Question: please help me solve 2.a and 2.c Problem 2) Whole lotta stuff! On January 1, 2020, Beerbo paid $6,500,000 cash to purchase Forty-Niner Miner Co.

please help me solve 2.a and 2.c

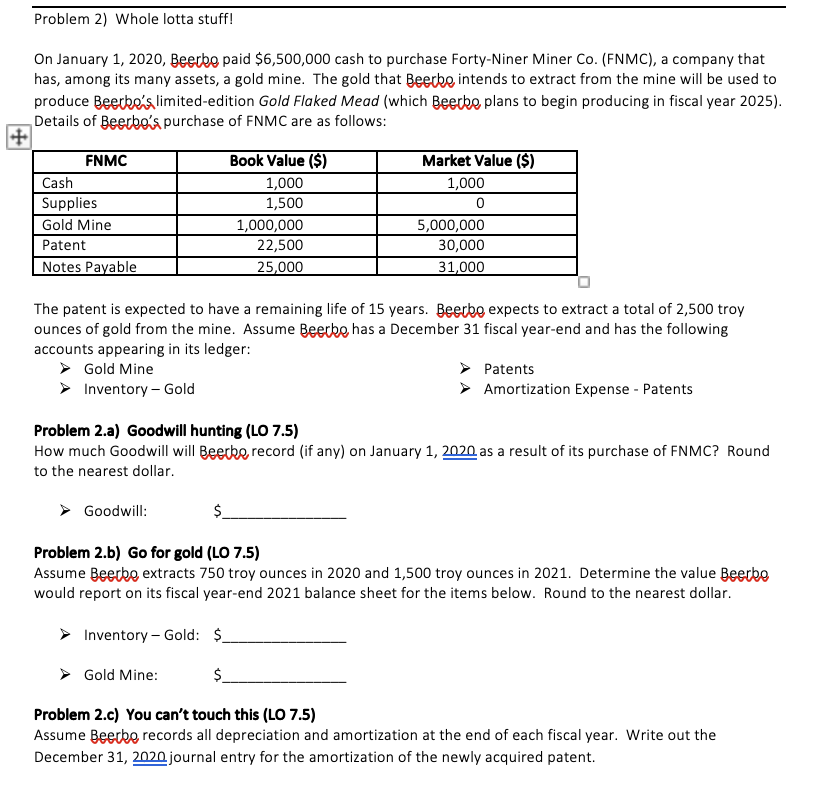

Problem 2) Whole lotta stuff! On January 1, 2020, Beerbo paid $6,500,000 cash to purchase Forty-Niner Miner Co. (FNMC), a company that has, among its many assets, a gold mine. The gold that Beerbe intends to extract from the mine will be used to produce Beerbe's limited-edition Gold Flaked Mead (which Beerbe plans to begin producing in fiscal year 2025). Details of Beerbo's purchase of FNMC are as follows: + FNMC Cash Supplies Gold Mine Patent Notes Payable Book Value ($) 1,000 1,500 1,000,000 22,500 25,000 Market Value ($) 1,000 0 5,000,000 30,000 31,000 The patent is expected to have a remaining life of 15 years. Beerbo expects to extract a total of 2,500 troy ounces of gold from the mine. Assume Beerbe has a December 31 fiscal year-end and has the following accounts appearing in its ledger: Gold Mine Patents Inventory - Gold Amortization Expense - Patents Problem 2.a) Goodwill hunting (LO 7.5) How much Goodwill will Beecke record (if any) on January 1, 2020 as a result of its purchase of FNMC? Round to the nearest dollar. Goodwill: $ Problem 2.b) Go for gold (LO 7.5) Assume Beerbo extracts 750 troy ounces in 2020 and 1,500 troy ounces in 2021. Determine the value Beerbo would report on its fiscal year-end 2021 balance sheet for the items below. Round to the nearest dollar. Inventory-Gold: $ Gold Mine: $ Problem 2.c) You can't touch this (LO 7.5) Assume Beerbe records all depreciation and amortization at the end of each fiscal year. Write out the December 31, 2020 journal entry for the amortization of the newly acquired patent. Problem 2) Whole lotta stuff! On January 1, 2020, Beerbo paid $6,500,000 cash to purchase Forty-Niner Miner Co. (FNMC), a company that has, among its many assets, a gold mine. The gold that Beerbe intends to extract from the mine will be used to produce Beerbe's limited-edition Gold Flaked Mead (which Beerbe plans to begin producing in fiscal year 2025). Details of Beerbo's purchase of FNMC are as follows: + FNMC Cash Supplies Gold Mine Patent Notes Payable Book Value ($) 1,000 1,500 1,000,000 22,500 25,000 Market Value ($) 1,000 0 5,000,000 30,000 31,000 The patent is expected to have a remaining life of 15 years. Beerbo expects to extract a total of 2,500 troy ounces of gold from the mine. Assume Beerbe has a December 31 fiscal year-end and has the following accounts appearing in its ledger: Gold Mine Patents Inventory - Gold Amortization Expense - Patents Problem 2.a) Goodwill hunting (LO 7.5) How much Goodwill will Beecke record (if any) on January 1, 2020 as a result of its purchase of FNMC? Round to the nearest dollar. Goodwill: $ Problem 2.b) Go for gold (LO 7.5) Assume Beerbo extracts 750 troy ounces in 2020 and 1,500 troy ounces in 2021. Determine the value Beerbo would report on its fiscal year-end 2021 balance sheet for the items below. Round to the nearest dollar. Inventory-Gold: $ Gold Mine: $ Problem 2.c) You can't touch this (LO 7.5) Assume Beerbe records all depreciation and amortization at the end of each fiscal year. Write out the December 31, 2020 journal entry for the amortization of the newly acquired patent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts