Question: please help me solve along with multiple choice Your uncle Fred just purchased a new boat. He brags to you about the low 6.8% interest

please help me solve along with multiple choice

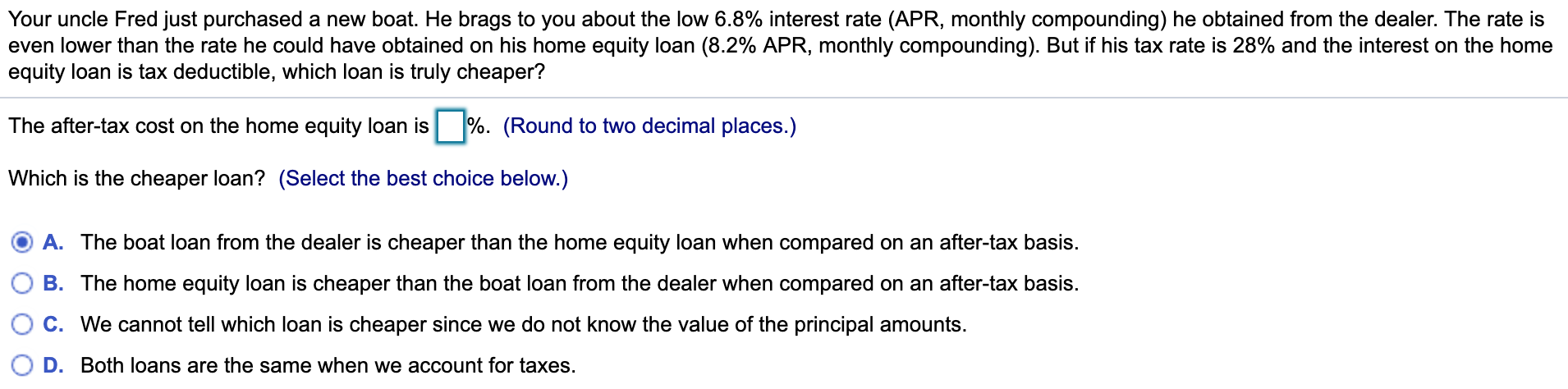

Your uncle Fred just purchased a new boat. He brags to you about the low 6.8% interest rate (APR, monthly compounding) he obtained from the dealer. The rate is even lower than the rate he could have obtained on his home equity loan (8.2% APR, monthly compounding). But if his tax rate is 28% and the interest on the home equity loan is tax deductible, which loan is truly cheaper? The after-tax cost on the home equity loan is %. (Round to two decimal places.) Which is the cheaper loan? (Select the best choice below.) A. The boat loan from the dealer is cheaper than the home equity loan when compared on an after-tax basis. B. The home equity loan is cheaper than the boat loan from the dealer when compared on an after-tax basis. C. We cannot tell which loan is cheaper since we do not know the value of the principal amounts. D. Both loans are the same when we account for taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts