Question: please help me prepare a payroll register i am so lost Almari has four employees who are paid on an hourly basis plus time-and-a-half for

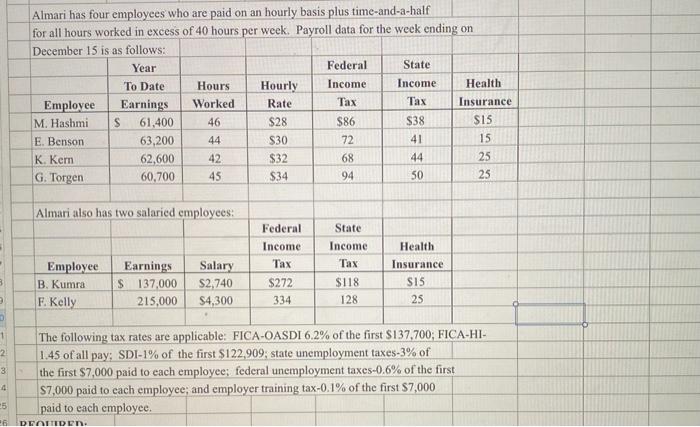

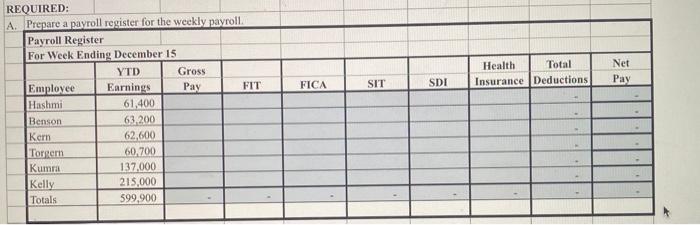

Almari has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 hours per week. Payroll data for the week ending on December 15 is as follows: Year Federal State To Date Hours Hourly Income Income Health Employee Earnings Worked Rate Tax Tax Insurance M. Hashmi S 61,400 46 $28 $86 $38 SIS E. Benson 63,200 $30 72 41 15 K Kern 62,600 42 $32 68 44 25 G. Torgen 60,700 45 $34 94 50 25 44 Almari also has two salaried employees: Employee B. Kumra F. Kelly Earnings Salary $ 137,000 $2,740 215,000 $4,300 Federal Income Tax S272 334 State Income Tax $118 128 Health Insurance SIS 25 1 2 3 The following tax rates are applicable: FICA-OASDI 6.2% of the first $137,700; FICA-HI- 1.45 of all pay: SDI-1% of the first $122,909, state unemployment taxes-3% of the first $7,000 paid to each employee; federal unemployment taxes-0.6% of the first $7,000 paid to each employee; and employer training tax-0.1% of the first $7,000 paid to each employee. 5 26 DEOTIDET. Health Total Insurance Deductions Net Pay FICA SIT SDI REQUIRED: A Prepare a payroll register for the weekly payroll Payroll Register For Week Ending December 15 YTD Gross Employee Earnings Pay FIT Hashmi 61,400 Benson 63,200 Kern 62,600 Torger 60,700 Kumra 137,000 Kelly 215,000 Totals 599,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts