Question: Please help me out with the correct solution for the following practice questions Required information Problem 8-1A (Algo) Plant asset costs; depreciation methods LO C1,

![LO C1, P1 [The following information applies to the questions displayed below.]](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66dfc9c2b33ac_21066dfc9c25502d.jpg)

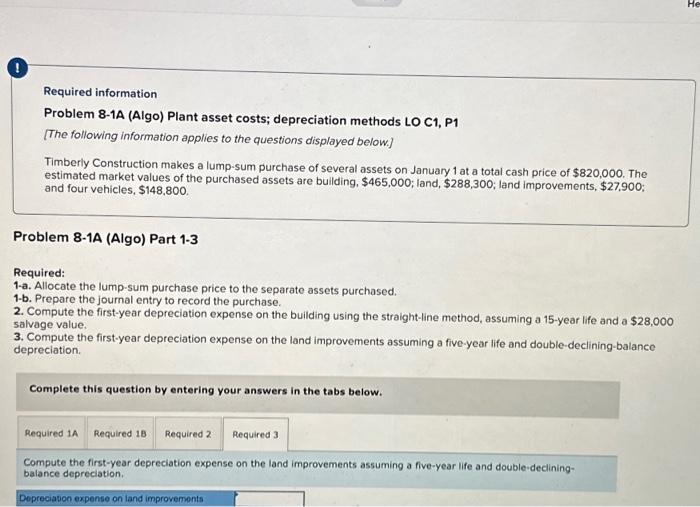

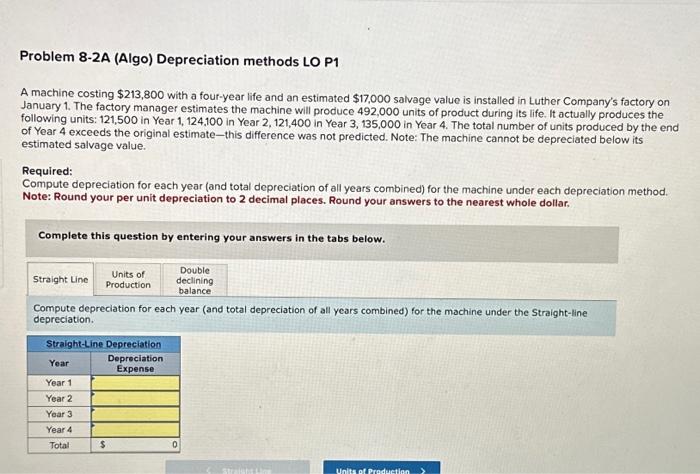

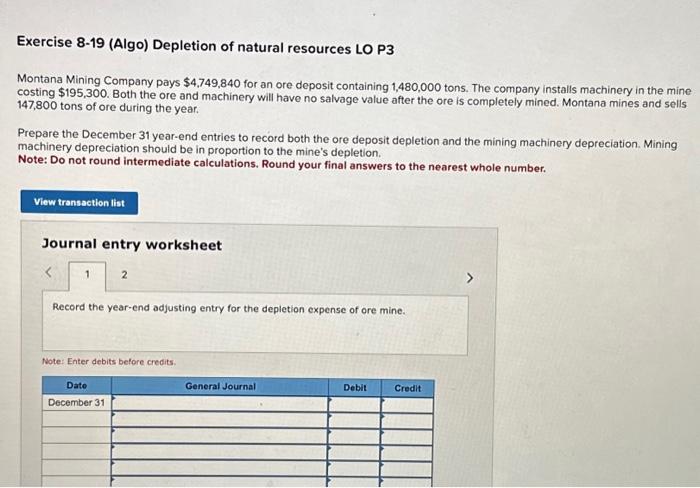

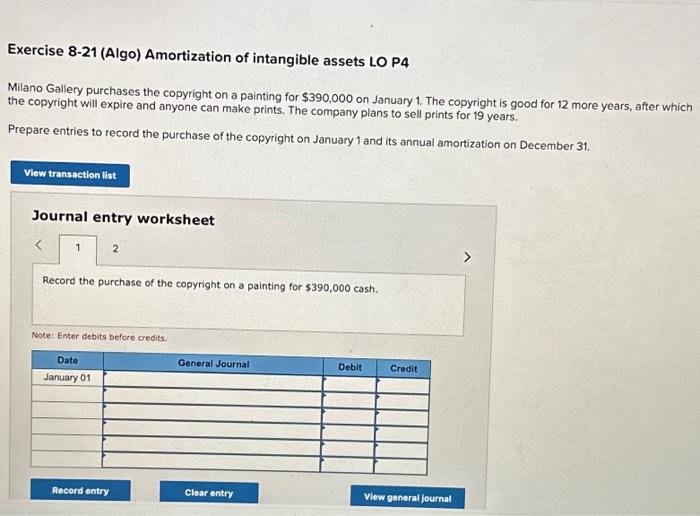

Required information Problem 8-1A (Algo) Plant asset costs; depreciation methods LO C1, P1 [The following information applies to the questions displayed below.] Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $820,000. The estimated market values of the purchased assets are building, $465,000; land, $288,300; land improvements, $27,900; and four vehicles, $148,800. Problem 8-1A (Algo) Part 1-3 Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15 -year life and a $28,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-decliningbalance depreciation. Problem 8-2A (Algo) Depreciation methods LO P1 A machine costing $213,800 with a four-year life and an estimated $17,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 492,000 units of product during its life. It actually produces the following units: 121,500 in Year 1, 124,100 in Year 2,121,400 in Year 3, 135,000 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Straight-line depreciation. Exercise 8-18 (Algo) Partial-year depreciation; disposal of plant asset LO P2 Rayya Company purchases a machine for $176,400 on January 1, 2021. Straight-line depreciation is taken each year for four years assuming a seven-year life and no salvage value. The machine is sold on July 1,2025 , during its fifth year of service. Prepare entries to record the partial year's depreciation on July 1,2025, and to record the sale under each separate situation. (1) The machine is sold for $75,600 cash. (2) The machine is sold for $60,480 cash. Journal entry worksheet Record the depreciation expense as of July 1, 2025. Note: Enter debits before credits. Exercise 8-19 (Algo) Depletion of natural resources LO P3 Montana Mining Company pays $4,749,840 for an ore deposit containing 1,480,000 tons. The company installs machinery in the mine costing $195,300. Both the ore and machinery will have no salvage value after the ore is completely mined. Montana mines and sells 147,800 tons of ore during the year. Prepare the December 31 year-end entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. Note: Do not round intermediate calculations. Round your final answers to the nearest whole number. Journal entry worksheet 2 Record the year-end adjusting entry for the depletion expense of ore mine. Note: Enter debits before credits. Exercise 8-21 (Algo) Amortization of intangible assets LO P4 Milano Gallery purchases the copyright on a painting for $390,000 on January 1 . The copyright is good for 12 more years, after which the copyright will expire and anyone can make prints. The company plans to sell prints for 19 years. Prepare entries to record the purchase of the copyright on January 1 and its annual amortization on December 31. Journal entry worksheet Record the purchase of the copyright on a painting for $390,000 cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts