Question: Please help me . Safe me please.. I will give upvote so sure . PLease Q1. (a) The 20-year, RM1,000 face value bonds of Waco

Please help me . Safe me please.. I will give upvote so sure . PLease

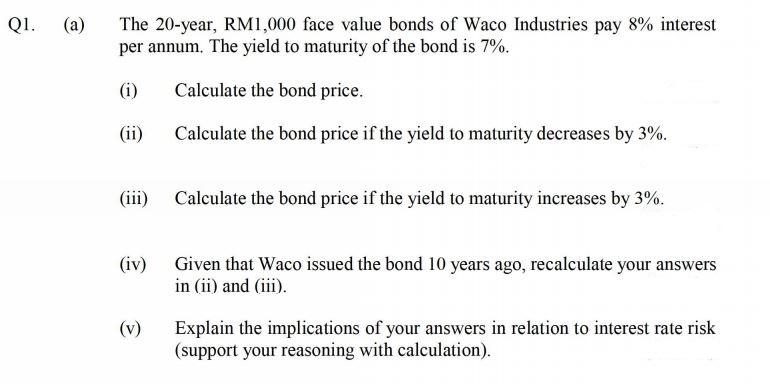

Q1. (a) The 20-year, RM1,000 face value bonds of Waco Industries pay 8% interest per annum. The yield to maturity of the bond is 7%. (i) Calculate the bond price. (ii) Calculate the bond price if the yield to maturity decreases by 3%. (iii) Calculate the bond price if the yield to maturity increases by 3%. (iv) Given that Waco issued the bond 10 years ago, recalculate your answers in (ii) and (iii). (v) Explain the implications of your answers in relation to interest rate risk (support your reasoning with calculation)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock