Question: Please help me out with this Question 1 Compute the arithmetic average annual return from the end of 2015 to the end of 2018 on

Please help me out with this

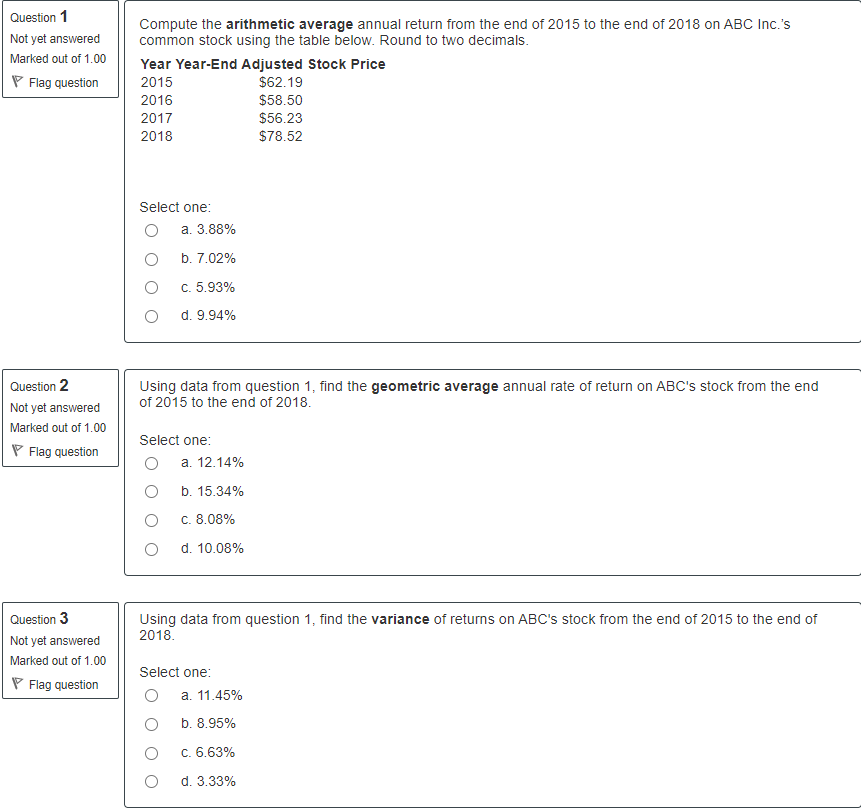

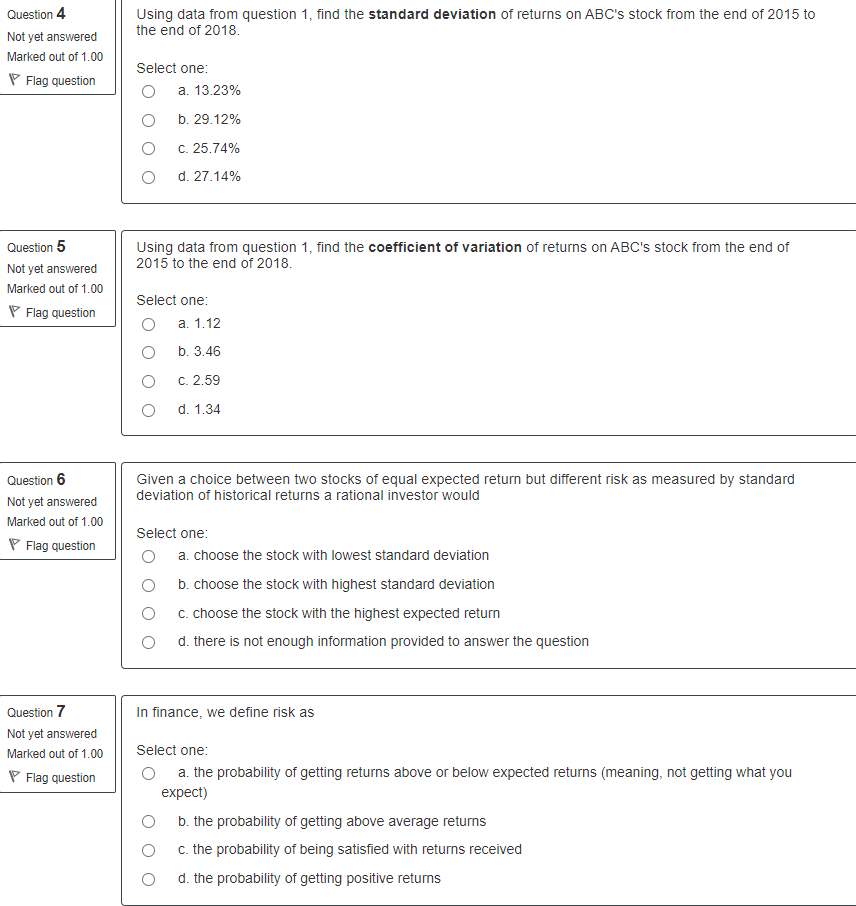

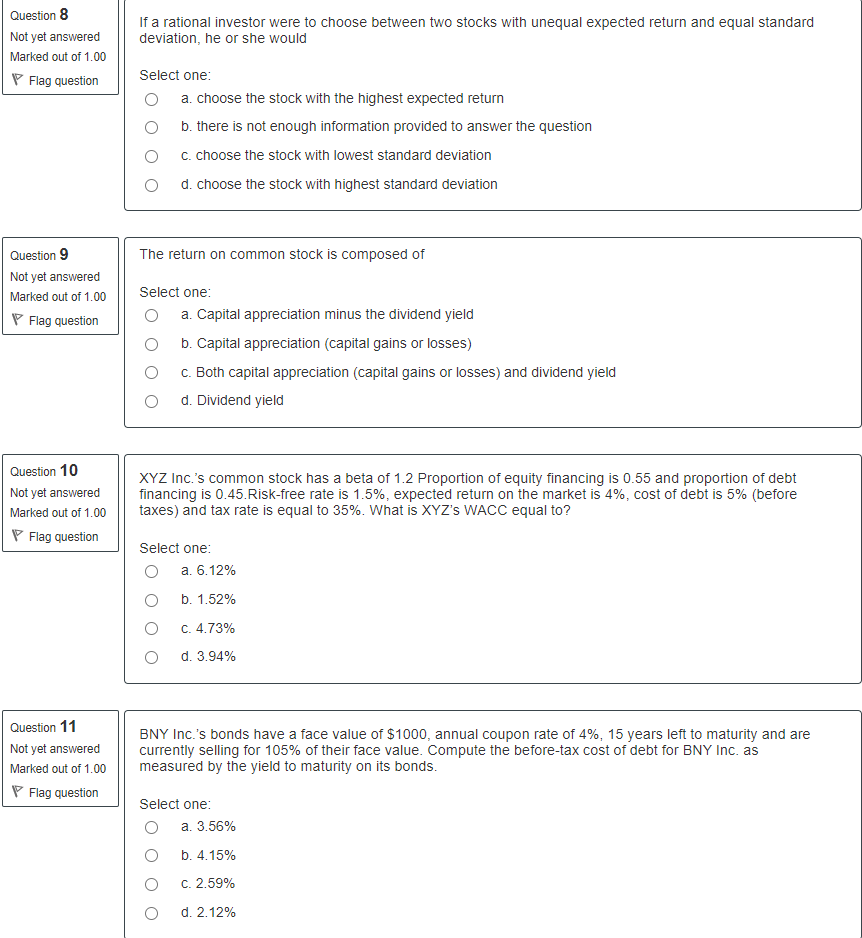

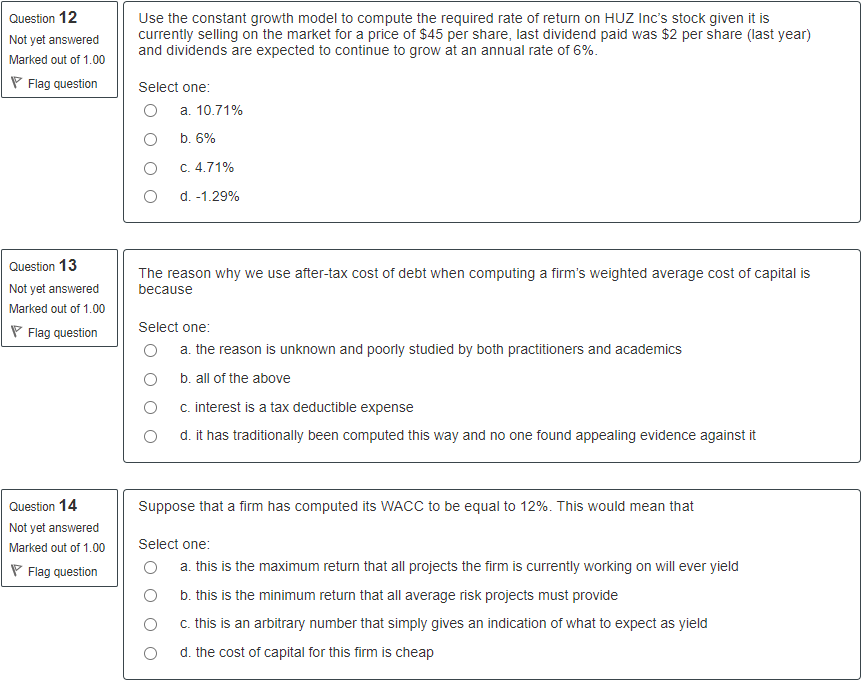

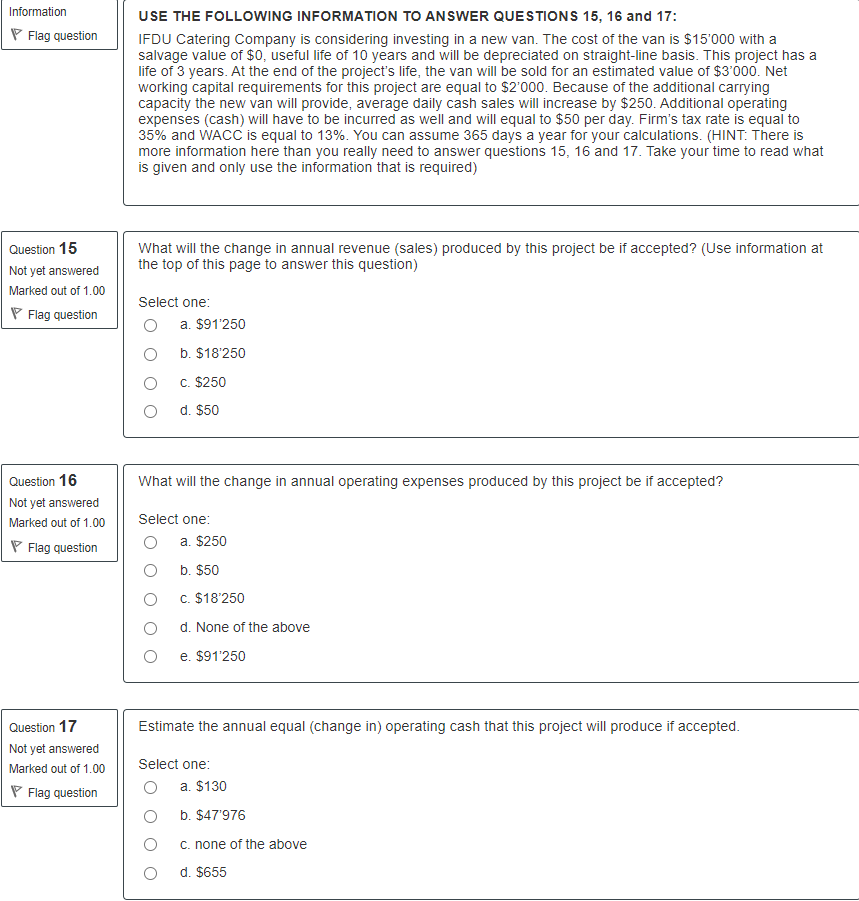

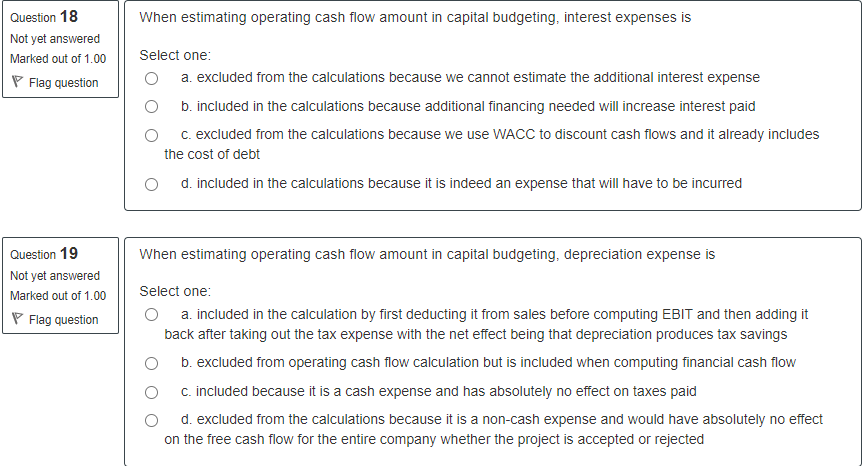

Question 1 Compute the arithmetic average annual return from the end of 2015 to the end of 2018 on ABC Inc.'s Not yet answered common stock using the table below. Round to two decimals. Marked out of 1.00 Year Year-End Adjusted Stock Price Flag question 2015 $62.19 2016 $58.50 2017 $56.23 2018 $78.52 Select one: O a. 3.88% O b. 7.02% O C. 5.93% O d. 9.94% Question 2 Using data from question 1, find the geometric average annual rate of return on ABC's stock from the end Not yet answered of 2015 to the end of 2018. Marked out of 1.00 Flag question Select one: O a. 12.14% O b. 15.34% O C. 8.08% O d. 10.08% Question 3 Using data from question 1, find the variance of returns on ABC's stock from the end of 2015 to the end of Not yet answered 2018. Marked out of 1.00 Flag question Select one: O a. 11.45% O b. 8.95% O C. 6.63% O d. 3.33%Question 4 Using data from question 1, find the standard deviation of returns on ABC's stock from the end of 2015 to Not yet answered the end of 2018. Marked out of 1.00 Flag question Select one: O a. 13.23% O b. 29.12% O C. 25.74% O d. 27.14% Question 5 Using data from question 1, find the coefficient of variation of returns on ABC's stock from the end of Not yet answered 2015 to the end of 2018 Marked out of 1.00 Flag question Select one: O a. 1.12 O b. 3.46 O C. 2.59 O d. 1.34 Question 6 Given a choice between two stocks of equal expected return but different risk as measured by standard Not yet answered deviation of historical returns a rational investor would Marked out of 1.00 \\ Flag question Select one: O a. choose the stock with lowest standard deviation O b. choose the stock with highest standard deviation O c. choose the stock with the highest expected return O d. there is not enough information provided to answer the question Question 7 In finance, we define risk as Not yet answered Marked out of 1.00 Select one: Flag question a. the probability of getting returns above or below expected returns (meaning, not getting what you expect) O b. the probability of getting above average returns O c. the probability of being satisfied with returns received O d. the probability of getting positive retumsQuestion 3 Not yet answered Marked out of 1.00 '17 Flag question If a rational investor were to choose between two stocks with unequal expected return and equal standard deviation, he or she would Select one: Q a. choose the stock with the highest expected return b. there is not enough information provided to answer the question C. CHOOSE the Stock Will] lowest standard deviation 0 O D d. choose the stock with highest standard deviation Question 9 Not yet answered Marked out of 1.00 "F Flag question Question 10 Not yet answered Marked out of 1.00 '17 Flag question The return on common stock is composed of Select one: Q a. Capital appreciation minus the dividend yield b. Capital appreciation (capital gains or losses} c. Both capital appreciation (capital gains or losses} and dividend yield 0 O Q d. Dividend yield XYZ Inc.'s common stock has a beta of 1.2 Proportion of equity nancing is 0.55 and proportion of debt nancing is 0.45Riskfnee rate is 1.5%, expected return on the market is 4%, cost of debt is 5% (before taxes) and tax rate is equal to 35%. What is XYZ's WACC equal to? Select ONE: 0 a. 5.12% O b.1.52% O c. 4.73% O {13.94% Question 11 Not yet answered Marked out of 1.01] '17 Flag question BNY Inc.'s bonds have a face value of$1000, annual coupon rate of 4%, 15 years leit to maturity and are currently selling for 105% of their face value. Compute the beforetax cost of debt for BNY Inc. as measured by the yield to maturity on its bonds. Select one: Q a. 3.56% C) {14.15% 0 c. 2.59% O o. 2.12% Question 12 Use the constant growth model to compute the required rate of return on HUZ Inc's stock given it is Not yet answered currently selling on the market for a price of $45 per share, last dividend paid was $2 per share (last year) Marked out of 1.00 and dividends are expected to continue to grow at an annual rate of 6%. Flag question Select one: O a. 10.71% O b. 6% O C. 4.71% O d. -1.29% Question 13 The reason why we use after-tax cost of debt when computing a firm's weighted average cost of capital is Not yet answered because Marked out of 1.00 Flag question Select one: O a. the reason is unknown and poorly studied by both practitioners and academics O b. all of the above O c. interest is a tax deductible expense O d. it has traditionally been computed this way and no one found appealing evidence against it Question 14 Suppose that a firm has computed its WACC to be equal to 12%. This would mean that Not yet answered Marked out of 1.00 Select one: Flag question O a. this is the maximum return that all projects the firm is currently working on will ever yield O b. this is the minimum return that all average risk projects must provide O C. this is an arbitrary number that simply gives an indication of what to expect as yield O d. the cost of capital for this firm is cheapInformation USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS 15, 16 and 17: Flag question IFDU Catering Company is considering investing in a new van. The cost of the van is $15'000 with a salvage value of $0, useful life of 10 years and will be depreciated on straight-line basis. This project has a life of 3 years. At the end of the project's life, the van will be sold for an estimated value of $3'000. Net working capital requirements for this project are equal to $2'000. Because of the additional carrying capacity the new van will provide, average daily cash sales will increase by $250. Additional operating expenses (cash) will have to be incurred as well and will equal to $50 per day. Firm's tax rate is equal to 35% and WACC is equal to 13%. You can assume 365 days a year for your calculations. (HINT: There is more information here than you really need to answer questions 15, 16 and 17. Take your time to read what is given and only use the information that is required) Question 15 What will the change in annual revenue (sales) produced by this project be if accepted? (Use information at Not yet answered the top of this page to answer this question) Marked out of 1.00 Flag question Select one: O a. $91'250 O b. $18'250 O C. $250 O d. $50 Question 16 What will the change in annual operating expenses produced by this project be if accepted? Not yet answered Marked out of 1.00 Select one: Flag question O a. $250 O b. $50 O C. $18 250 O d. None of the above O e. $91'250 Question 17 Estimate the annual equal (change in) operating cash that this project will produce if accepted. Not yet answered Marked out of 1.00 Select one: Flag question O a. $130 O b. $47'976 O c. none of the above O d. $655Question 18 When estimating operating cash flow amount in capital budgeting, interest expenses is Not yet answered Marked out of 1.00 Select one: Flag question O a. excluded from the calculations because we cannot estimate the additional interest expense O b. included in the calculations because additional financing needed will increase interest paid O c. excluded from the calculations because we use WACC to discount cash flows and it already includes the cost of debt O d. included in the calculations because it is indeed an expense that will have to be incurred Question 19 When estimating operating cash flow amount in capital budgeting, depreciation expense is Not yet answered Marked out of 1.00 Select one: \\Flag question O a. included in the calculation by first deducting it from sales before computing EBIT and then adding it back after taking out the tax expense with the net effect being that depreciation produces tax savings O b. excluded from operating cash flow calculation but is included when computing financial cash flow O c. included because it is a cash expense and has absolutely no effect on taxes paid O d. excluded from the calculations because it is a non-cash expense and would have absolutely no effect on the free cash flow for the entire company whether the project is accepted or rejected