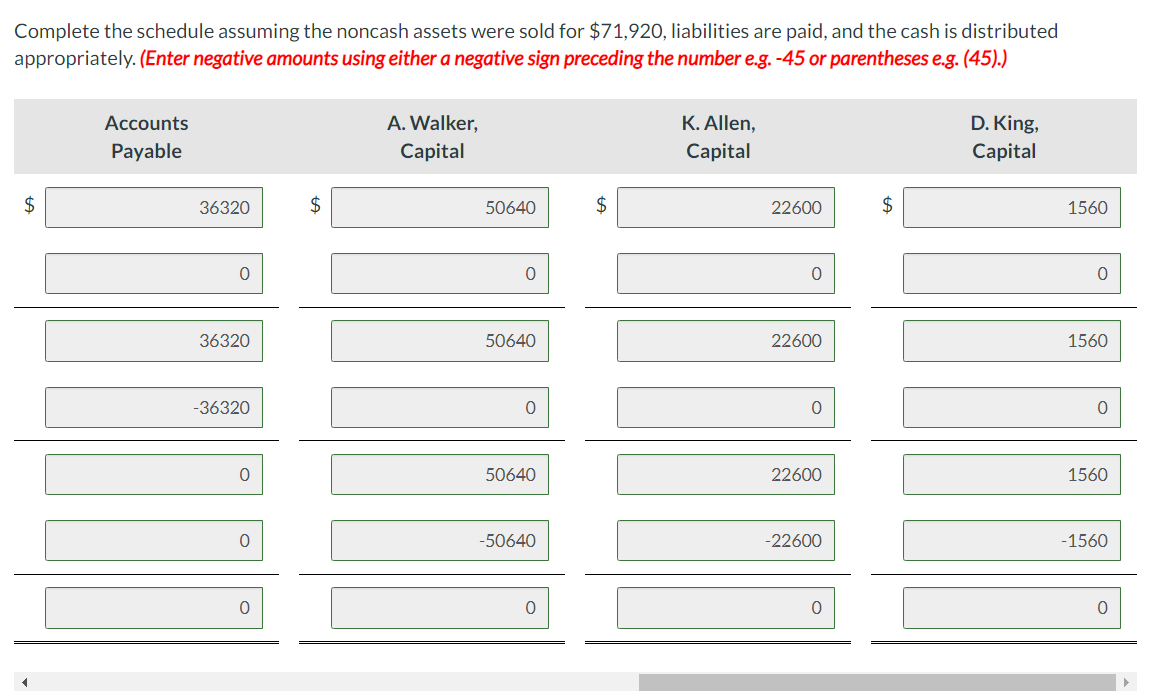

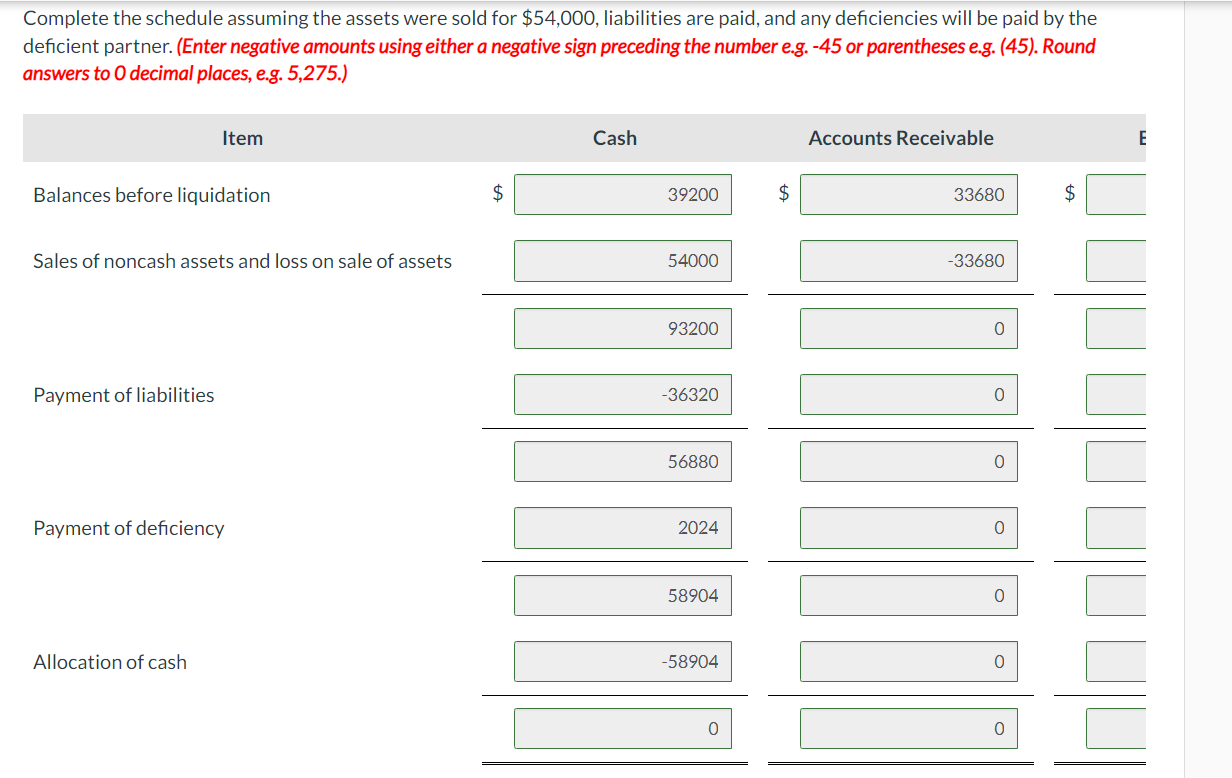

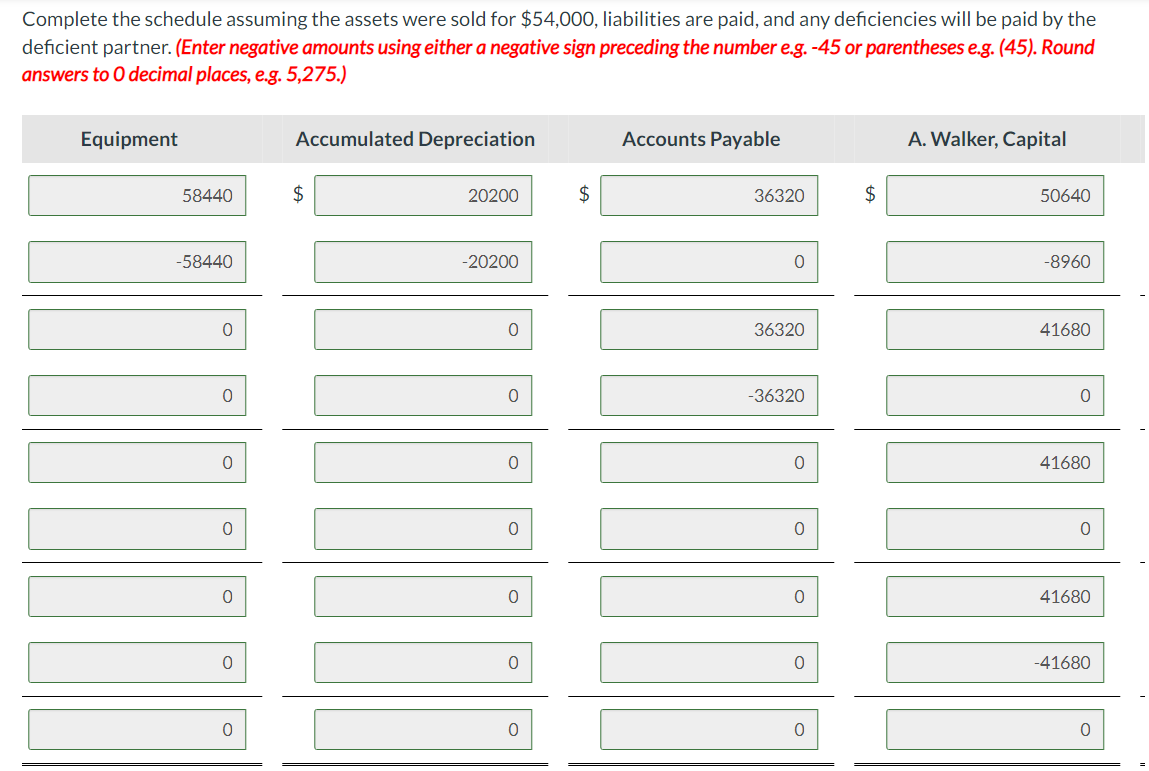

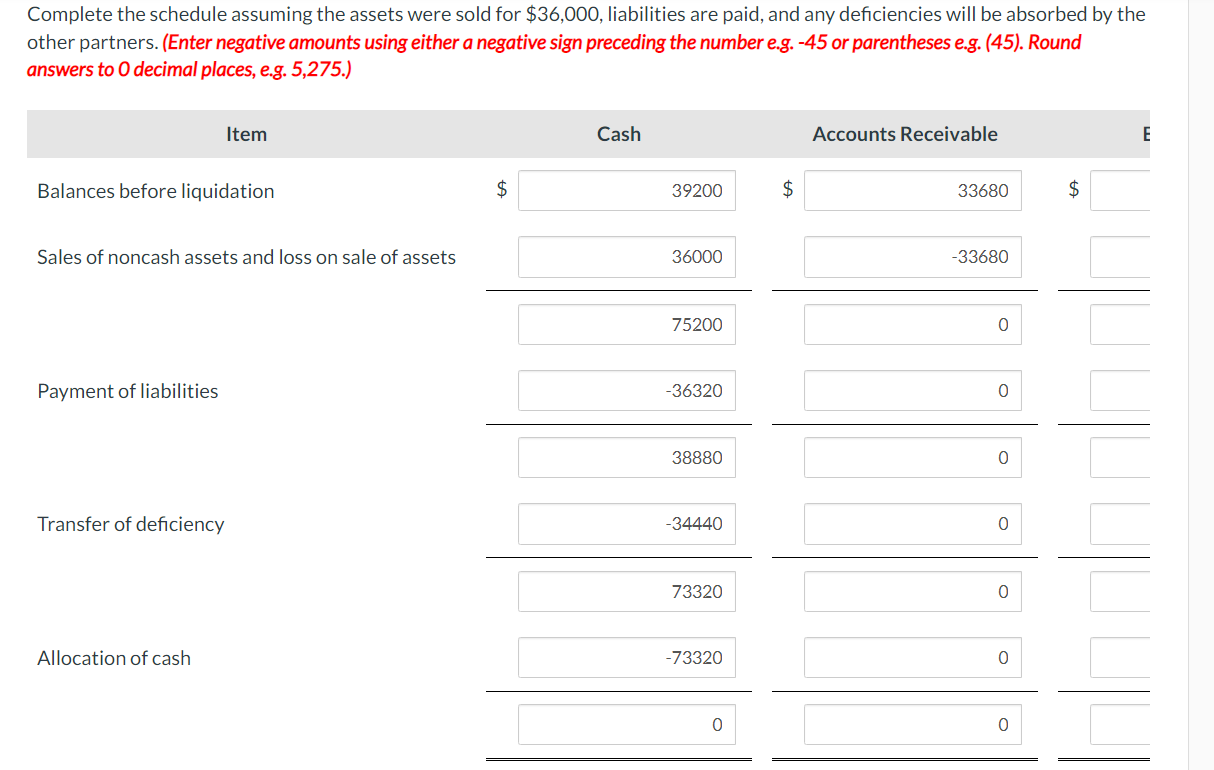

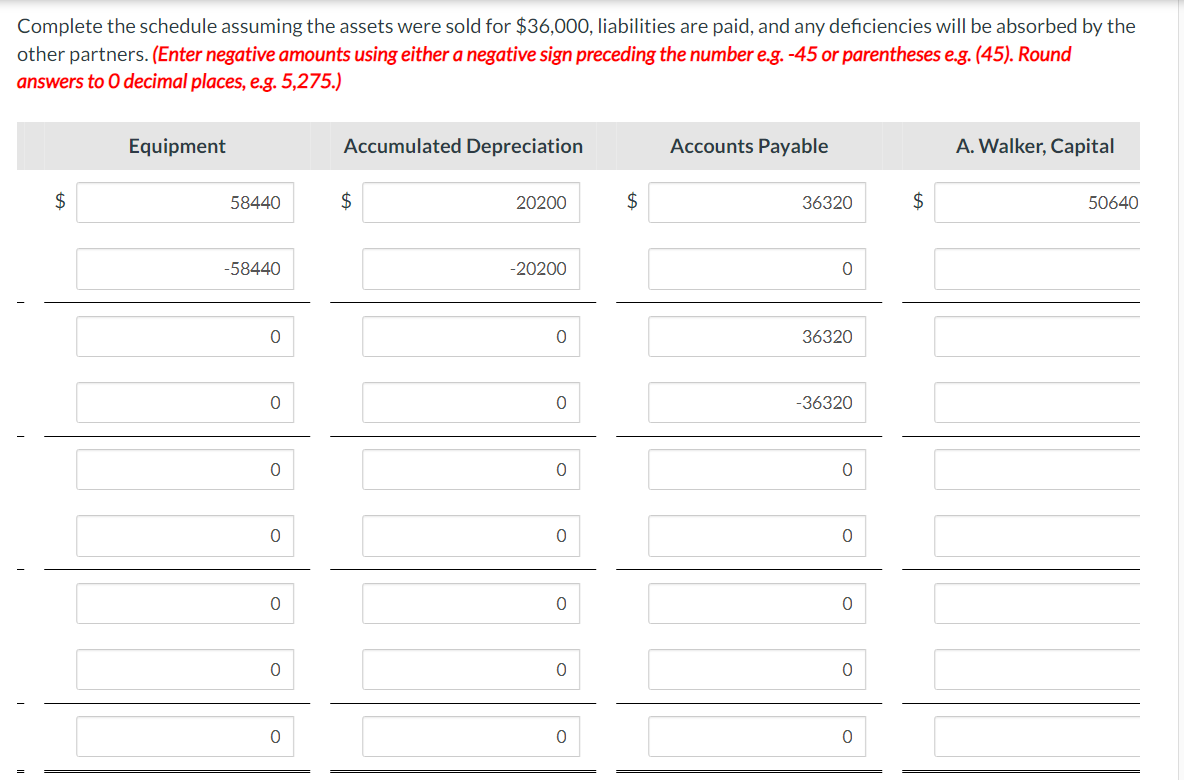

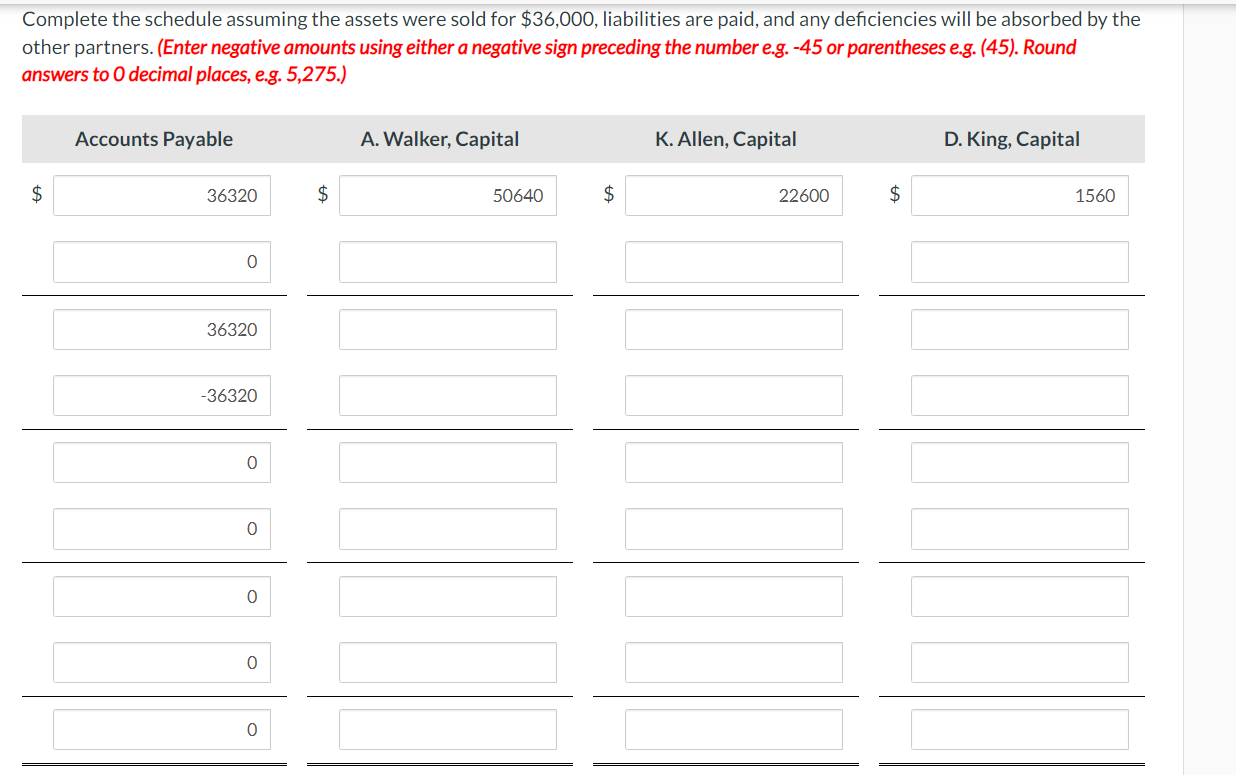

The partners in Carla Vista Partnership decided to liquidate the partnership on June 30,2024 , when the balances in the partnership's accounts were as follows: The partners share profit and loss 5:3:2 for Walker, Allen, and King, respectively. The partners in Carla Vista Partnership decided to liquidate the partnership on June 30,2024 , when the balances in the partnership's accounts were as follows: The partners share profit and loss 5:3:2 for Walker, Allen, and King, respectively. Complete the schedule assuming the noncash assets were sold for $71,920, liabilities are paid, and the cash is distributed appropriately. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).) Complete the schedule assuming the noncash assets were sold for $71,920, liabilities are paid, and the cash is distributed appropriately. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).) Complete the schedule assuming the noncash assets were sold for $71,920, liabilities are paid, and the cash is distributed appropriately. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).) Complete the schedule assuming the assets were sold for $54,000, liabilities are paid, and any deficiencies will be paid by the leficient partner. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45). Round inswers to 0 decimal places, e.g. 5,275.) Complete the schedule assuming the assets were sold for $54,000, liabilities are paid, and any deficiencies will be paid by the deficient partner. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 5,275.) Complete the schedule assuming the assets were sold for $54,000, liabilities are paid, and any deficiencies will be paid by the deficient partner. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 5,275.) Complete the schedule assuming the assets were sold for $36,000, liabilities are paid, and any deficiencies will be absorbed by the other partners. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 5,275.) Complete the schedule assuming the assets were sold for $36,000, liabilities are paid, and any deficiencies will be absorbed by the other partners. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 5,275.) Complete the schedule assuming the assets were sold for $36,000, liabilities are paid, and any deficiencies will be absorbed by the other partners. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 5,275.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts