Question: please help me solve and explain along the way! Thank you!! 9. (From Introduction to Mathematical Programming by W. Winston and M. Venkataramanan) A portfolio

please help me solve and explain along the way! Thank you!!

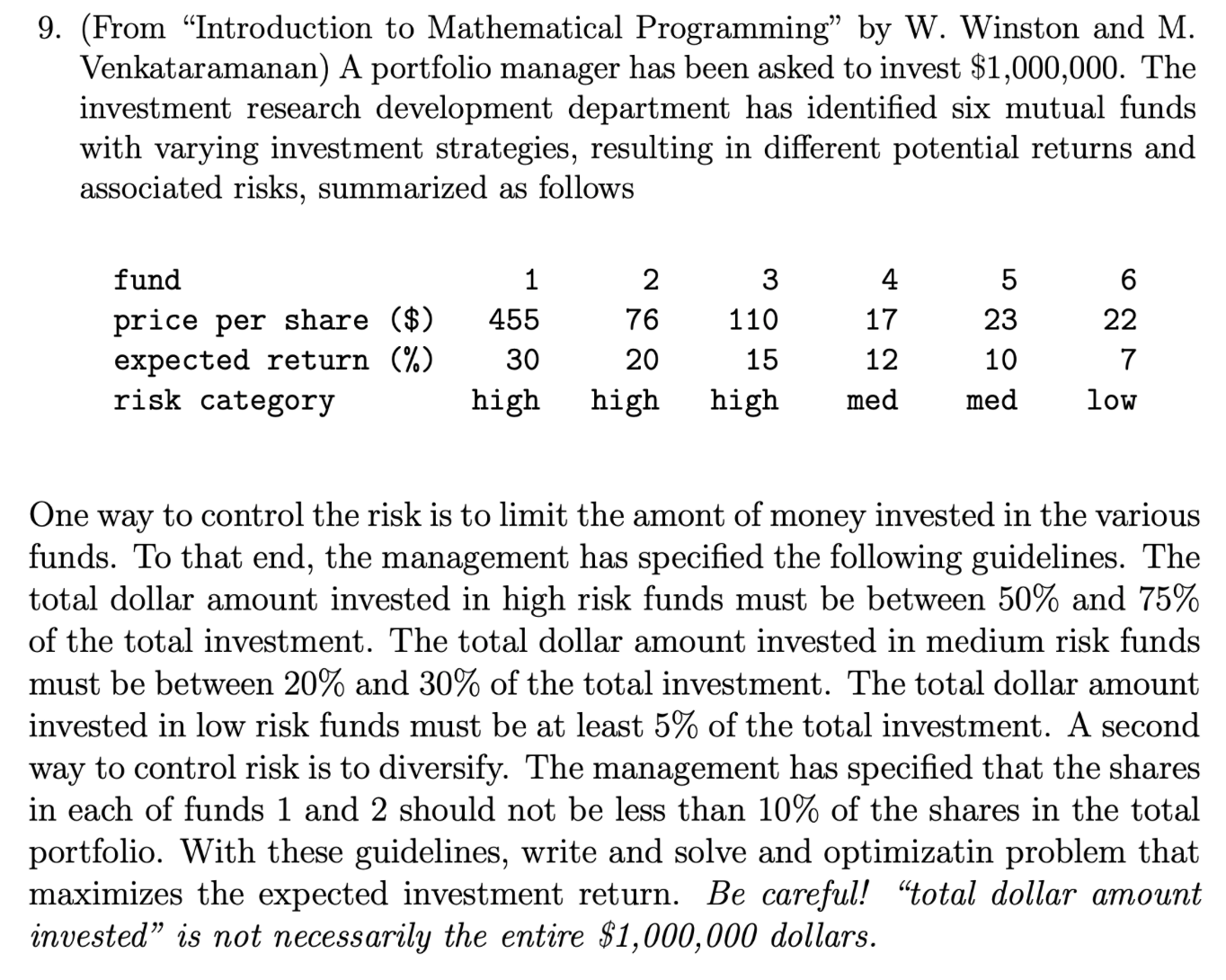

9. (From \"Introduction to Mathematical Programming\" by W. Winston and M. Venkataramanan) A portfolio manager has been asked to invest $1,000,000. The investment research deve10pment department has identied six mutual funds with varying investment strategies, resulting in different potential returns and associated risks, summarized as follows fund 1 2 3 4 5 6 price per share ($) 455 76 110 17 23 22 expected return ('Z.) 30 20 15 12 10 7 risk category high high high med med low One way to control the risk is to limit the amont of money invested in the various funds. To that end, the management has specied the following guidelines. The total dollar amount invested in high risk funds must be between 50% and 75% of the total investment. The total dollar amount invested in medium risk funds must be between 20% and 30% of the total investment. The total dollar amount invested in low risk funds must be at least 5% of the total investment. A second way to control risk is to diversify. The management has specied that the shares in each of funds 1 and 2 should not be less than 10% of the shares in the total portfolio. With these guidelines, write and solve and optimizatin problem that maximizes the expected investment return. Be careful! \"total dollar amount invested\" is not necessarily the entire $1,000, 000 dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts