Question: Please help me . Please help me . Please help me The current discount rate on a 6-months banker's acceptance is 6 percent per annum,

Please help me . Please help me . Please help me

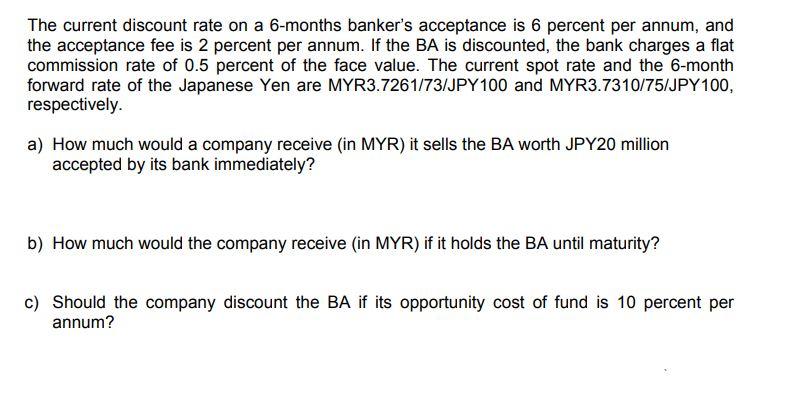

The current discount rate on a 6-months banker's acceptance is 6 percent per annum, and the acceptance fee is 2 percent per annum. If the BA is discounted, the bank charges a flat commission rate of 0.5 percent of the face value. The current spot rate and the 6-month forward rate of the Japanese Yen are MYR3.7261/73/JPY 100 and MYR3.7310/75/JPY100, respectively. a) How much would a company receive (in MYR) it sells the BA worth JPY20 million accepted by its bank immediately? b) How much would the company receive (in MYR) if it holds the BA until maturity? c) Should the company discount the BA if its opportunity cost of fund is 10 percent per annum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts