Question: please help me prepare the required general journal adjusting entries in an Excel spreadsheet. Thank you for helping. - $890 of salaries has accrued of

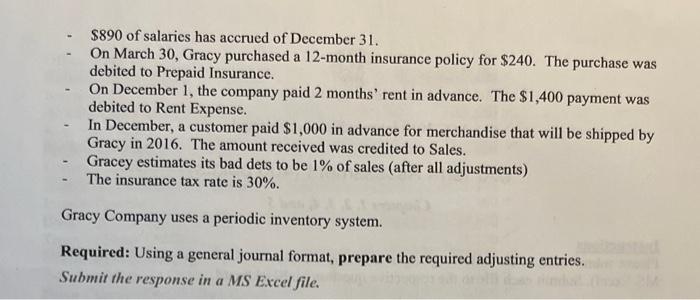

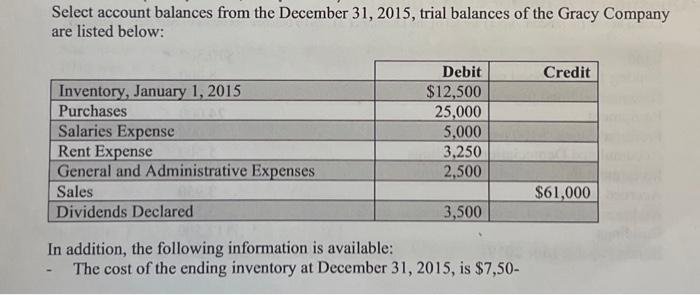

- $890 of salaries has accrued of December 31 . - On March 30, Gracy purchased a 12-month insurance policy for $240. The purchase was debited to Prepaid Insurance. - On December 1, the company paid 2 months' rent in advance. The $1,400 payment was debited to Rent Expense. - In December, a customer paid $1,000 in advance for merchandise that will be shipped by Gracy in 2016 . The amount received was credited to Sales. - Gracey estimates its bad dets to be 1% of sales (after all adjustments) - The insurance tax rate is 30%. Gracy Company uses a periodic inventory system. Required: Using a general journal format, prepare the required adjusting entries. Submit the response in a MS Excel file. Select account balances from the December 31,2015 , trial balances of the Gracy Company are listed below: In addition, the following information is available: - The cost of the ending inventory at December 31,2015 , is $7,50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts