Question: please help me provide excel the formulas thank u Question 1: Assume you deposit $700 every three months at a 6 percent annual rate, compounded

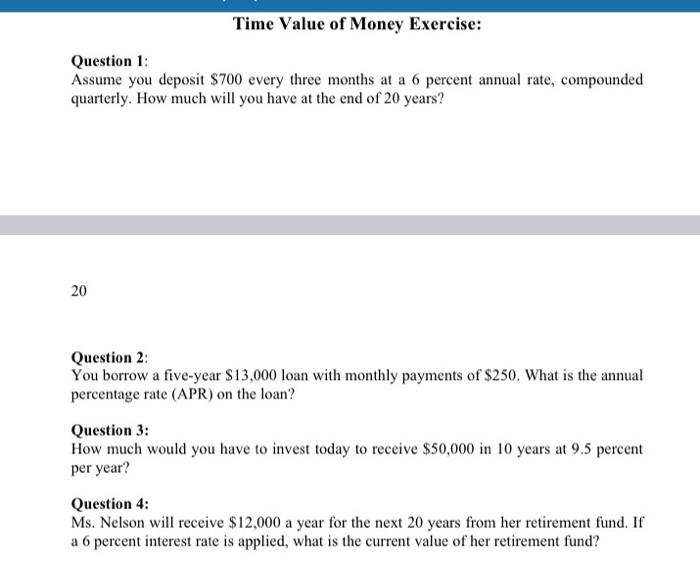

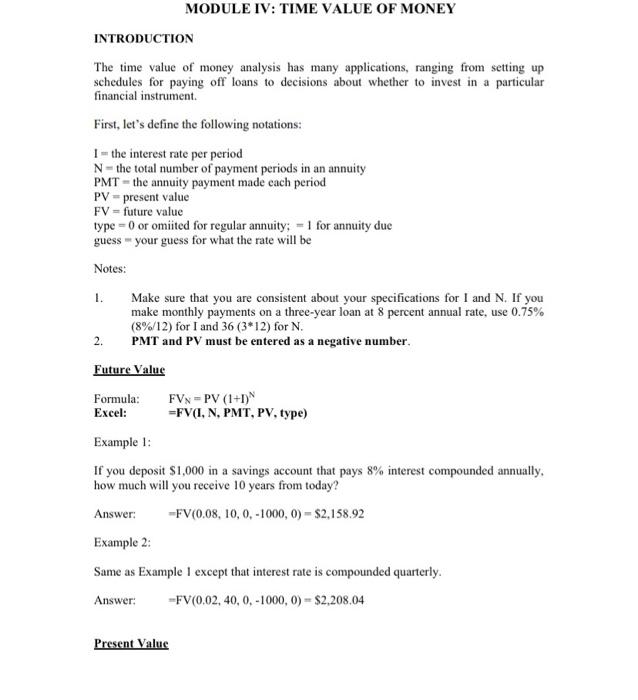

Question 1: Assume you deposit $700 every three months at a 6 percent annual rate, compounded quarterly. How much will you have at the end of 20 years? 20 Question 2: You borrow a five-year $13,000 loan with monthly payments of $250. What is the annual percentage rate (APR) on the loan? Question 3: How much would you have to invest today to receive $50,000 in 10 years at 9.5 percent per year? Question 4: Ms. Nelson will receive $12,000 a year for the next 20 years from her retirement fund. If a 6 percent interest rate is applied, what is the current value of her retirement fund? INTRODUCTION The time value of money analysis has many applications, ranging from setting up schedules for paying off loans to decisions about whether to invest in a particular financial instrument. First, let's define the following notations: I= the interest rate per period N= the total number of payment periods in an annuity PMT = the annuity payment made each period PV= present value FV= future value type =0 or omiited for regular annuity; =1 for annuity due guess = your guess for what the rate will be Notes: 1. Make sure that you are consistent about your specifications for I and N. If you make monthly payments on a three-year loan at 8 percent annual rate, use 0.75% (8%/12) for I and 36(312) for N. 2. PMT and PV must be entered as a negative number. Future Value Formula:Excel:FVN=PV(1+1)N=FV(I,N,PMT,PV,type) Example 1: If you deposit $1,000 in a savings account that pays 8% interest compounded annually. how much will you receive 10 years from today? Answer: =FV(0.08,10,0,1000,0)=$2,158.92 Example 2: Same as Example 1 except that interest rate is compounded quarterly. Answer: =FV(0.02,40,0,1000,0)=$2,208,04 Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts