Question: please help me solve all 4 finance questions, will rate positive!! please only attempt if you will answer all. thank you and will return the

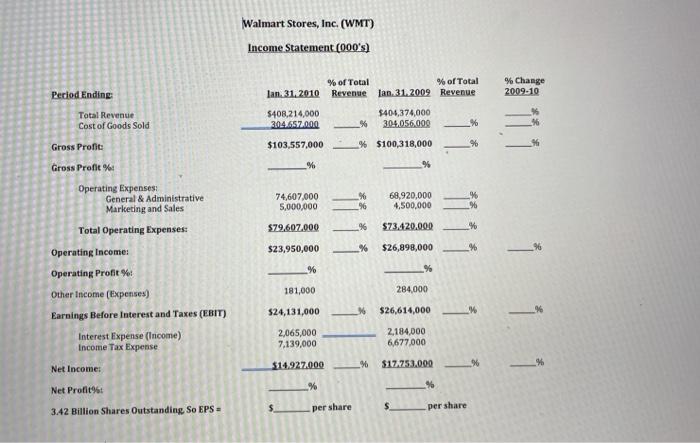

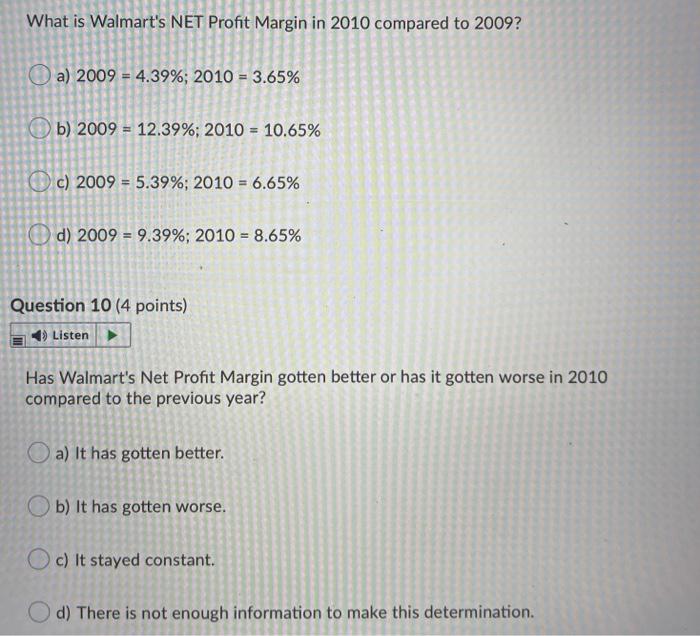

Walmart Stores, Inc. (WMT) Income Statement (000's) % of Total % of Total lan 31, 2010 Revenue lan, 31.2009 Revenue % Change 2009.10 Period Ending Total Revenue Cost of Goods Sold $408.214,000 304.6677000 $406,374,000 304,056.000 % % _ Gross Profit % $100,318,000 % $103.557.000 % Gross Profit % Operating Expenses General & Administrative Marketing and Sales 74,607,000 5,000,000 68,920,000 4,500,000 %6 $79.607.000 Total Operating Expenses: 96 $73.420.000 % 1 1 1 $23,950,000 % $26,898,000 % Operating Income: - % % Operating Profit % Other income (Expenses) Earnings Before Interest and Taxes (EBIT) 181,000 284,000 $24,131,000 $26,614,000 % % Interest Expense (Income) Income Tax Expense 2,065,000 7,139,000 2,184,000 6,677.000 1 1 $14.927.000 M Net Income: $17.753.000 96 % % Net Profit $ $ 3.42 Billion Shares Outstanding So EPS - per share per share What is Walmart's NET Profit Margin in 2010 compared to 2009? a) 2009 = 4.39%; 2010 = 3.65% b) 2009 = 12.39%; 2010 = 10.65% c) 2009 = 5.39%; 2010 = 6.65% d) 2009 = 9.39%; 2010 = 8.65% Question 10 (4 points) Listen Has Walmart's Net Profit Margin gotten better or has it gotten worse in 2010 compared to the previous year? a) It has gotten better. b) It has gotten worse. c) It stayed constant. d) There is not enough information to make this determination. What would be Walmart's EPS on 3.42 billion shares outstanding be at the end of both 2009 and 2010 fiscal years? a) $15.19/share in 2009; $14.36/share in 2010 b) $25.19/share in 2009; $24.36/share in 2010 c) $5.19/share in 2009; $4.36/share in 2010 d) There is not enough information to determine this. Question 12 (4 points) Listen What is the % change in Walmart's Total Revenue in 2010 compared to the previous year? a).95% b) .095% c) .0095% d) 9.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts