Question: Please help me . Please help me .. Please help QUESTION 3 Assume the following information: Spot rate 90-day forward rate GBP/MYR5.6350-92 GBP/MYR5.6330-78 90-day borrowing

Please help me . Please help me .. Please help

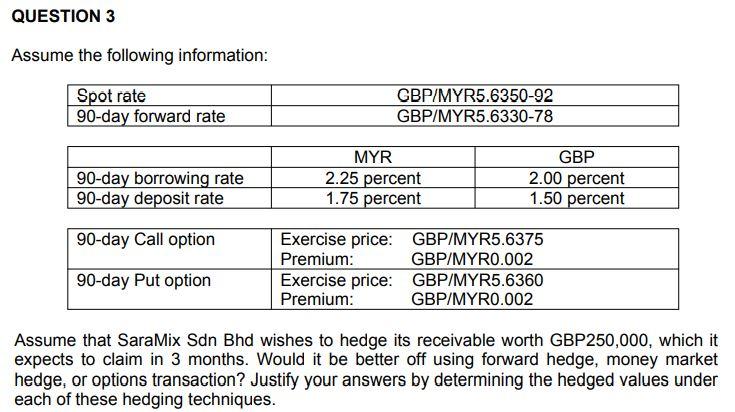

QUESTION 3 Assume the following information: Spot rate 90-day forward rate GBP/MYR5.6350-92 GBP/MYR5.6330-78 90-day borrowing rate 90-day deposit rate MYR 2.25 percent 1.75 percent GBP 2.00 percent 1.50 percent 90-day Call option Exercise price: GBP/MYR5.6375 Premium: GBP/MYR0.002 Exercise price: GBP/MYR5.6360 Premium: GBP/MYRO.002 90-day Put option Assume that SaraMix Sdn Bhd wishes to hedge its receivable worth GBP250,000, which it expects to claim in 3 months. Would it be better off using forward hedge, money market hedge, or options transaction? Justify your answers by determining the hedged values under each of these hedging techniques

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts