Question: please help me Presented below are selected transactions for Milton Company for 2020. Jan. 1 Received $9,000 scrap value on retirement of machinery that was

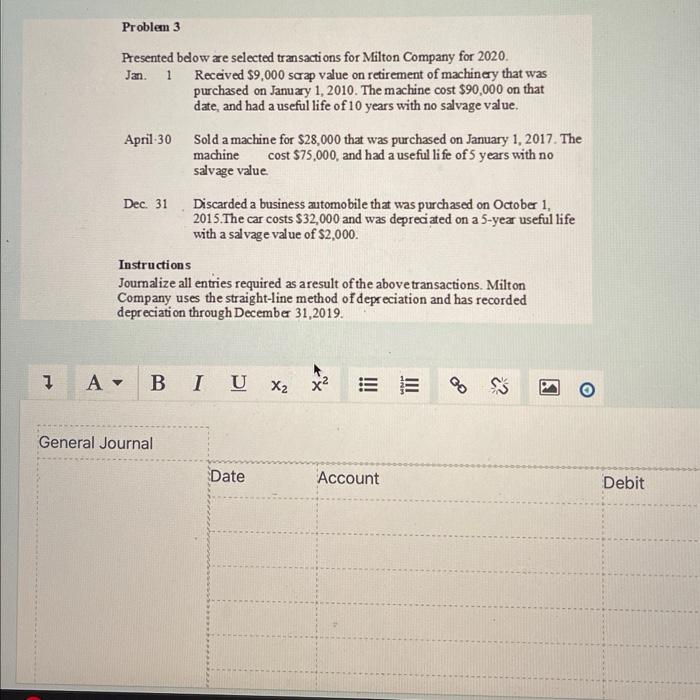

Presented below are selected transactions for Milton Company for 2020. Jan. 1 Received $9,000 scrap value on retirement of machinery that was purchased on January 1,2010 . The machine cost $90,000 on that date, and had a useful life of 10 years with no salvage value, April-30 Sold a machine for $28,000 that was purchased on January 1,2017 . The machine cost $75,000, and had a useful life of 5 years with no salvage value. Dec. 31 Discarded a business automobile that was purchased on October 1 , 2015.The car costs $32,000 and was depreciated on a 5-year useful life with a salvage value of $2,000. Instructions Journalize all entries required as aresult of the above transactions. Milton Company uses the straight-line method of depreciation and has recorded depreciation through December 31,2019. General Journal \begin{tabular}{|c|c|c|c|} \hline Date & Account & Debit & Credit \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts