Question: Please help me Quality Manufacturing needs to acquire a packing machine which will cost the company $80,000. It is estimated that in six years' time

Please help me

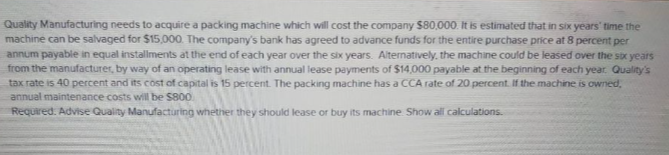

Quality Manufacturing needs to acquire a packing machine which will cost the company $80,000. It is estimated that in six years' time the machine can be salvaged for $15,000. The company's bank has agreed to advance funds for the entire purchase price at 8 percent per annum payable in equal installments at the end of each year over the six years. Alternatively, the machine could be leased over the six years from the manufacturer, by way of an operating lease with annual lease payments of $14,000 payable at the beginning of each year. Quality's tax rate is 40 percent and its cost of capital is 15 percent. The packing machine has a CCA rate of 20 percent. If the machine is owned annual maintenance costs will be 5800 Required. Advise Quality Manufacturing whether they should lease or buy its machine Show all calculations. Quality Manufacturing needs to acquire a packing machine which will cost the company $80,000. It is estimated that in six years' time the machine can be salvaged for $15,000. The company's bank has agreed to advance funds for the entire purchase price at 8 percent per annum payable in equal installments at the end of each year over the six years. Alternatively, the machine could be leased over the six years from the manufacturer, by way of an operating lease with annual lease payments of $14,000 payable at the beginning of each year. Quality's tax rate is 40 percent and its cost of capital is 15 percent. The packing machine has a CCA rate of 20 percent. If the machine is owned annual maintenance costs will be 5800 Required. Advise Quality Manufacturing whether they should lease or buy its machine Show all calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts