Question: Please help me prepare this problem by using Excel Problem 2-1 0 Common Information Ownership Interest Market Number of Price per Cash Shares Share Total

Please help me prepare this problem by using Excel

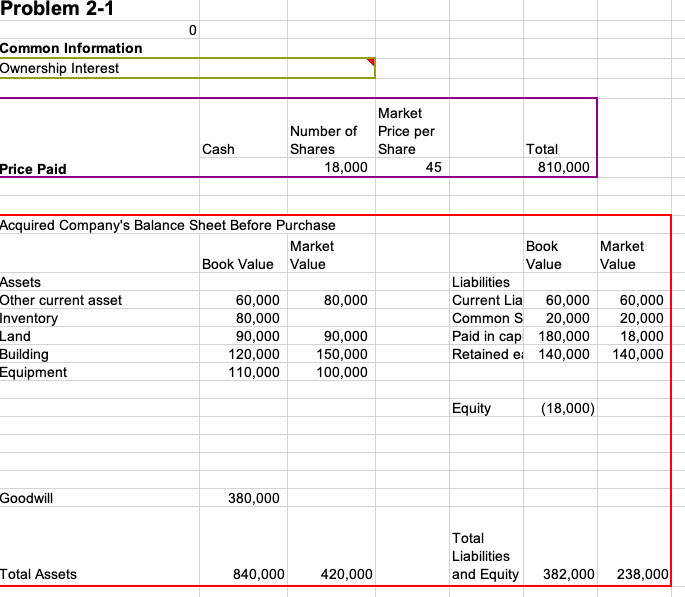

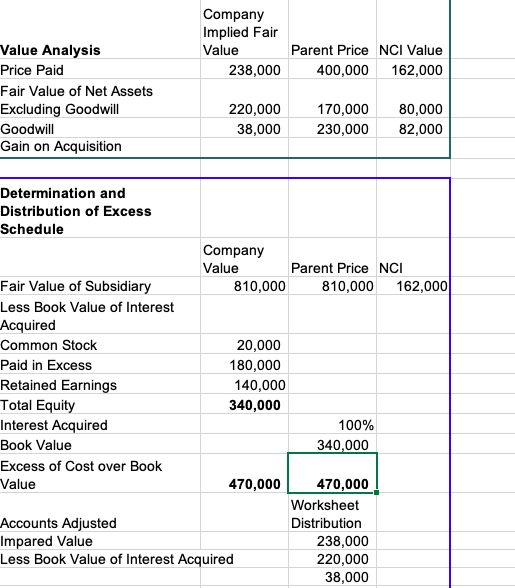

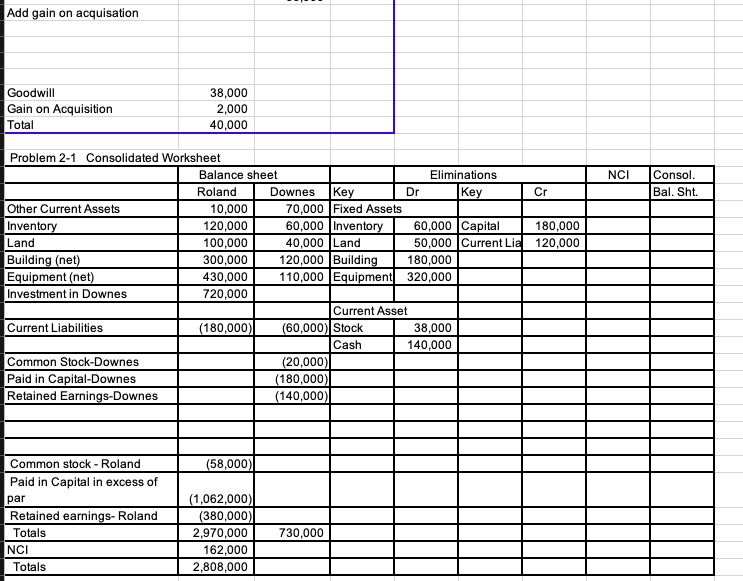

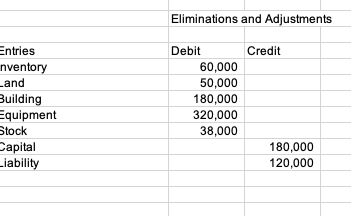

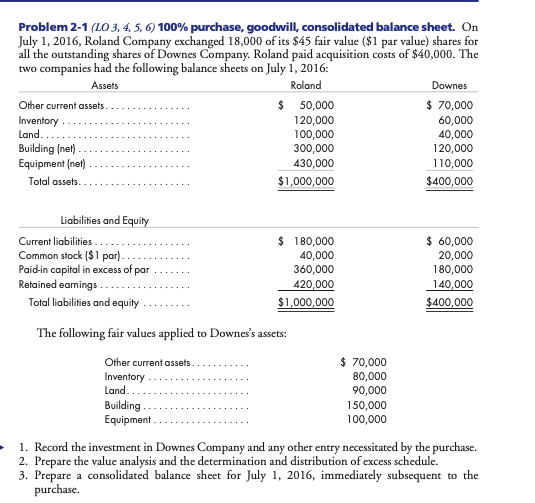

Problem 2-1 0 Common Information Ownership Interest Market Number of Price per Cash Shares Share Total Price Paid 18,000 45 810,000 Acquired Company's Balance Sheet Before Purchase Market Book Market Book Value Value Value Value Assets Liabilities Other current asset 60,000 80,000 Current Lia 60,000 60,000 Inventory 80,000 Common S 20,000 20,000 Land 90,000 90,000 Paid in cap 180,000 18,000 Building 120,000 150,000 Retained e: 140,000 140,000 Equipment 110,000 100,000 Equity (18,000) Goodwill 380,000 Total Liabilities Total Assets 840,000 420,000 and Equity 382,000 238,000Company Implied Fair Value Analysis Value Parent Price NCI Value Price Paid 238,000 400,000 162,000 Fair Value of Net Assets Excluding Goodwill 220,000 170,000 80,000 Goodwill 38,000 230,000 82,000 Gain on Acquisition Determination and Distribution of Excess Schedule Company Value Parent Price NCI Fair Value of Subsidiary 810,000 810,000 162,000 Less Book Value of Interest Acquired Common Stock 20,000 Paid in Excess 180,000 Retained Earnings 140,000 Total Equity 340,000 Interest Acquired 100% Book Value 340,000 Excess of Cost over Book Value 470,000 470,000 Worksheet Accounts Adjusted Distribution Impared Value 238,000 Less Book Value of Interest Acquired 220,000 38,000Add gain on acquisation Goodwill 38,000 Gain on Acquisition 2,000 Total 40,000 Problem 2-1 Consolidated Worksheet Balance sheet Eliminations NCI Consol Roland Downes Key Dr Key Cr Bal. Sht Other Current Assets 10,000 70,000 Fixed Assets Inventory 120,000 60,000 Inventory 60,000 Capital 180,000 Land 100,000 40,000 Land 60,000 Current Lia 120,000 Building (net) 800,000 120,000 Building 180,000 Equipment (net) 430,000 110,000 Equipment 320,000 Investment in Downes 720,000 Current Asse Current Liabilities (180,000) (60,000) Stock 38,000 Cash 140,000 Common Stock-Downes 20,000) Paid in Capital-Downes 180,000) Retained Earnings-Downes 140,000) Common stock - Roland (58,000) Paid in Capital in excess of par (1,062,000) Retained earnings- Roland 380,000 Totals 2,970,000 730,000 NCI 162,000 Totals 2,808,000Eliminations and Adjustments Entries Debit Credit nventory 60,000 .and 50,000 Building 180,000 Equipment 320,000 Stock 38,000 Capital 180,000 iability 120,000Problem 2-1 (LO 3, 4, 5, 6) 100% purchase, goodwill, consolidated balance sheet. On July 1, 2016, Roland Company exchanged 18,000 of its $45 fair value ($1 par value) shares for all the outstanding shares of Downes Company. Roland paid acquisition costs of $40,000. The two companies had the following balance sheets on July 1, 2016: Assets Roland Downes Other current assets. $ 50,000 $ 70,000 Inventory . .. 120,000 60,000 Land. . . . 100,000 40,000 Building (net) . . . 300,000 120,000 Equipment (net) 430,000 110,000 Total assets. . . . . . $1,000,000 $400,000 Liabilities and Equity Current liabilities . . $ 180,000 $ 60,000 Common stock ($ 1 par). . . . . . . . . . . . 40,000 20,000 Paid-in capital in excess of par 360,000 180,000 Retained earnings . . ... 420,000 140,000 Total liabilities and equity . . . . .. ... $1,000,000 $400,000 The following fair values applied to Downes's assets: Other current assets . . . . . . . . . . . $ 70,000 Inventory . . . . 80,000 Land. . . . 90,000 Building . . . . . 150,000 Equipment . .. 100,000 1. Record the investment in Downes Company and any other entry necessitated by the purchase. 2. Prepare the value analysis and the determination and distribution of excess schedule. 3. Prepare a consolidated balance sheet for July 1, 2016, immediately subsequent to the purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts