Question: please help me out to solve this question. 4. Following are the extracts from the Trial Balance of PRITHVI & AAKASH as at 31st March,

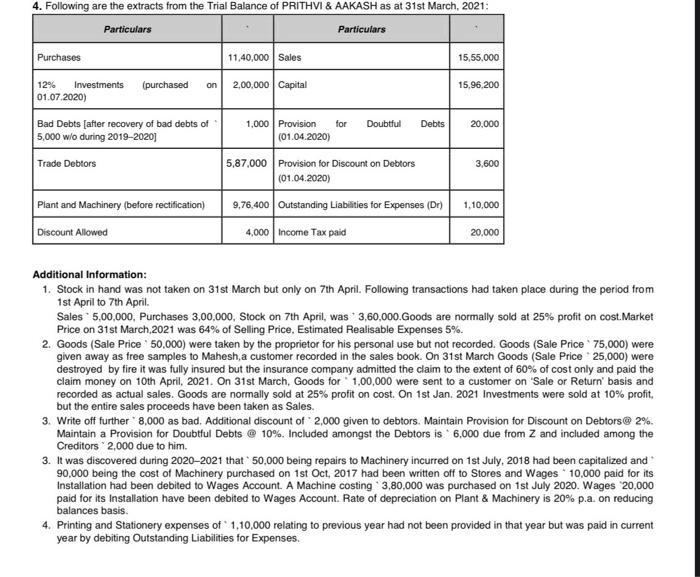

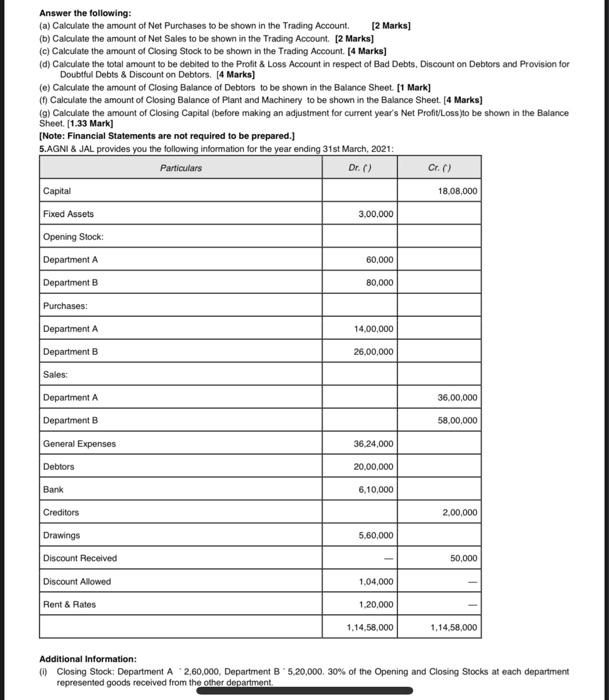

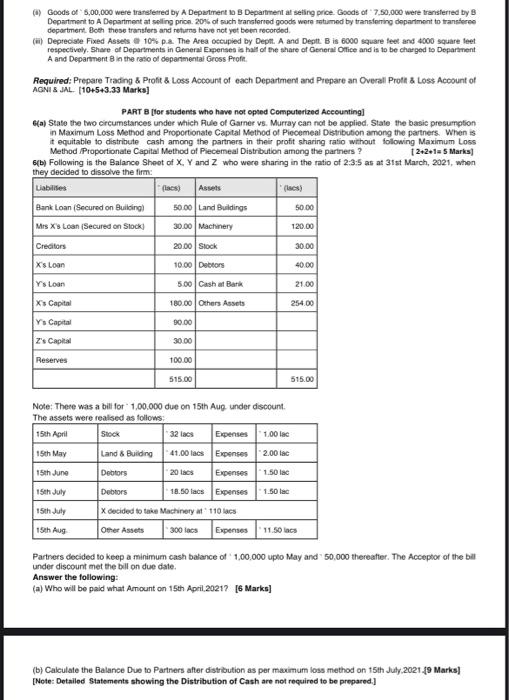

4. Following are the extracts from the Trial Balance of PRITHVI & AAKASH as at 31st March, 2021: Particulars Particulars Purchases 11,40,000 Sales 15,55.000 12% Investments (purchased 2,00,000 Capital 15,96,200 01.07.2020) on for 20,000 Bad Debts (after recovery of bad debts of 5,000 wlo during 2019-2020) Trade Debtors 3,600 1,000 Provision Doubtful Debts (01.04.2020) 5,87,000 Provision for Discount on Debtors (01.04.2020) 9,76,400 Outstanding Liabilities for Expenses (Dr) 4,000 Income Tax paid 1.10,000 Plant and Machinery (before rectification) Discount Allowed 20.000 Additional Information: 1. Stock in hand was not taken on 31st March but only on 7th April. Following transactions had taken place during the period from 1st April to 7th April Sales 5,00,000, Purchases 3,00.000, Stock on 7th April, was 3,60,000.Goods are normally sold at 25% profit on cost. Market Price on 31st March, 2021 was 64% of Selling Price. Estimated Realisable Expenses 5%. 2. Goods (Sale Price 50,000) were taken by the proprietor for his personal use but not recorded. Goods (Sale Price 75,000) were given away as free samples to Mahesh, a customer recorded in the sales book. On 31st March Goods (Sale Price 25,000) were destroyed by fire it was fully insured but the insurance company admitted the claim to the extent of 60% of cost only and paid the claim money on 10th April, 2021. On 31st March, Goods for 1,00,000 were sent to a customer on 'Sale or Return' basis and recorded as actual sales. Goods are normally sold at 25% profit on cost. On 1st Jan. 2021 Investments were sold at 10% profit, but the entire sales proceeds have been taken as Sales. 3. Write off further 8,000 as bad. Additional discount of 2,000 given to debtors. Maintain Provision for Discount on Debtors@ 2%. Maintain a Provision for Doubtful Debts @ 10%. Included amongst the Debtors is 6,000 due from Z and included among the Creditors 2,000 due to him. 3. It was discovered during 2020-2021 that 50,000 being repairs to Machinery incurred on 1st July, 2018 had been capitalized and 90,000 being the cost of Machinery purchased on 1st Oct, 2017 had been written off to Stores and Wages 10,000 paid for its Installation had been debited to Wages Account. A Machine costing 3,80,000 was purchased on 1st July 2020. Wages 20,000 paid for its Installation have been debited to Wages Account. Rate of depreciation on Plant & Machinery is 20% p.a on reducing balances basis. 4. Printing and Stationery expenses of 1,10.000 relating to previous year had not been provided in that year but was paid in current year by debiting Outstanding Liabilities for Expenses. Answer the following: (a) Calculate the amount of Net Purchases to be shown in the Trading Account. [2 marks] (b) Calculate the amount of Net Sales to be shown in the Trading Account. [2 Marks) (c) Calculate the amount of Closing Stock to be shown in the Trading Account. [4 Marks] (d) Calculate the total amount to be debited to the Profit & Loss Account in respect of Bad Debts, Discount on Debtors and Provision for Doubtful Debts & Discount on Debtors. [4 Marks) (e) Calculate the amount of Closing Balance of Debtors to be shown in the Balance Sheet [1 mark] ( Calculate the amount of Closing Balance of Plant and Machinery to be shown in the Balance Sheet [4 Marks] (9) Calculate the amount of Closing Capital (before making an adjustment for current year's Net Profit loss to be shown in the Balance Sheet. (1.33 Mark] [Note: Financial Statements are not required to be prepared.) 5.AGNI & JAL provides you the following information for the year ending 31st March, 2021: Particulars Dr.() Cr.) Capital 18.08,000 Fixed Assets 3,00.000 Opening Stock: Department A 60,000 Department B 80,000 Purchases: Department A 14.00,000 Department 26,00.000 Sales: Department 36,00,000 Department B 58.00.000 General Expenses 36.24,000 Debtors 20,00,000 Bank 6,10,000 Creditors 2,00,000 Drawings 5,60,000 Discount Received 50,000 1.04,000 Discount Allowed Rent & Rates 1.20,000 1.14.58.000 1.14.58.000 Additional Information: Closing Stock: Department A 2,60,000, Department B5.20,000. 30% of the Opening and Closing Stocks at each department represented goods received from the other department ) Goods of 5,00,000 were transferred by A Department Department at selling price. Goods of 7,50,000 were transferred by B Department to A Department at selling price 20% of such transferred goods were mtumed by transferring department to transferee department. Both these transfers and returns have not yet been recorded (H) Depreciate Fixed Assets 10% pa The Area occupied by Deptt. A and Deptt B is 6000 square feet and 4000 square feet respectively. Share of Departments in General Expenses is half of the share of General Office and is to be charged to Department A and Department in the ratio of departmental Gross Profit Required: Prepare Trading & Profit & Loss Account of each Department and Prepare an Overall Proft & Loss Account of AGNI & JAL (10+5+3.33 Marks) PART 8 (for students who have not opted Computerized Accounting (a) State the two circumstances under which Rule of Garner vs. Murray can not be applied. State the basic presumption in Maximum Loss Method and Proportionate Capital Method of Piecemeal Distribution among the partners. When is it equitable to distribute cash among the partners in their profit sharing ratio without following Maximum Loss Method Proportionate Capital Method of Piecemeal Distribution among the partners ? 2-2015 Marks 6(b) Following is the Balance Shoot of X, Y and Z who were sharing in the ratio of 2-3:5 as at 31st March, 2021, when they decided to dissolve the firm: Liabilities (cs) Assets Bank Loan (Secured on Building 50.00 Land Buildings 50.00 Mrs X Loan (Secured on Stock 30.00 Machinery 120.00 Creditors 20.00 Stock 30.00 Xs Loan 10.00 Debtors 40.00 Ys Loan 5.00 Cash at Bank 21.00 Xs Capital 180.00 Others Assets 254.00 Ys Capital 90.00 Z's Capital 30.00 Reserves 100.00 515.00 515.00 Note: There was a bill for 100.000 due on 15th Aug under discount The assets were realised as follows 15th April Stock 32 lacs Expenses 1.00 Inc 15th May Land & Building 6 41.00 lacs Expenses 2.00 lac 15th June Debtors 20 Iacs Expenses 1.50 lac 15th July Debtors 18.50 tacs Expenses 1.50 lac 15th JUNY X decided to take Machinery at 110 lacs 15th Aug Other Assets 300 focs Expenses 11.50 Sacs Partners decided to keep a minimum cash balance of 1,00,000 uplo May and 50,000 thereafter. The Acceptor of the bat under discount met the bill on due date. Answer the following: (a) Who will be paid what Amount on 15th April.20217 [6 Marks] (b) Calculate the Balance Due to Partners after distribution as per maximum loss method on 15th July 2021.19 Marks] [Note: Detailed Statements showing the Distribution of Cash are not required to be prepared.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts