Question: please help me Part 2: Problem Solving A financial services provider that provides computer software systems approaches you. The compor started off as a small

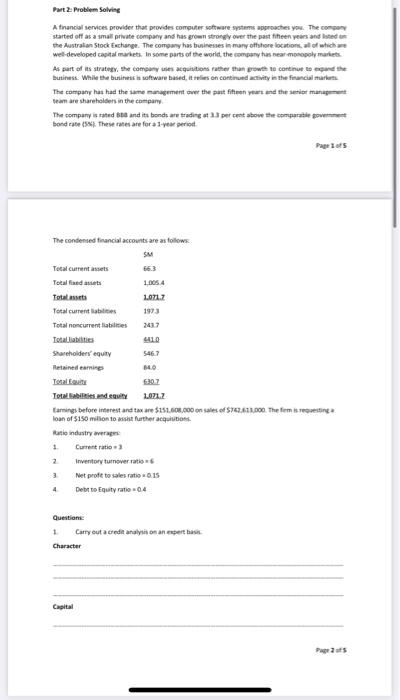

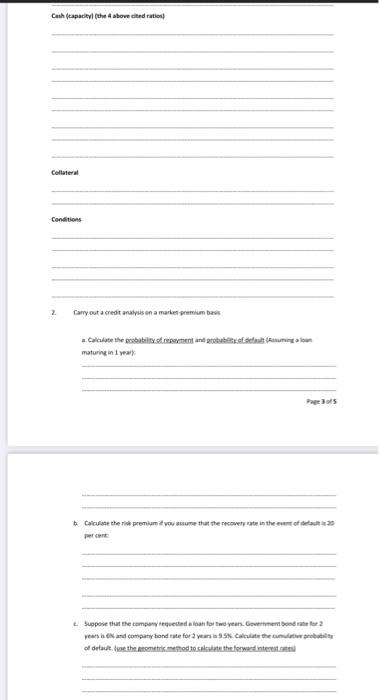

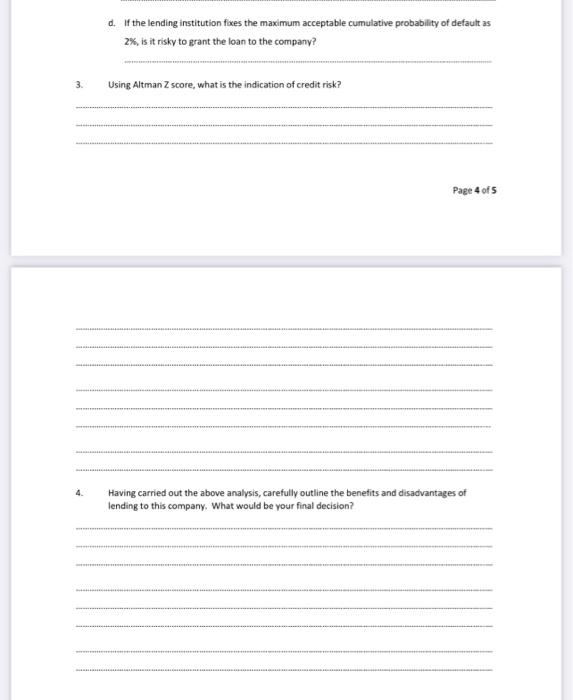

Part 2: Problem Solving A financial services provider that provides computer software systems approaches you. The compor started off as a small private company and has grown strongly over the past tiheen years and listed the Australian Stock Exchange. The company has businesses in many offshore location, all of which are wel developed capital markets. In some parts of the world, the company has near Monopoly markets As part of its strategy, the company wies acquisitions rather than grow to continue to end the business. While the business in software based trees on continued activity in the financial markets The company has had the same management over the past the year and the senior manat team are shareholders in the company The company is rated and its bonds are trading 33 per cent above the comparable government bond cute. These rates are for a 1-year period 1973 The condensed financial accounts are as follows SM Total current assets 1.0054 Totalt LOLZ Total currenties Total noncurrenties Totalliet 10 Shareholders' equity 5467 Retained in HO Total Totalidity 1.071.2 taries before interest and taxare $15.60.000 on sales of $143.616.000. The fem sretne loan of $150 milion to further acquisto tatie industry + Current ratio 2 Inventory turnover ratio 3 Net profitto sales ratio 0.15 4 Debt to Equity ratio 04 Questione 1 Carry out a credit analysis on neers Character Capital Page 1 Caith capacity (the above cited ration Collateral Conditions 2 Carry out a credit analysis on a market premium basis maturing in 1 year Page Dots Calculate the risk premium ou aume that the recovery rate in the 20 4. Suppose that the competed for years. Government bonde2 years and company bond te for 2 years 35. Calculate the com of detail thotthod to calculate the forward interest d. If the lending institution fixes the maximum acceptable cumulative probability of default as 2%, is it risky to grant the loan to the company? 3. Using Altman Zscore, what is the indication of credit risk? Page 4 of 5 Having carried out the above analysis, carefully outline the benefits and disadvantages of lending to this company. What would be your final decision? Part 2: Problem Solving A financial services provider that provides computer software systems approaches you. The compor started off as a small private company and has grown strongly over the past tiheen years and listed the Australian Stock Exchange. The company has businesses in many offshore location, all of which are wel developed capital markets. In some parts of the world, the company has near Monopoly markets As part of its strategy, the company wies acquisitions rather than grow to continue to end the business. While the business in software based trees on continued activity in the financial markets The company has had the same management over the past the year and the senior manat team are shareholders in the company The company is rated and its bonds are trading 33 per cent above the comparable government bond cute. These rates are for a 1-year period 1973 The condensed financial accounts are as follows SM Total current assets 1.0054 Totalt LOLZ Total currenties Total noncurrenties Totalliet 10 Shareholders' equity 5467 Retained in HO Total Totalidity 1.071.2 taries before interest and taxare $15.60.000 on sales of $143.616.000. The fem sretne loan of $150 milion to further acquisto tatie industry + Current ratio 2 Inventory turnover ratio 3 Net profitto sales ratio 0.15 4 Debt to Equity ratio 04 Questione 1 Carry out a credit analysis on neers Character Capital Page 1 Caith capacity (the above cited ration Collateral Conditions 2 Carry out a credit analysis on a market premium basis maturing in 1 year Page Dots Calculate the risk premium ou aume that the recovery rate in the 20 4. Suppose that the competed for years. Government bonde2 years and company bond te for 2 years 35. Calculate the com of detail thotthod to calculate the forward interest d. If the lending institution fixes the maximum acceptable cumulative probability of default as 2%, is it risky to grant the loan to the company? 3. Using Altman Zscore, what is the indication of credit risk? Page 4 of 5 Having carried out the above analysis, carefully outline the benefits and disadvantages of lending to this company. What would be your final decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts