Question: Please help me . SHOW WORK PLEASE Question 8 of 10 - /6 : View Policies Current Attempt in Progress At the end of its

Please help me . SHOW WORK PLEASE

Please help me . SHOW WORK PLEASE

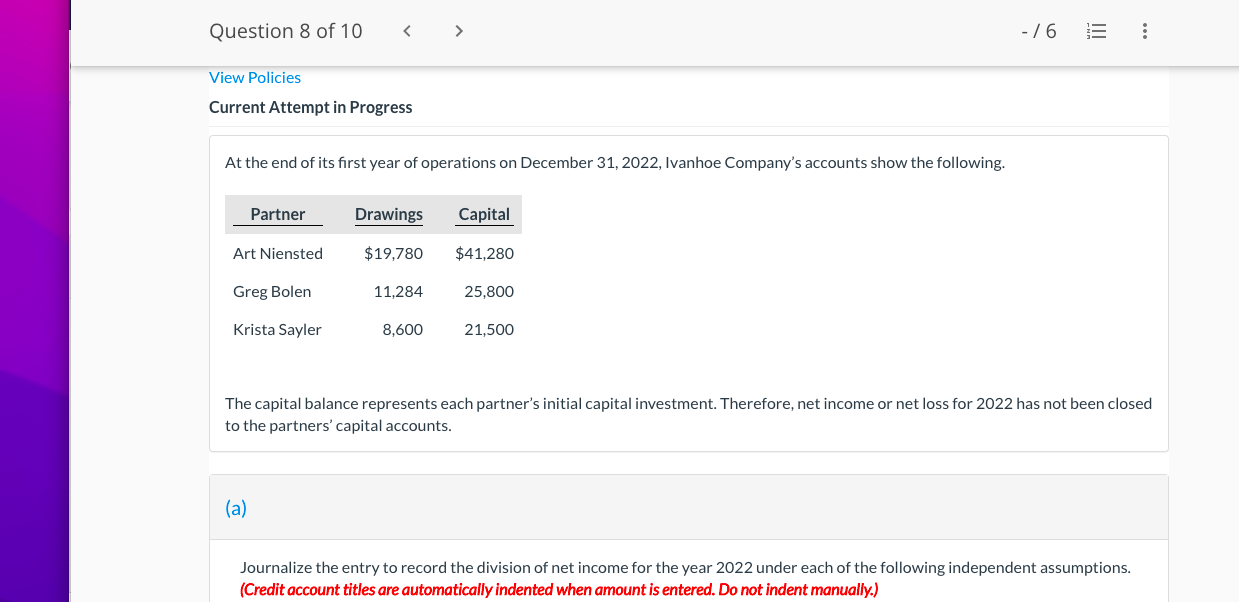

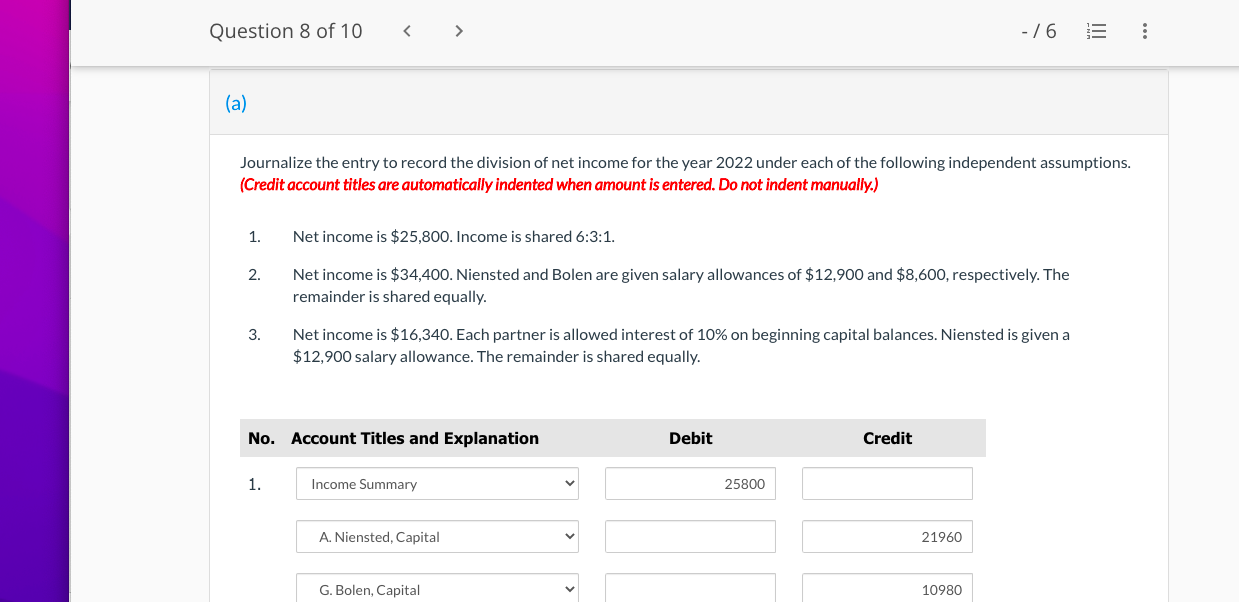

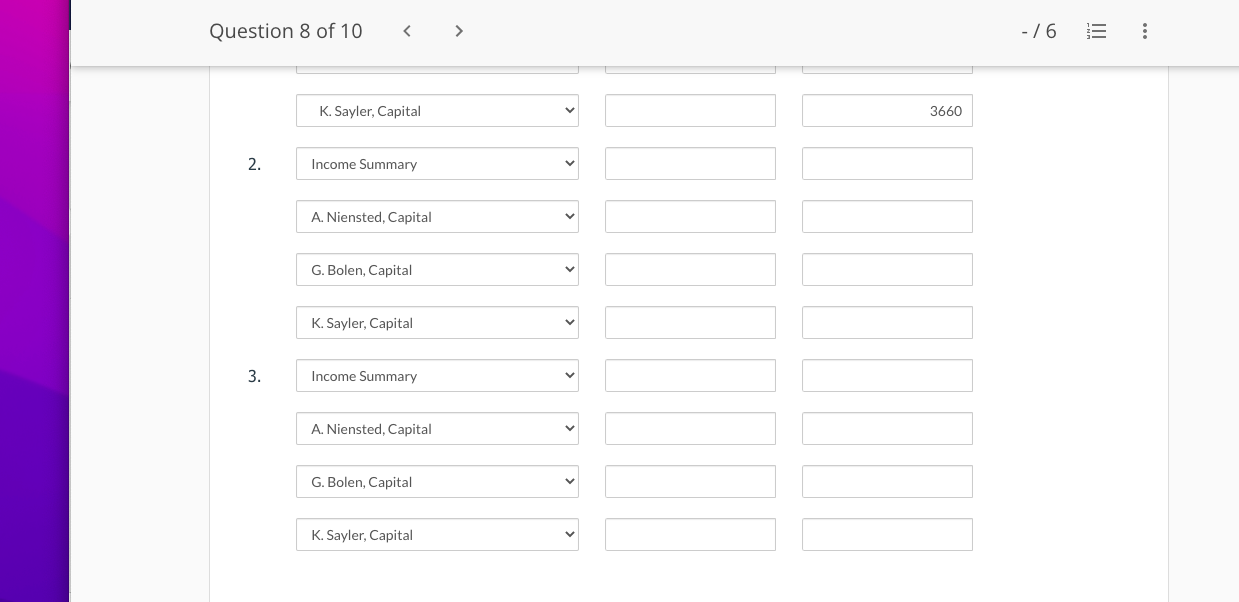

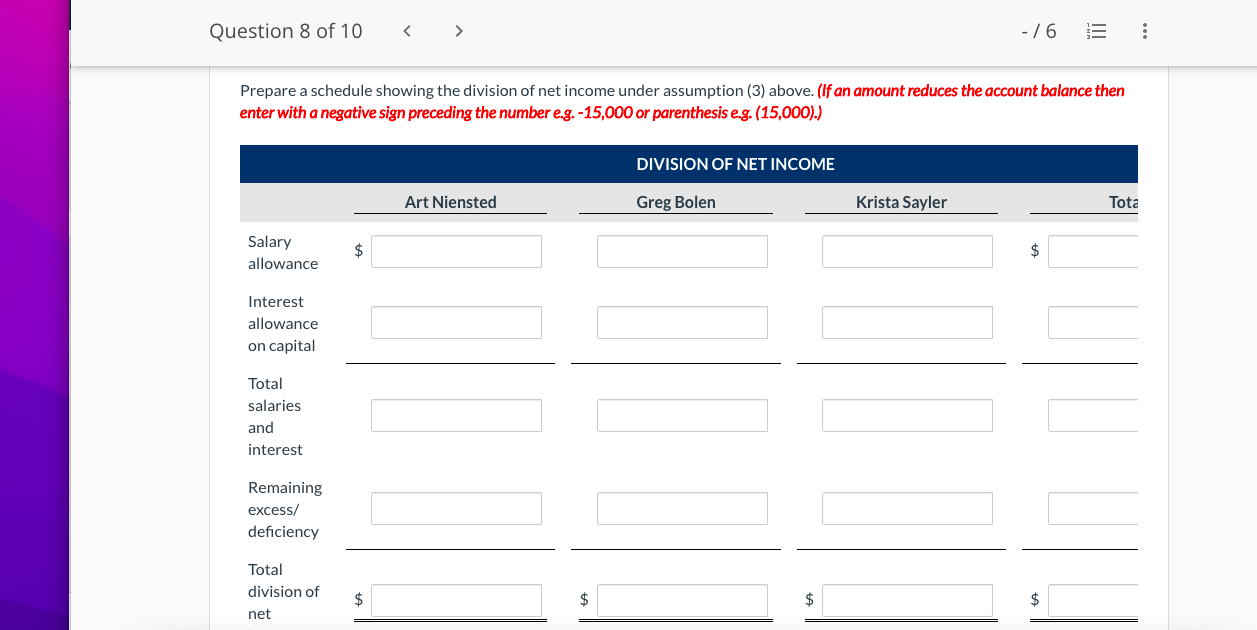

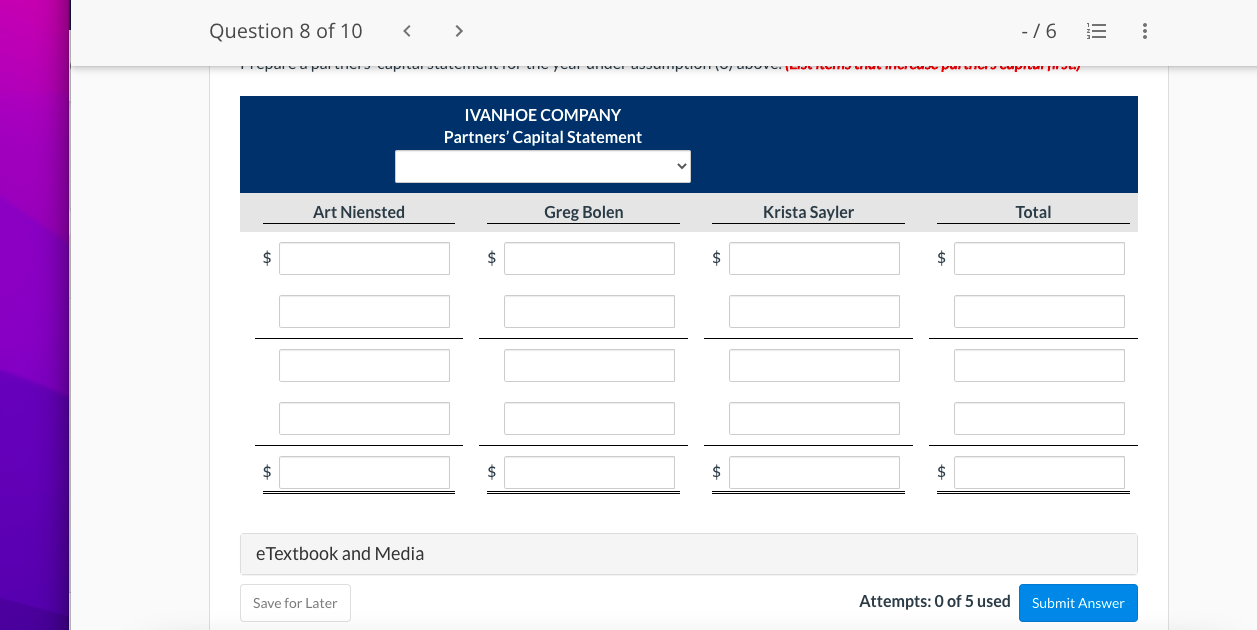

Question 8 of 10 - /6 : View Policies Current Attempt in Progress At the end of its first year of operations on December 31, 2022, Ivanhoe Company's accounts show the following. Partner Drawings Capital Art Niensted $19,780 $41.280 Greg Bolen 11,284 25,800 Krista Sayler 8,600 21,500 The capital balance represents each partner's initial capital investment. Therefore, net income or net loss for 2022 has not been closed to the partners' capital accounts. (a) Journalize the entry to record the division of net income for the year 2022 under each of the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Question 8 of 10 - /6 III : (a) Journalize the entry to record the division of net income for the year 2022 under each of the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) 1. Net income is $25,800. Income is shared 6:3:1. 2. Net income is $34,400. Niensted and Bolen are given salary allowances of $12,900 and $8,600, respectively. The remainder is shared equally. 3. Net income is $16,340.Each partner is allowed interest of 10% on beginning capital balances. Niensted is given a $12,900 salary allowance. The remainder is shared equally. No. Account Titles and Explanation Debit Credit 1. Income Summary 25800 A. Niensted, Capital 21960 G. Bolen, Capital 10980 Question 8 of 10 - / 6 III : K. Sayler, Capital 3660 2. Income Summary A. Niensted, Capital G. Bolen, Capital K. Sayler, Capital > 3. Income Summary > A. Niensted, Capital G. Bolen, Capital K. Sayler, Capital Question 8 of 10 > - /6 III : Prepare a schedule showing the division of net income under assumption (3) above. (If an amount reduces the account balance then enter with a negative sign preceding the number e.g. -15,000 or parenthesis eg. (15,000).) DIVISION OF NET INCOME Art Niensted Greg Bolen Krista Sayler Tota Salary allowance $ $ Interest allowance on capital Total salaries and interest Remaining excess/ deficiency Total division of net $ $ $ $ Question 8 of 10 - /6 III : ITI PUI LIVIT FOI LO TUE JOUIT wove. U TOIT I pursur IVANHOE COMPANY Partners' Capital Statement V Art Niensted Greg Bolen Krista Sayler Total $ $ $ $ $ $ e Textbook and Media Save for Later Attempts: 0 of 5 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts