Question: please help me solve 14,16,18 14. Table 2.4 lists various nominal exchange rates for the U.S. Compare the Euro/Dollar exchange rates in March 31, 2016

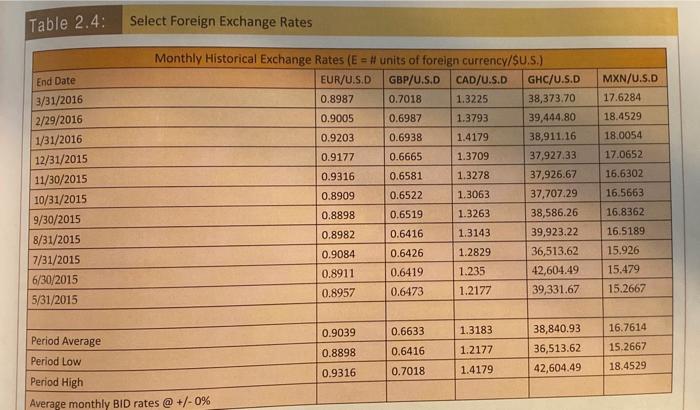

14. Table 2.4 lists various nominal exchange rates for the U.S. Compare the Euro/Dollar exchange rates in March 31, 2016 to November 30/2015. If you planned to vacation in France on one of these days with a constrained budget, holding all else constant, which day would you choose to travel? Why? 15. If the general price level (P) in the U.S. was 100 in comparison to 85 (P) in Canada on June 30, 2015, what would be the real CAN/US exchange rate? If inflation takes place in Canada, causing its general price level to rise to 120 , what happens to the nominal and real CAN/US exchange rates? If a Canadian tourist travels to the United States on that day, which would offer the traveler greater buying power? Use Table 2.4 for nominal exchange rates. 16. If the general price level (P) in the U.S. was 125 in comparison to 165 (P) in Ghana on February 29 , 2015 , what would be the real GHC/US exchange rate? If inflation takes place in the U.S., causing its general price level to rise to 130 , what happens to the nominal and real GHC/US exchange rates? If an American tourist travels to Ghana on that day, which would offer the traveler greater buying power? Use Table 2.4 for nominal exchange rates. 17. A U.S. multinational corporation has a subsidiary in Mexico. After a Presidential election in the United States, the U.S. renegotiates the North America Free Trade Agreement (NAFTA) to incorporate a 15% tariff (tax) on all goods imported to America from Mexico. This makes imports from Mexico more expensive to Americans, all else held constant. What is the net effect on the nominal MXN/USD exchange rate? What is the net effect on the real MXN/USD exchange rate? What is the net effect on the US multinational's net income in U.S. Dollars? 18. A U.S. multinational corporation has a subsidiary in China. After a Presidential election in the United States, the U.S. places a 35\% tariff (tax) on all goods imported to America from China. This makes imports from China more expensive to Americans, all else held constant. What is the net effect on the nominal CHY/USD exchange rate? What is the net effect on the real CHY/USD exchange rate? What is the net effect on the US multinational's net income in U.S. Dollars? able 2.4: Select Foreign Exchange Rates 14. Table 2.4 lists various nominal exchange rates for the U.S. Compare the Euro/Dollar exchange rates in March 31, 2016 to November 30/2015. If you planned to vacation in France on one of these days with a constrained budget, holding all else constant, which day would you choose to travel? Why? 15. If the general price level (P) in the U.S. was 100 in comparison to 85 (P) in Canada on June 30, 2015, what would be the real CAN/US exchange rate? If inflation takes place in Canada, causing its general price level to rise to 120 , what happens to the nominal and real CAN/US exchange rates? If a Canadian tourist travels to the United States on that day, which would offer the traveler greater buying power? Use Table 2.4 for nominal exchange rates. 16. If the general price level (P) in the U.S. was 125 in comparison to 165 (P) in Ghana on February 29 , 2015 , what would be the real GHC/US exchange rate? If inflation takes place in the U.S., causing its general price level to rise to 130 , what happens to the nominal and real GHC/US exchange rates? If an American tourist travels to Ghana on that day, which would offer the traveler greater buying power? Use Table 2.4 for nominal exchange rates. 17. A U.S. multinational corporation has a subsidiary in Mexico. After a Presidential election in the United States, the U.S. renegotiates the North America Free Trade Agreement (NAFTA) to incorporate a 15% tariff (tax) on all goods imported to America from Mexico. This makes imports from Mexico more expensive to Americans, all else held constant. What is the net effect on the nominal MXN/USD exchange rate? What is the net effect on the real MXN/USD exchange rate? What is the net effect on the US multinational's net income in U.S. Dollars? 18. A U.S. multinational corporation has a subsidiary in China. After a Presidential election in the United States, the U.S. places a 35\% tariff (tax) on all goods imported to America from China. This makes imports from China more expensive to Americans, all else held constant. What is the net effect on the nominal CHY/USD exchange rate? What is the net effect on the real CHY/USD exchange rate? What is the net effect on the US multinational's net income in U.S. Dollars? able 2.4: Select Foreign Exchange Rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts