Question: Please help me .. Please help me .. Please help me .. Please QUESTION 4 Hanis and Amin are in partnership business sharing the profit

Please help me .. Please help me .. Please help me .. Please

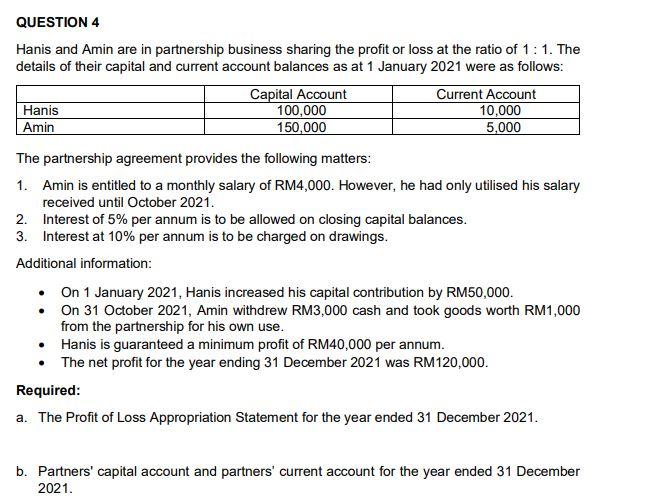

QUESTION 4 Hanis and Amin are in partnership business sharing the profit or loss at the ratio of 1: 1. The details of their capital and current account balances as at 1 January 2021 were as follows: Capital Account Current Account Hanis 100,000 10,000 Amin 150,000 5,000 The partnership agreement provides the following matters: 1. Amin is entitled to a monthly salary of RM4,000. However, he had only utilised his salary received until October 2021. 2. Interest of 5% per annum is to be allowed on closing capital balances. 3. Interest at 10% per annum is to be charged on drawings. Additional information: On 1 January 2021, Hanis increased his capital contribution by RM50,000. On 31 October 2021, Amin withdrew RM3,000 cash and took goods worth RM1,000 from the partnership for his own use. Hanis is guaranteed a minimum profit of RM40,000 per annum. The net profit for the year ending 31 December 2021 was RM120,000. Required: a. The Profit of Loss Appropriation Statement for the year ended 31 December 2021. b. Partners' capital account and partners' current account for the year ended 31 December 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts