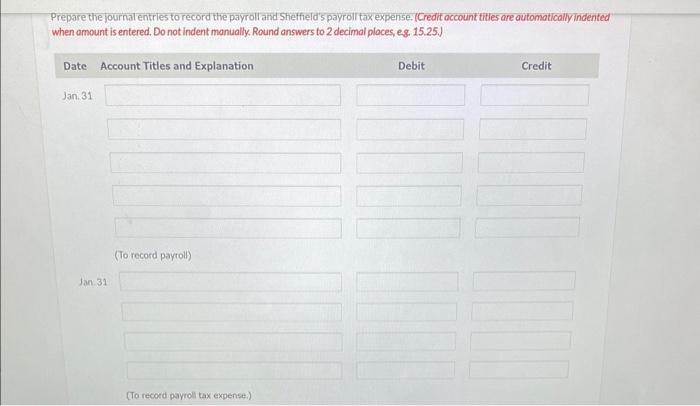

Question: please help me prepare a journal entry. Prepare the journal entries to record the payroll and Sheffield's payroll tax expense. (Credit occount titles are automatically

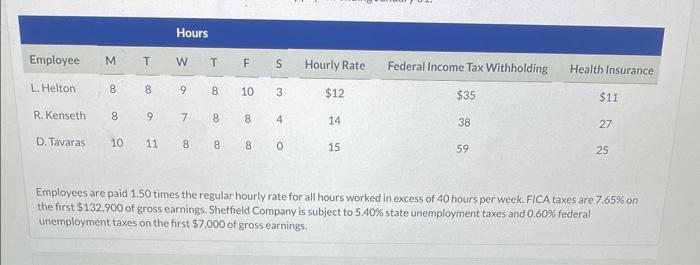

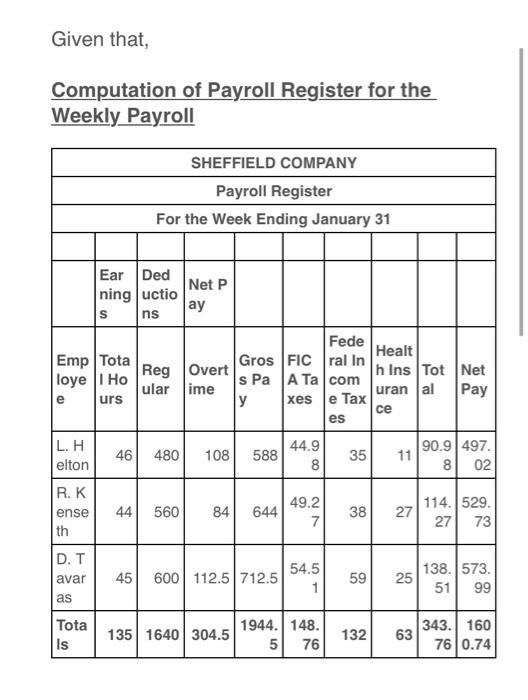

Prepare the journal entries to record the payroll and Sheffield's payroll tax expense. (Credit occount titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal ploces, eg. 15.25.) Employees are paid 1.50 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the first $132,900 of gross earnings. Sheffield Company is subject to 5.40% state unemployment taxes and 0.60% federal unemployment taxes on the first $7,000 of gross earnings. Computation of Payroll Register for the Whalkio, Dawrall

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts