Question: Please help me Question 1 Assuming that you have been appointed finance director of BPX Bhd. The company is considering investing in the production of

Please help me

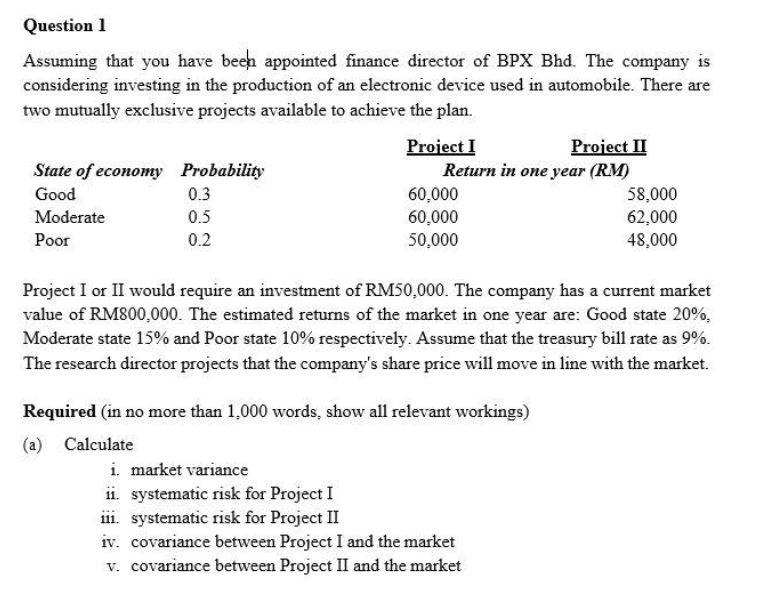

Question 1 Assuming that you have been appointed finance director of BPX Bhd. The company is considering investing in the production of an electronic device used in automobile. There are two mutually exclusive projects available to achieve the plan. Project I Project II State of economy Probability Return in one year (RM) Good 0.3 60,000 58.000 Moderate 0.5 60.000 62,000 Poor 0.2 50.000 48,000 Project I or II would require an investment of RM50,000. The company has a current market value of RM800,000. The estimated returns of the market in one year are: Good state 20% Moderate state 15% and Poor state 10% respectively. Assume that the treasury bill rate as 9%. The research director projects that the company's share price will move in line with the market. Required (in no more than 1,000 words, show all relevant workings) (a) Calculate i. market variance ii. systematic risk for Project I 111. systematic risk for Project II iv. covariance between Project I and the market V. covariance between Project II and the market Question 1 Assuming that you have been appointed finance director of BPX Bhd. The company is considering investing in the production of an electronic device used in automobile. There are two mutually exclusive projects available to achieve the plan. Project I Project II State of economy Probability Return in one year (RM) Good 0.3 60,000 58.000 Moderate 0.5 60.000 62,000 Poor 0.2 50.000 48,000 Project I or II would require an investment of RM50,000. The company has a current market value of RM800,000. The estimated returns of the market in one year are: Good state 20% Moderate state 15% and Poor state 10% respectively. Assume that the treasury bill rate as 9%. The research director projects that the company's share price will move in line with the market. Required (in no more than 1,000 words, show all relevant workings) (a) Calculate i. market variance ii. systematic risk for Project I 111. systematic risk for Project II iv. covariance between Project I and the market V. covariance between Project II and the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts