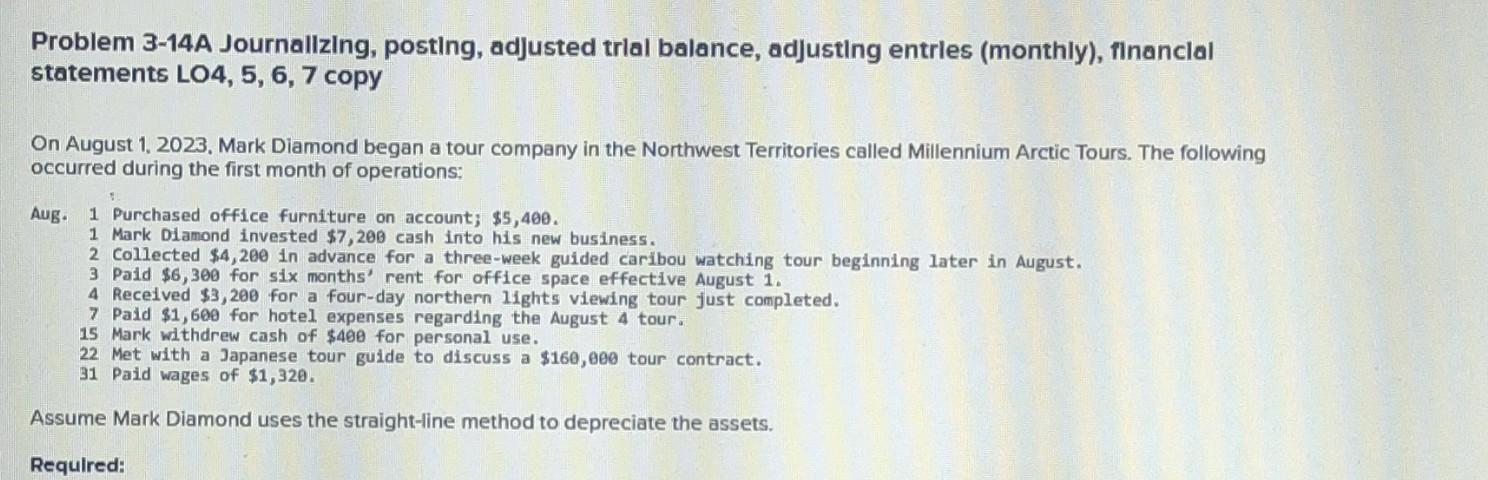

Question: please help me Problem 3-14A Journallzing, posting, adjusted trial balance, adjusting entrles (monthly), financlal statements LO4, 5, 6, 7 copy On August 1, 2023. Mark

please help me

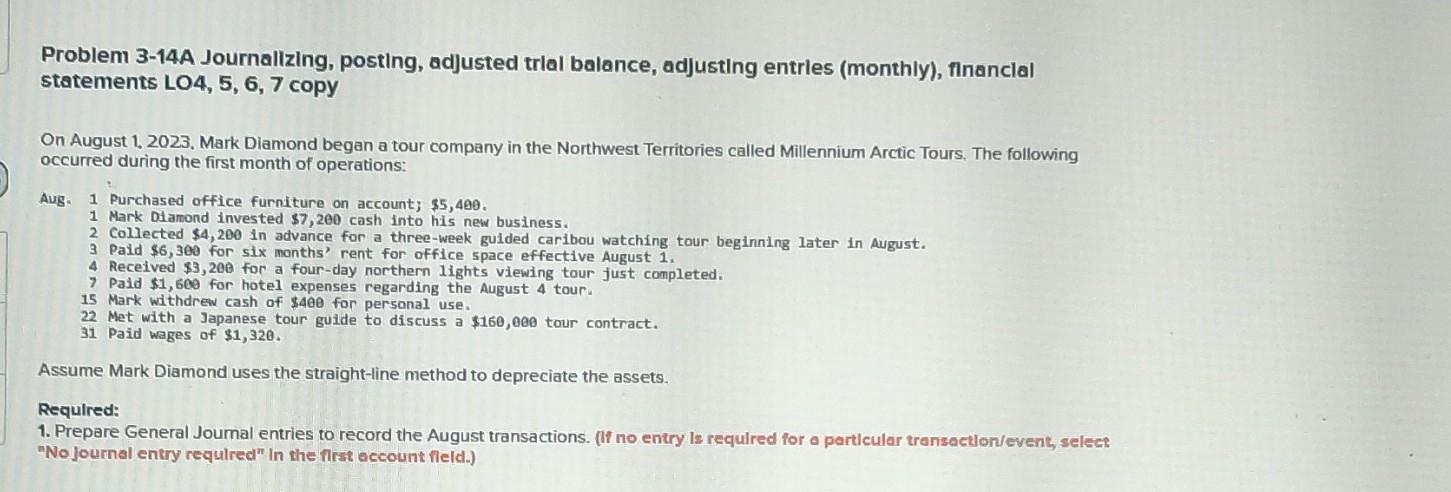

Problem 3-14A Journallzing, posting, adjusted trial balance, adjusting entrles (monthly), financlal statements LO4, 5, 6, 7 copy On August 1, 2023. Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first month of operations: Aug. 1 Purchased office furniture on account; $5,400. 1 Mark Diamond invested $7,200 cash into his new business. 2 Collected $4,200 in advance for a three-week guided caribou watching tour beginning later in August. 4 Paid $6,300 for six months rent for office space effective August 1. 4 Received $3,200 for a four-day northern lights viewing tour just completed. 7 Paid $1,600 for hotel expenses regarding the August 4 tour. 15 Mark withdrew cash of $408 for personal use. 22 Met with a Japanese tour guide to discuss a $160,000 tour contract. 31 Paid wages of $1,320. Assume Mark Diamond uses the straight-line method to depreciate the assets. Problem 3-14A Journalizing, posting, adjusted trial balance, adjusting entrles (monthly), financlal statements LO4, 5, 6, 7 copy On August 1, 2023. Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours, The following occurred during the first month of operations: Aug. 1 Purchased office furniture on account; $5,400. 1 Mark Diamond invested $7,200 cash into his new business. 3 Collected $4,200 in advance for a three-week guided caribou watching tour beginning later in August. 3 Pald $6,300 for six months' rent for office space effective August 1. 7 Received $3,200 for a four-day northern lights viewing tour just completed. 15 Mark withdrew cash of $46e for persanal use. 31 Maid wages of $1,320. Assume Mark Diamond uses the straight-line method to depreciate the assets. Requlred: 1. Prepare General Joumal entries to record the August transactions. (ff no entry is requlred for a particular transactlon/event, selecs "No journel entry required" in the first eccount field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts