Question: PLease help me out in the last part which is C, I don't need both A and B becasue I done with them. Show me

PLease help me out in the last part which is C, I don't need both A and B becasue I done with them. Show me how to get the answer for this one qestion only part C

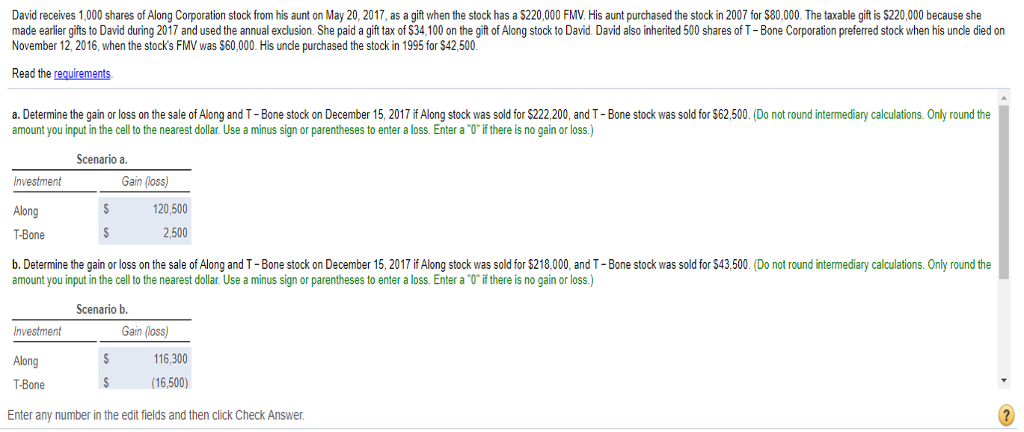

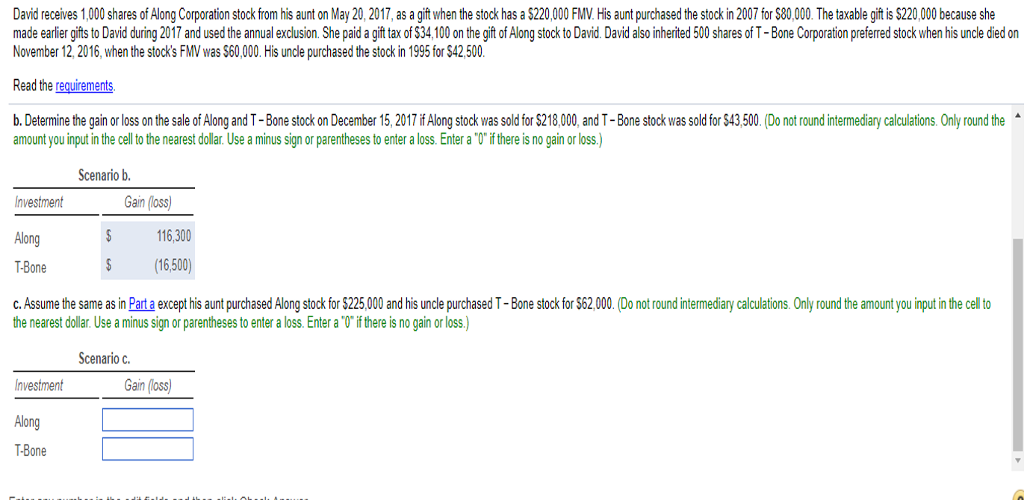

David receives 1,000 shares of Along Corporation stock from his aunt on May 20, 2017, as a gift when the stock has a $220,000 FMV. His aunt purchased the stock in 2007 for $80,000. The taxable gift is $220,000 because she made earlier gifts to David during 2017 and used the annual exclusion. She paid a gift tax of S34,100 on the gift of Along stock to David. David also inherited 500 shares of T-Bone Corporation preferred stock when his uncle died orn November 12, 2016, when the stocks FMV was $60,000. His uncle purchased the stock in 1995 for $42,500. Read the requirements a. Determine the gain or loss on the sale of Along and T-Bone stock on December 15, 2017 if Along stock was sold for $222 200, and T- Bone stock was sold for $62,500. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar. Use a minus sign or parentheses to enter a loss. Enter a if there is no gain or loss.) Scenario a. Investment Gain (loss) Along T-Bone 20,500 2,500 b. Determine the gain or loss on the sale of Along and T-Bone stock on December 15,2017 if Along stock was sold for $218,000, and T-Bone stock was sold for $43,500. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar. Use a minus sign or parentheses to enter a loss. Enter a if there is no gain or loss.) Scenario b. Investment Gain (loss) Along T-Bone 16,300 16,500) Enter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts